So how are these

tariffs understanding

for you, Mr. Trump?

From the 90-day backtrack on reciprocal tariffs to the “unsustainable”

commerce conflict with China

, indicators are rising that the U.S. President’s commerce techniques is probably not understanding precisely as deliberate.

Since

Donald Trump

took workplace simply over 100 days in the past, the S&P 500 has fallen greater than 8 per cent, U.S. shopper confidence has plunged to an virtually five-year low and

recession odds

are rising.

Yesterday the president barely

repelled a problem

to his international tariff offensive within the Republican-controlled Senate and polls present a majority of Individuals are towards them, Bloomberg stories.

Jimmy Jean, chief economist of Desjardins Group, in a current observe took a take a look at a few of the methods the commerce conflict with China and

Trump’s “tariff home of playing cards”

are falling aside.

Inflation

Entrance and centre, the take a look at for tariffs within the American individuals’s eyes can be rising costs.

China, America’s third-biggest buying and selling associate and second greatest supply of imported items, now faces a 145 per cent tariff from the US. It has responded with a 125 per cent tariff on American items.

As the biggest supply of overseas content material for U.S. private consumption, tariffs on China will erode actual disposable earnings and the buying energy of American households, particularly lower-income households, stated Jean.

The Tax Basis estimates that the duties on Chinese language items — even accounting for Trump’s exemptions on electronics — will price households US$1,200 a yr.

And costs are already rising.

E-commerce procuring websites like

Shein Group Ltd and Temu

face a 120 per cent tariff on lots of their merchandise as a result of U.S. authorities’s choice to finish the “de minimus” exemption for small packages from China.

In accordance with a survey by Bloomberg, costs on these websites have jumped from 51 per cent to 377 per cent on some objects. On Temu’s shipped-from-China items, taxes exceeded the worth of the product. A US$19.49 energy strip, for instance, attracted US$27.56 in import prices.

Equipment, development supplies and industrial tools may even turn out to be dearer, stated Jean, threatening companies’ capital spending plans and company margins.

Provide chain disruptions

China shouldn’t be solely a serious exporter of completed items, however a “crucial provider” of components and uncooked supplies, stated Jean. Roofing membranes, for instance, are made in a small variety of Chinese language factories and in the course of the pandemic lockdowns, disruption in these provides led to delays and price overruns in North American development initiatives.

“Within the context of what now resembles a quasi-embargo on Chinese language imports, many extra such stress factors are more likely to emerge,” he stated.

They would come with

EV batteries

, prescription drugs, for which China provides 40 per cent of energetic components utilized in the US, and

uncommon earth components

(China controls about 70 per cent of worldwide output).

Retaliation

“China holds significant financial leverage,” stated Jean. In previous commerce disputes China has focused politically delicate U.S. exports corresponding to pork and soybeans, however this time it has broadened the assault, suspending Boeing Co. jet deliveries and chopping imports of oil and

liquefied pure fuel

from the US.

World influence

The entire world feels the ache when two of its largest economies enter a commerce conflict, and early estimates put the potential hit to international output at as much as US$2 trillion, stated Jean.

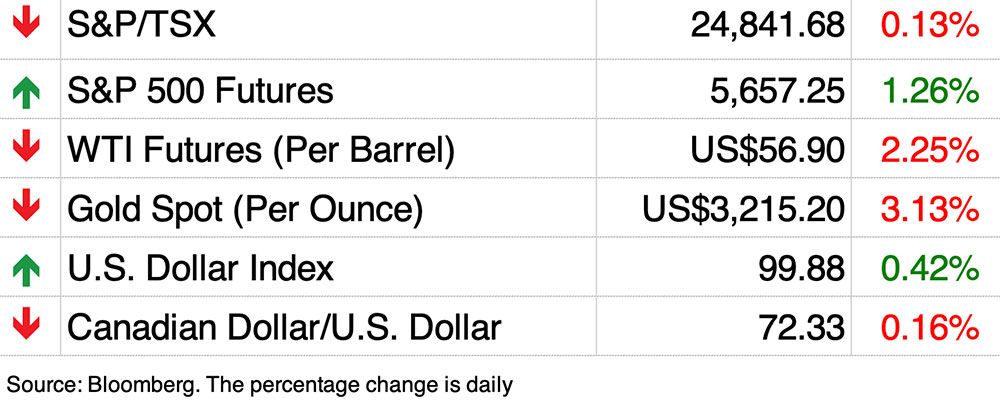

Commodities are already displaying the pressure.

Copper costs

fell 6 per cent final month — the worst drop since mid-2022 — on indicators that the commerce conflict was beginning to damage economies.

Oil sank

16 per cent in April to under US$60 a barrel, partly due to international demand fears.

Most regarding, although, is the blow to the US’s status as a protected haven, stated Jean.

Bond yields have surged and the U.S. greenback slumped, “a mix extra generally related to international locations grappling with stability of funds crises,” he stated.

China is the second largest overseas holder of U.S. Treasuries, however thus far has kept away from utilizing this leverage.

Nevertheless, “the mere notion that Beijing might shift its reserves leaves buyers on tenterhooks,” stated Jean.

