Apple gained vital market share in early 2025, rising 13 p.c whereas the worldwide smartphone market remained primarily flat.

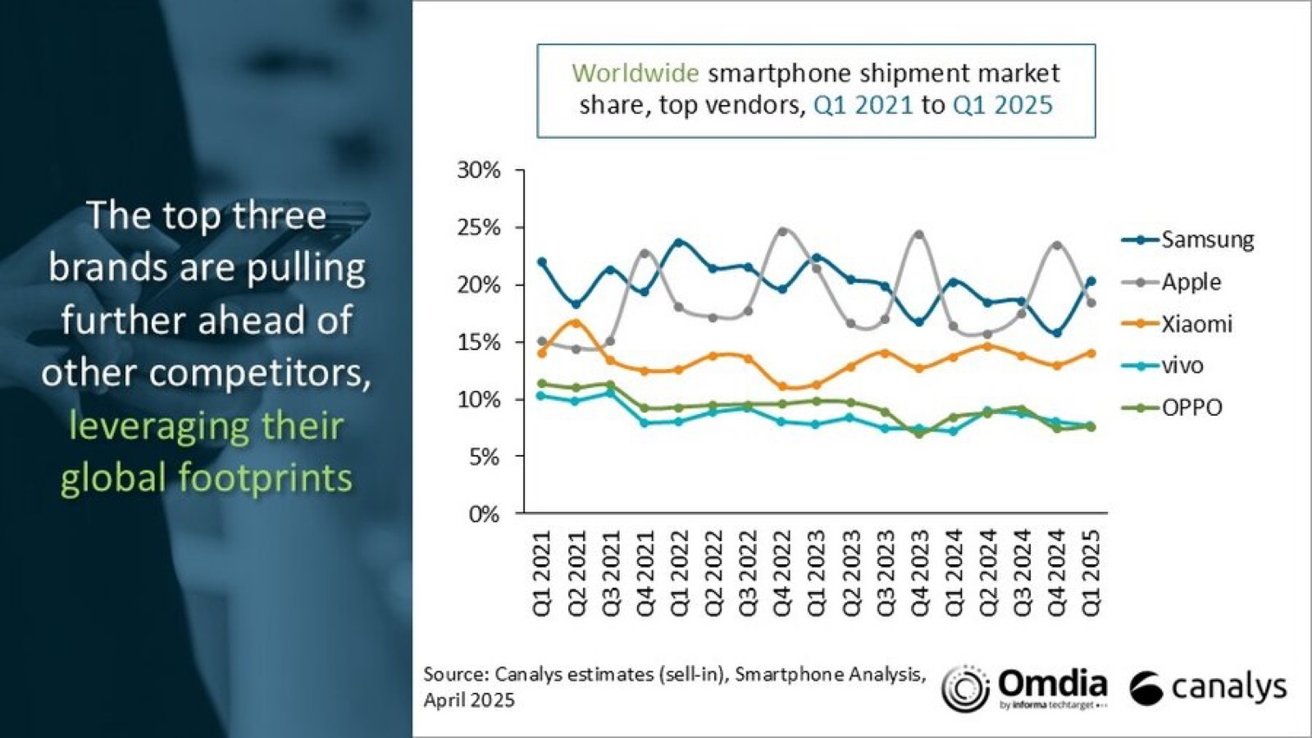

Apple outpaced the broader smartphone market in Q1 2025, transport 55 million iPhone items and rising its world share to 19 p.c, up from 16 p.c a yr earlier, in line with Canalys Analysis’s April report.

