A brand new fear has taken centre stage in international markets this week, upstaging even

Donald Trump’s tariff struggle

— American debt.

The turnaround began final Friday when Moody’s downgraded america’ credit standing, throwing its ballooning deficit into the highlight. Wrangling over Trump’s “massive lovely” tax invoice has simply ramped up nervousness.

The priority is that the invoice would add trillions of {dollars} to the deficit simply as traders are cooling on U.S. belongings. In keeping with the Congressional Price range Workplace, the invoice would add nearly $4 trillion to a nationwide debt already approaching $37 trillion. The invoice was handed at present after an all-night session by the Home and now goes on to the Senate.

Ipek Ozkardeskaya, senior analyst at Swissquote Financial institution, says the U.S. has been in a position to hold borrowing at this scale at a reasonably low value as a result of traders crave U.S. debt.

Treasuries are liquid

, perceived as low danger and have in each balanced portfolio, together with these of central banks.

“What’s altering is that traders are starting to query whether or not this ever-growing U.S. debt load is really viable — and maybe extra importantly, whether or not it’s as low danger as we fake it to be,” she mentioned in a morning observe.

Yesterday traders confirmed their displeasure by pushing the U.S. Treasury’s 20-year bond yield to five.1 per cent, slightly below a two-decade excessive. The selloff continued throughout the curve, elevating the 10-year to 4.60 per cent and 30-year above 5 per cent.

“This was the market’s approach of signalling a insecurity within the U.S. authorities and its coverage course,” mentioned Ozkardeskaya.

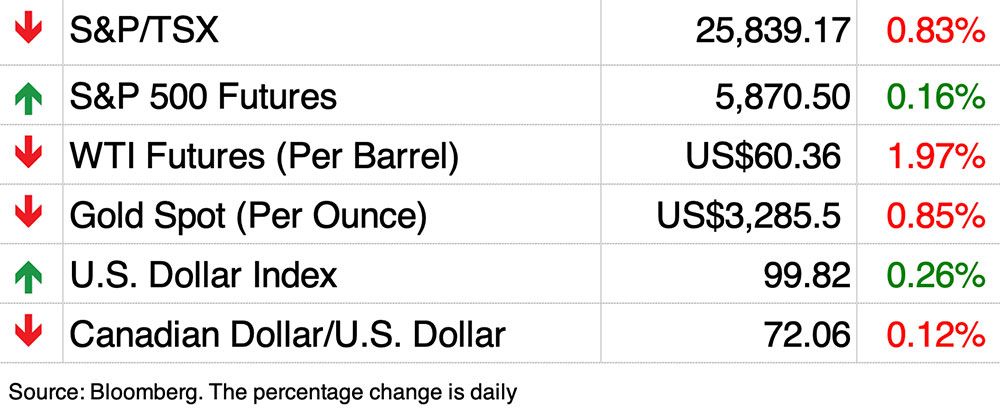

The bitter sentiment unfold to the inventory market. The S&P 500 fell 1.6 per cent, the Dow 1.9 per cent, and the Nasdaq 1.4 per cent. Bitcoin, in the meantime, set an all-time excessive, over US$109,000.

The underside line, Ozkardeskaya mentioned, is the “U.S. exceptionalism narrative” that has been driving markets shouldn’t be based mostly on

Apple Inc.

or

Nvidia Corp.

, however on the credibility and power of the U.S. Treasury market.

“That particular standing is one thing traders gave — and one thing they might take away.”

May it worsen? Sure, mentioned Ozkardeskaya.

Within the Nineteen Eighties, the 10-year yield topped 15 per cent and the 20-year neared 10 per cent. Ozkardeskaya doesn’t count on a return to these highs, however a spike much like that seen throughout the UK’s mini-budget disaster is feasible.

Join right here to get Posthaste delivered straight to your inbox.