“Such a transfer, nevertheless refined, might rattle the very foundations of the worldwide monetary system, the place Treasuries function the final word risk-free asset.

Enroll right here to get Posthaste delivered straight to your inbox.

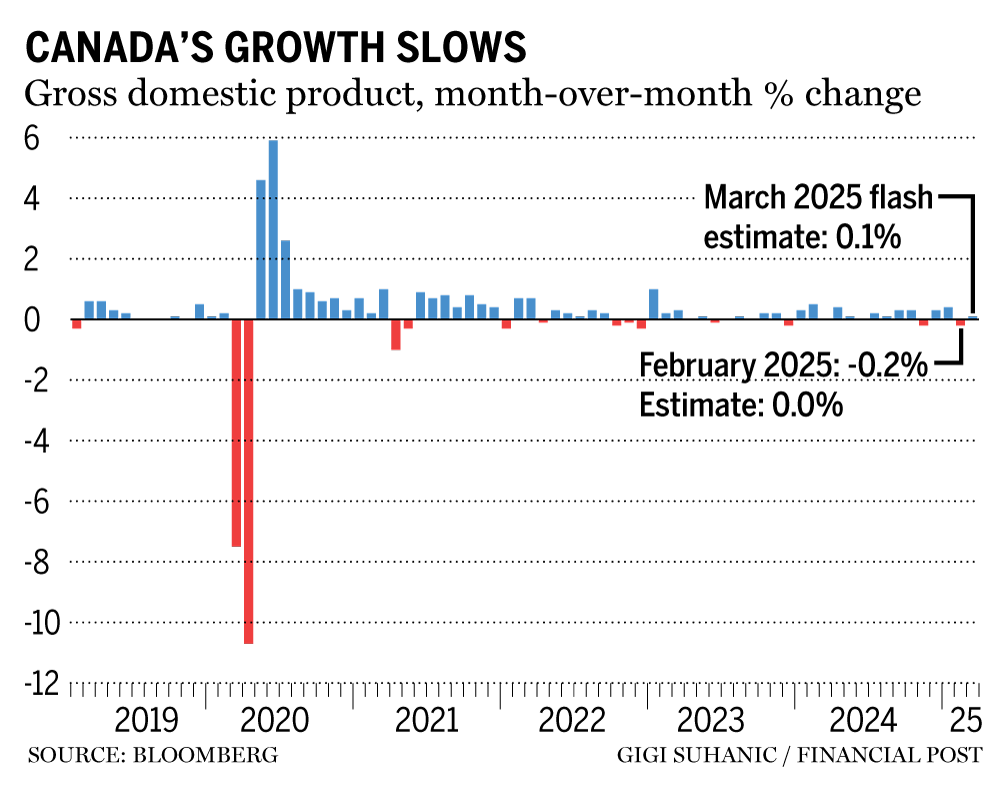

Canada’s economic system

shrank in February and barely grew in March, Statistics Canada knowledge confirmed Wednesday. A decline in

gross home product

of 0.2 per cent adopted by 0.1 per cent progress suggests the primary quarter will are available under expectations at 1.5 per cent.

The second quarter, when tariffs start to hit dwelling, is anticipated be worse. CIBC Capital Markets forecasts that the second quarter will present a “modest contraction,” main the

Financial institution of Canada

to chop its rate of interest in June.

In the present day’s Knowledge: United States ISM Manufacturing, development spending Earnings: Apple Inc., Amazon.com Inc., Cenovus Vitality Inc., Cameco Corp., AltaGas Ltd., Thomson Reuters Corp. Bombardier Inc., TC Vitality Corp., Canadian Nationwide Railway Co., Aritzia Inc., Eldorado Gold Corp.

Canadian economic system headed for recession this yr, based on Deloitte outlook What’s deep-sea mining and why is Donald Trump instantly so curious about it? Will 5 groups within the NHL playoffs (and a surge of patriotism) imply ka-ching for Canada?

Irrespective of how onerous we attempt, our bank card statements can reveal that many people have succumbed to impulse shopping for in some unspecified time in the future. Whereas it would supply a brief thrill, it will probably throw your monetary objectives off monitor and depart you feeling powerless over your cash. Mary Castillo seems at why we make impulse purchases and gives sensible recommendations on how to withstand temptation.

Learn extra

Are you nervous about having sufficient for retirement? Do you have to modify your portfolio? Are you beginning out or making a change and questioning methods to construct wealth? Are you making an attempt to make ends meet? Drop us a line at wealth@postmedia.com along with your contact data and the gist of your drawback and we’ll discover some consultants that will help you out whereas writing a Household Finance story about it (we’ll preserve your title out of it, in fact).

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

may also help navigate the complicated sector, from the newest tendencies to financing alternatives you received’t wish to miss. Plus test his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

In the present day’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? E-mail us at

.

TD, BMO economists jumpy about Liberal minority

Financial institution of Canada would possibly go lighter on price cuts with Liberals in energy

Bookmark our web site and assist our journalism: Don’t miss the enterprise information you have to know — add financialpost.com to your bookmarks and join our newsletters right here