Canada’s

auto trade

was as soon as once more in Donald Trump’s sights when america president recommended Wednesday that he was contemplating growing tariffs on the sector.

“I actually don’t need vehicles from Canada,” Trump

mentioned yesterday within the Oval Workplace

. “So once I put tariffs on Canada, they’re paying 25 per cent, however that would go up by way of vehicles. After we put tariffs on, all we’re doing is we’re saying, ‘We don’t need your vehicles, in all due respect.”

Trump already has a

25 per cent tariff

on autos imported to the U.S., however there are exemptions associated to the

Canada-U.S.-Mexico Settlement (CUSMA)

. One other tariff on auto elements not compliant with CUSMA might come by Could 3.

In the meanwhile, Canada and Mexico nonetheless maintain some aggressive benefit over different international locations, mentioned Florence Jean-Jacobs, principal economist for Desjardins Group.

“However with the tariff scenario continually in flux and the said goal of the U.S. administration to reshore auto manufacturing, Canada’s auto sector continues to be in a susceptible place,”

she mentioned in a report yesterday.

The built-in provide chain between the 2 international locations has been a long time within the making, and it might take a “substantial funding” to switch it.

“Nonetheless, for producers with factories producing related items on each U.S. and Canadian soil, we might even see a higher improve in funding in U.S. vegetation, to the detriment of Canadian services,” Jean-Jacobs mentioned.

In Ontario, Canada’s manufacturing heartland, the auto trade and first steel manufacturing stand out as most in danger in a commerce battle, she mentioned.

Two thirds of auto revenues come from exports to america, making it essentially the most uncovered of the province’s industries. It is usually capital intensive and regionally concentrated, making it more durable to regulate rapidly to shocks.

“Job and productive capability losses might turn into lasting if tariffs persist over an prolonged interval,” she mentioned — and that may pose a threat to the province’s financial system.

About 4.5 per cent of jobs in Ontario are in industries susceptible to the commerce battle, with the auto trade representing 65,000 of them.

Ford Motor Co.

,

Normal Motors Co.

, Stellantis NV, Honda Motor Co. and Toyota Motor Co. all make vehicles in Ontario and there has already been disruption.

GM’s CAMI Meeting plant in Ingersoll, Ont. has

introduced it is going to shut the plant

subsequent month and reopen in October at half capability due to decreased market demand. As much as 500 employees will lose their jobs

After tariffs had been first introduced,

Stellantis, which makes Chrysler and Dodge automobiles

, shut its Windsor plant for 2 weeks.

“The present commerce surroundings will inevitably trigger some tough reshuffling of things of manufacturing in Ontario’s financial system in 2025 and 2026, and job losses seem unavoidable,” Jean-Jacobs mentioned.

“We count on the auto sector to battle most given its built-in worth chains with the U.S. and excessive dependence on this export market.”

If the tariffs stay in place for the remainder of the 12 months and CUSMA compliance doesn’t enhance, Ontario’s

unemployment fee

might close to 9 per cent by the top of 12 months, she mentioned.

Enroll right here to get Posthaste delivered straight to your inbox.