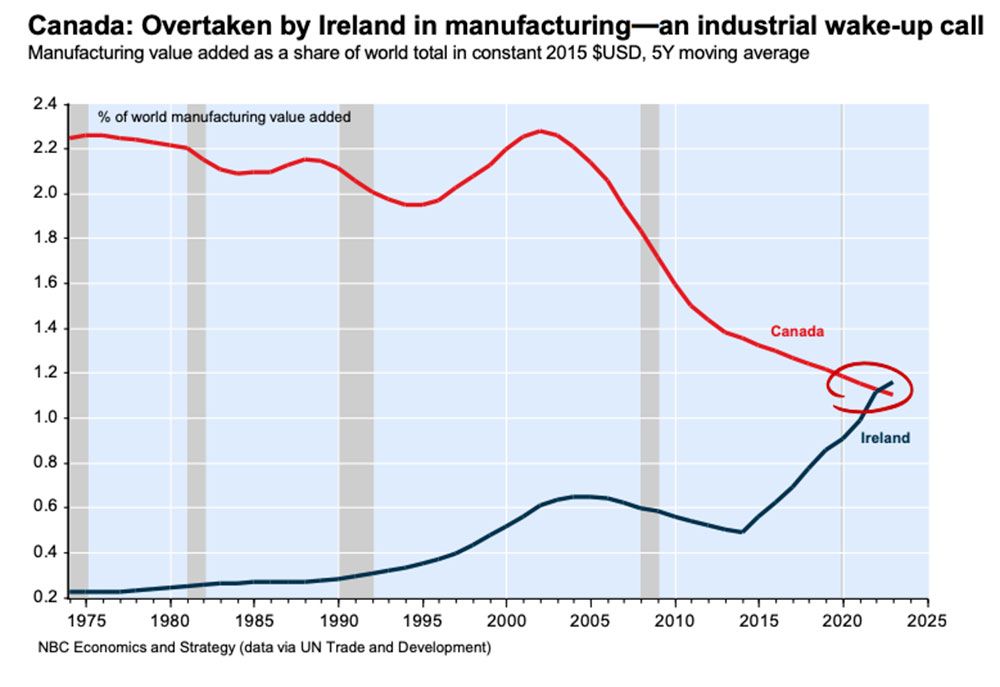

Eire has simply an eighth of Canada’s inhabitants, however its manufacturing unit sector has outgrown ours — and in keeping with the economists at Nationwide Financial institution of Canada, extra regulation is accountable.

Statistics Canada says regulatory necessities for manufacturing have surged 42 per cent since 2005 to whole greater than 105,000.

“The end result has been a profound atrophy of Canada’s manufacturing base — unmatched throughout the industrialized world,” write Stéfane Marion and Ethan Currie.

In the present day’s Knowledge: Canada industrial product and uncooked supplies costs, United States present dwelling gross sales Earnings: Toronto Dominion Financial institution, Lightspeed Commerce Inc., Ralph Lauren Corp., Williams-Sonoma Inc.

Why Canada Publish staff are set to strike once more and what it means for companies CPP fund not planning to chop U.S. publicity regardless of ‘wild trip’ in markets, CEO says Are the large banks a purchase heading into earnings season?

Patricia and Craig each flip 65 in 2026. Till U.S. President Donald Trump’s commerce struggle and all of the uncertainty that has precipitated each within the markets and the financial system they’d each deliberate to retire subsequent 12 months. Now they aren’t so positive that’s a sensible aim, particularly since they nonetheless have a mortgage.

Household Finance seems on the choices.

Are you apprehensive about having sufficient for retirement? Do you might want to regulate your portfolio? Are you beginning out or making a change and questioning easy methods to construct wealth? Are you attempting to make ends meet? Drop us a line at wealth@postmedia.com together with your contact information and the gist of your drawback and we’ll discover some specialists that can assist you out whereas writing a Household Finance story about it (we’ll hold your title out of it, after all).

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Publish column

may also help navigate the complicated sector, from the most recent traits to financing alternatives you received’t need to miss. Plus verify his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date every day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

for interviews with Canada’s main specialists in enterprise, economics, housing, the power sector and extra.

In the present day’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Publish employees, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this article? Electronic mail us at

.

Canada dwelling costs are heading into correction territory

Canadians aren’t the one vacationers shunning America as international visits plummet

Bookmark our web site and assist our journalism: Don’t miss the enterprise information you might want to know — add financialpost.com to your bookmarks and join our newsletters right here