The

Canada-United States commerce struggle

is affecting anxious Canadian mother and father’ potential to avoid wasting for his or her youngsters’s

training

, in line with a brand new research by

registered training financial savings plan (RESP)

supplier Embark Pupil Corp.

Virtually two-thirds of fogeys are involved about commerce tensions and practically half mentioned it has impacted their potential to avoid wasting for his or her baby’s training, in line with the survey of 1,000 mother and father with youngsters underneath the age of 5. And 60 per cent mentioned it has modified how they method financial savings and 55 per cent mentioned it has impacted their funding methods.

These

tariff anxieties

are solely including to the mounting challenges going through new mother and father at the moment, together with a scarcity of sleep and the rising price of training.

Virtually 80 per cent of fogeys mentioned they’re usually woken up by their youngsters, with 41 per cent indicating they’re getting six or fewer hours of sleep per night time and 37 per cent admitted to creating monetary choices they regretted whereas being sleep-deprived.

“This survey exhibits that new mother and father are going through an ideal storm: a scarcity of sleep, on a regular basis challenges of elevating younger youngsters,

rising prices

, and now, commerce tensions,” Andrew Lo, chief government of Embark, mentioned in a

.

The most typical purpose mother and father gave for not opening an RESP was not having sufficient cash, adopted by worry of their monetary state of affairs altering and worries about having to make common contributions.

Rising training prices have elevated the problem. Kids born in 2024 are projected to pay 36 per cent extra in comparison with at the moment, in line with Embark’s estimates.

Nevertheless, 82 per cent nonetheless take into account their baby’s training a prime precedence, rating increased than the 77 per cent who mentioned paying down debt and the 72 per cent who mentioned saving for retirement have been a prime precedence.

A majority of the mother and father surveyed spend plenty of time fascinated about how they’ll pay for post-secondary training and need that they had extra data about saving and investing for it.

Lo really useful shifting from a “saving is unattainable” to an “each little bit counts” mindset to navigate financial uncertainty.

“It’s straightforward to get discouraged by market volatility, however even contributing slightly every month to your baby’s RESP could make a giant distinction over time,” he mentioned. “Authorities grants alone can match as much as 20 per cent of your RESP contributions, delivering rapid worth earlier than factoring in compound progress and funding positive aspects.”

However the outlook is gloomy for a lot of Canadian mother and father, with 67 per cent believing it’s troublesome to steadiness their household’s present wants with their long-term monetary objectives and 21 per cent who assume Canada-U.S. commerce relations have completely modified for the more serious.

Enroll right here to get Posthaste delivered straight to your inbox.

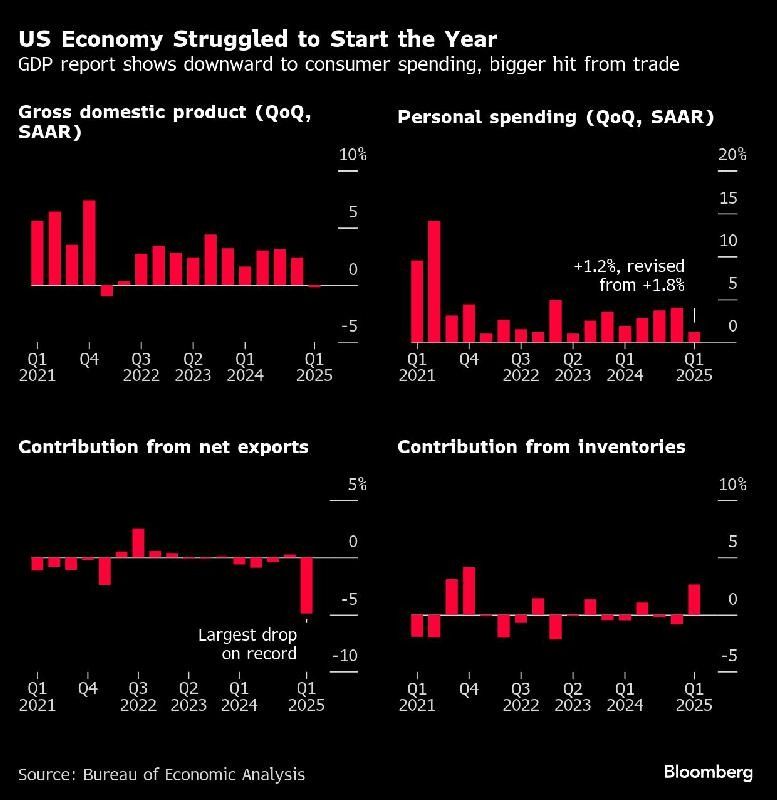

The U.S. financial system shrank firstly of the yr, restrained by weaker client spending and an excellent larger affect from commerce than initially reported.

Gross home product decreased at a 0.2 per cent annualized tempo within the first quarter, the second estimate from the Bureau of Financial Evaluation confirmed Thursday. That in contrast with an initially reported 0.3 per cent decline.

The financial system’s major progress engine — client spending — superior 1.2 per cent, down from an preliminary estimate of 1.8 per cent and the weakest tempo in nearly two years. Meantime, web exports subtracted practically 5 share factors from the GDP calculation, barely greater than the primary projection and the biggest on document.

The slight upward revision in GDP mirrored stronger enterprise funding and a larger accumulation of inventories. Federal authorities spending wasn’t as a lot of a drag as initially reported.

— Bloomberg

Immediately’s Information: Canada actual GDP for the primary quarter, month-to-month actual GDP for March, Ottawa’s fiscal monitor for March, United States private earnings and consumption for April, advance financial indicators report for April and College of Michigan client sentiment index for Might Earnings: Lowe’s Cos. Inc., Laurentian Financial institution of Canada, Cover Progress Corp.

Trump’s transfer to dam international college students from Harvard sends shockwaves inside Canadian circles David Rosenberg: Newest labour knowledge exhibits Canadians are begging the Financial institution of Canada for renewed charge reduction Noah Solomon: You possibly can’t all the time get what you need — the tariff rendition How spousal RRSPs can scale back taxes with out getting you in hassle

Summer season usually ushers in a extra carefree monetary perspective, however with lingering increased rates of interest and the present geopolitical local weather affecting family budgets, funds for summer time enjoyable is likely to be restricted, particularly when additionally coping with debt. If you find yourself feeling monetary pressure, typical journeys involving journey, lodging, and day by day bills may appear unrealistic. Nevertheless, with cautious planning and a concentrate on budget-friendly selections, a memorable summer time with out overspending is feasible, writes Mary Castillo.

Discover out extra

.

Are you nervous about having sufficient for retirement? Do you’ll want to alter your portfolio? Are you beginning out or making a change and questioning easy methods to construct wealth? Are you making an attempt to make ends meet? Drop us a line at wealth@postmedia.com along with your contact data and the gist of your drawback and we’ll discover some consultants that will help you out whereas writing a Household Finance story about it (we’ll maintain your title out of it, in fact).

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Publish column

can assist navigate the advanced sector, from the most recent tendencies to financing alternatives you gained’t wish to miss. Plus verify his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

Immediately’s Posthaste was written by Noella Ovid with further reporting from Monetary Publish employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? E mail us at

.

How Canada and Mexico may develop commerce amid U.S. tariff fallout

‘Purchase Canadian’ boosts magnificence enterprise. Will tariffs find yourself reversing that?

Bookmark our web site and help our journalism: Don’t miss the enterprise information you’ll want to know — add financialpost.com to your bookmarks and join our newsletters right here