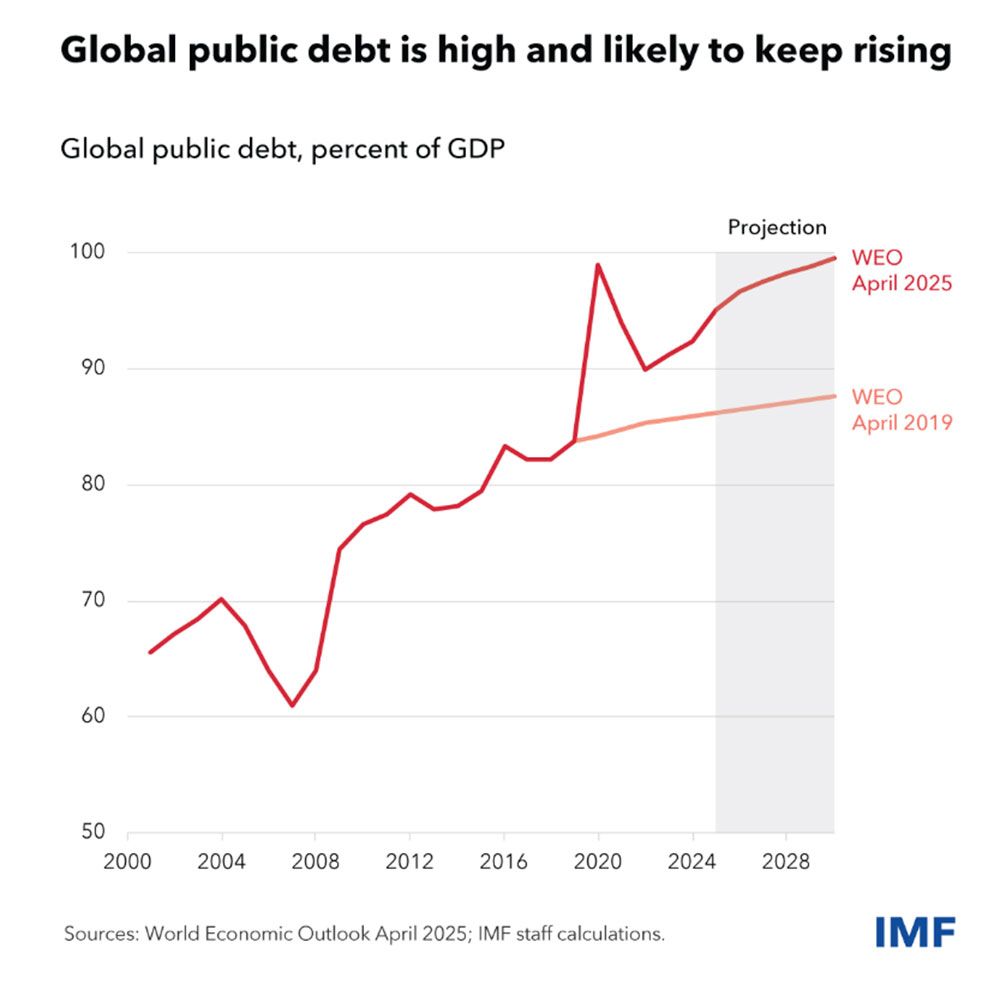

As commerce tensions grip the world, the

Worldwide Financial Fund

has a warning for international locations — watch your debt.

The

to leap 2.8 share factors this 12 months as tariffs decrease development and improve inflation. As its chart reveals, that may put international public debt on observe to achieve almost 100 per cent of GDP by the top of the last decade, surpassing the pandemic peak.

Within the worst case situation, public debt might hit 117 per cent of GDP by 2027, the very best stage for the reason that Second World Battle and 20 share factors increased than earlier projections.

Escalating geopolitical uncertainty might heighten debt dangers by pushing up spending on defence and public help applications, mentioned the Washington-based international lender. Tighter and extra risky monetary situations in america might improve financing prices in different international locations.

“In an unsure and quickly altering world, international locations might want to at first put their very own fiscal home so as,” mentioned the IMF.

At this time’s Information: United States sturdy items orders, current house gross sales Earnings: Teck Sources Ltd., Agnico Eagle Mines Ltd., Alphabet Inc., PepsiCo Inc., Procter & Gamble Co., Southwest Airways Co., Nasdaq Inc., Hasbro Inc., Intel Corp., Celestica Inc.

Jamie Golombek solutions questions concerning the federal election and your taxes The Canadian greenback is diving towards different main currencies regardless of gaining towards the buck Election guarantees add as much as deficits — and that’s with out calculating an financial slowdown

Questions on your taxes and the federal election? Check out our Q&A with tax professional Jamie Golombek to get solutions on how the election might have an effect on your private funds.

Discover out extra

Are you nervous about having sufficient for retirement? Do you might want to alter your portfolio? Are you beginning out or making a change and questioning the right way to construct wealth? Are you making an attempt to make ends meet? Drop us a line at wealth@postmedia.com along with your contact data and the gist of your downside and we’ll discover some specialists that will help you out whereas writing a Household Finance story about it (we’ll preserve your identify out of it, after all).

McLister on mortgages

Need to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

may also help navigate the advanced sector, from the most recent traits to financing alternatives you gained’t need to miss. Plus test his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

for interviews with Canada’s main specialists in enterprise, economics, housing, the power sector and extra.

At this time’s Posthaste was written by Pamela Heaven with further reporting from Monetary Submit employees, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

Holes emerge in Trump’s plan to convey again manufacturing

Why some economists see Canada falling into ‘deeper’ recession

Bookmark our web site and help our journalism: Don’t miss the enterprise information you might want to know — add financialpost.com to your bookmarks and join our newsletters right here