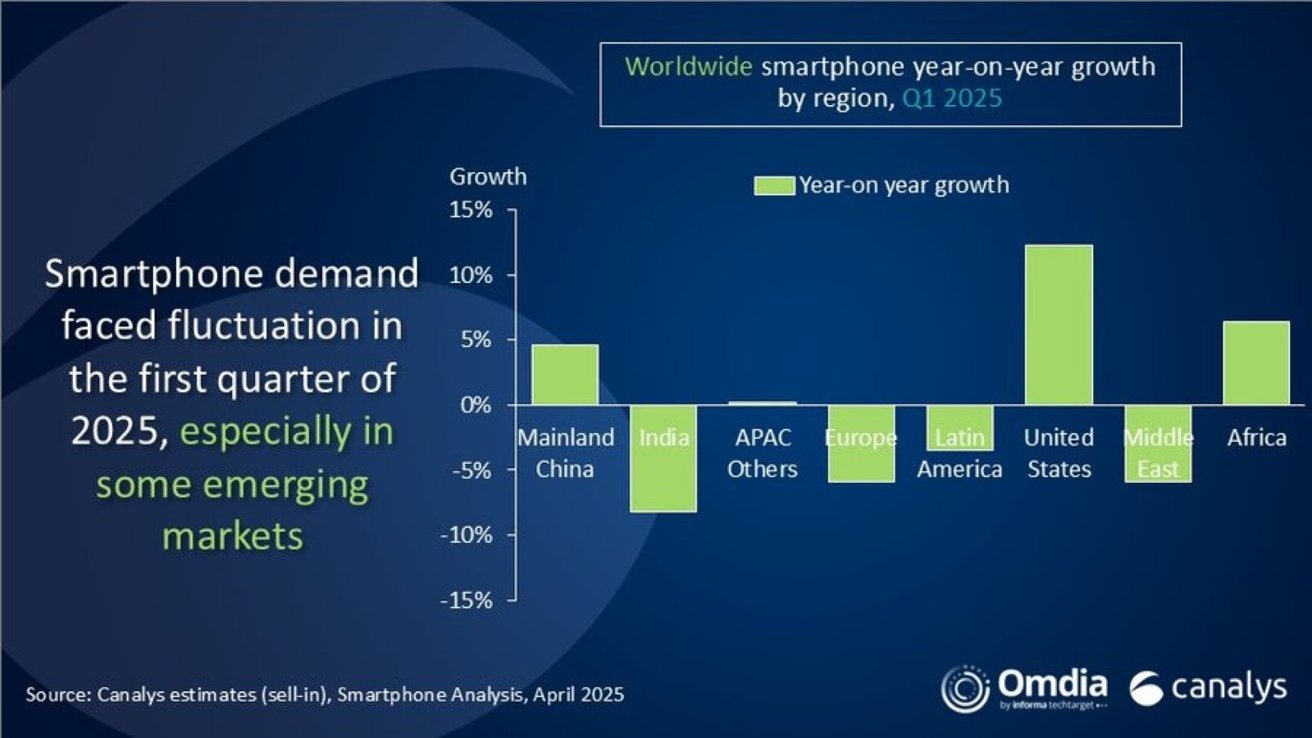

The general smartphone market grew simply 0.2 p.c yr over yr, reaching 296.9 million items. Apple’s 13 p.c development stood out, pushed by sturdy demand for the budget-focused iPhone 16e and gross sales momentum in the USA and rising Asia Pacific markets.

iPhone 16e launch reshapes early-year gross sales

The iPhone 16e, launched in February, gave Apple an uncommon enhance throughout what is often a slower post-holiday quarter. Most distributors see Q1 dips as holiday-driven demand fades, however Apple’s timing helped it maintain curiosity and develop attain in additional price-sensitive areas.

Worldwide smartphone shipments. Picture credit score: Canalys

Samsung remained the highest world vendor with 60.5 million items shipped, primarily flat yr over yr. Xiaomi grew 3 p.c to 41.8 million items, whereas vivo elevated 7 p.c. OPPO declined 9 p.c, and smaller distributors collectively misplaced market share, dropping from 34 p.c to 32 p.c.

Apple’s efficiency was additionally formed by its strategic response to world commerce dangers. The corporate constructed up U.S. stock forward of potential tariffs and accelerated manufacturing in India for the iPhone 15 and iPhone 16 collection.

High three manufacturers. Picture credit score: Canalys

These strikes diminished its reliance on Chinese language manufacturing and gave it extra pricing flexibility in unstable markets.

China stays a problem for iPhone development

The U.S. smartphone market grew 12 p.c in Q1, with Canalys attributing most of that development to Apple. Whereas iPhones inbuilt China nonetheless made up nearly all of U.S. shipments, India is now overlaying normal and Professional fashions — giving Apple insulation from future coverage shifts.

Not all areas have been as favorable. In China, iPhone shipments declined 9 p.c yr over yr. Authorities subsidies and rising native competitors challenged Apple’s pricing energy within the mid- and low-end segments.

Android manufacturers at the moment are feeling the squeeze within the $200 to $400 vary. Shoppers have gotten extra cautious, improve cycles are lengthening, and pricing strain is rising.

Smartphone demand. Picture credit score: Canalys

Apple, with its bundled companies, software program ecosystem, and aggressive trade-in presents, is best positioned to climate these shifts than most of its rivals.

For now, Apple stays one of many few smartphone makers displaying clear upward momentum. Whether or not that development continues will rely on its potential to handle manufacturing, keep forward of tariff headwinds, and keep product enchantment throughout premium and entry-level segments.