Extra

Canadian snowbirds

are placing their properties in Florida available on the market, in keeping with media reviews, however unloading them won’t be that straightforward —

particularly condos.

Actual property within the Sunshine State boomed through the pandemic, however now the tables have turned and the condominium market is in a severe droop, mentioned Admir Kolaj, a Toronto Dominion economist, in a latest report.

Condos play an enormous position in

Florida actual property

. There are about 1.5 million of them, accounting for 15 per cent of the state’s housing inventory, double the nationwide share.

Over the previous three months, gross sales have dropped 13 per cent and are down greater than 25 per cent from pre-pandemic ranges. Costs have fallen about 8 per cent from their peak, mentioned Kolaj.

Inventories are climbing, with near 80,000 condos and townhomes on the market, about 20,000 or 35 per cent greater than a 12 months in the past.

Headwinds buffeting the market embrace greater

rates of interest

(mortgage charges within the U.S. are nonetheless near 7 per cent), a steep drop-off in home migration and financial uncertainty introduced on by

Donald Trump’s tariff battle.

However Florida condos face their very own particular set of issues. For one, the Sunshine State is the most costly in America for

owners insurance coverage

, with condo-specific premiums estimated at double the nationwide common, mentioned Kolaj.

House owner affiliation charges are additionally climbing underneath new stricter regulation on condominium inspections and repairs. Buildings older than 30 years — greater than half the condos in Florida — should bear milestone inspections and condominium associations must foot the invoice for repairs. Kolaj mentioned in some reported circumstances the place there was the necessity for main repairs particular evaluation charges bumped into the hundreds.

“Given all of the headwinds that the condominium sector faces, it’s no marvel that many house owners are selecting to checklist their items on the market, rising the glut in an already-flooded market,” he mentioned.

Canadians are amongst them.

Florida has the most important share of international residence consumers in America, accounting for 20 per cent of the nationwide whole. Twenty-seven per cent of these consumers are Canadian, the very best share save for Latin People.

Based on media reviews, extra of these Canadians are placing their properties available on the market, spurred by a weaker greenback, stricter journey necessities and Trump’s repeated feedback about Canada because the 51st state.

Realtors in Florida advised CNN

earlier this 12 months they’ve seen a “sharp uptick” in Canadians trying to promote their properties.

“A number of the purchasers I’ve been coping with wish to promote at any price, even at a loss,” mentioned Share Ross, a realtor primarily based in southeast Florida.

Gulf Coast Information reported in April that Canadians had been making a “mass exodus” from Southwest Florida, after the U.S. required background checks and fingerprints in the event that they deliberate to remain greater than 30 days within the state.

Diminished international curiosity is only one other thing on a protracted checklist of challenges dealing with Florida’s condominium market, mentioned Kolaj. And homeowners might have to attend some time for a rebound.

There are indications that the state will soften its regulation on older condos and if different situations fall into place the condominium market might discover firmer footing by late 2026, he mentioned.

Join right here to get Posthaste delivered straight to your inbox.

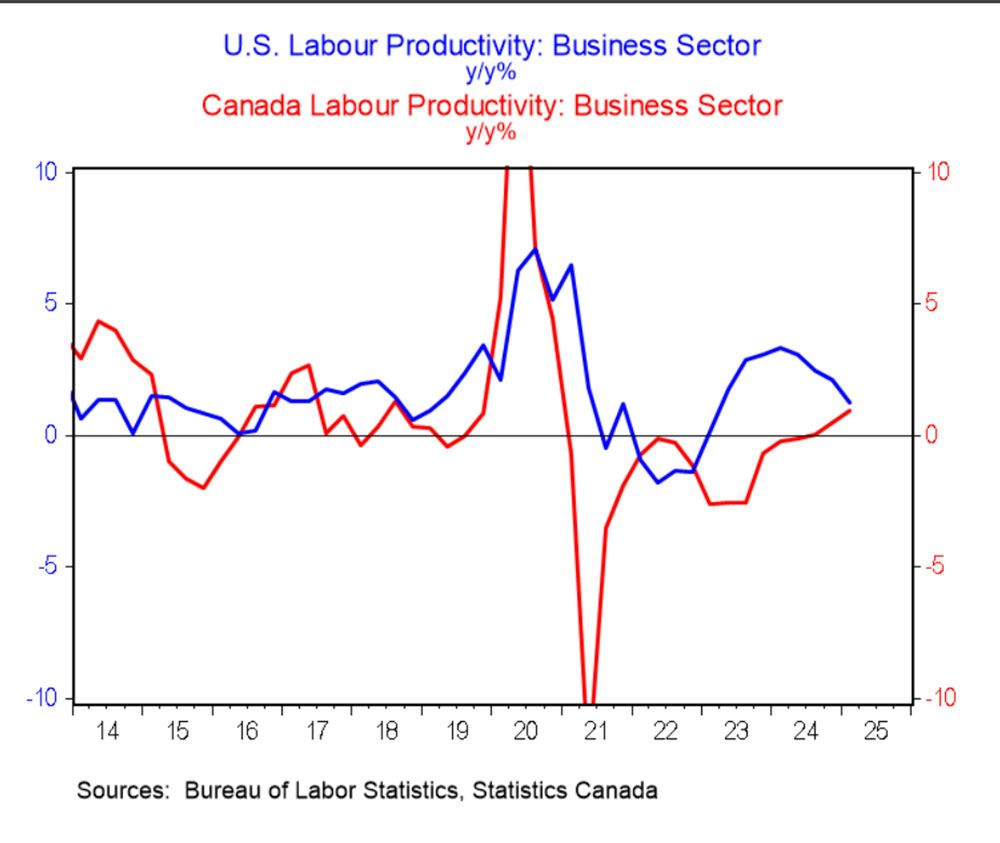

Canadian labour productiveness is lastly making features. As right this moment’s chart from BMO Capital Markets reveals productiveness development is on the rise and catching as much as the expansion fee of the US, although that has been declining.

Statistics Canada mentioned final week

that productiveness grew 0.2 per cent within the first quarter of 2025. That’s down from 1.2 per cent development in fourth quarter of 2024, however it’s the first time there have been consecutive quarterly will increase for the reason that begin of the COVID-19 pandemic.

“The unhealthy information is that productiveness might take successful within the coming quarters as financial development is anticipated to gradual meaningfully on account of commerce uncertainty,” mentioned BMO senior economist Shelly Kaushik.

Former prime ministers Jean Chretien, Joe Clark and different politicians and consultants attend a summit in Calgary to debate points together with peace and safety, commerce, vitality safety and important minerals, synthetic intelligence and quantum computing. Right this moment’s Information: United States Producer value index Earnings: Transat AT Inc., Adobe Inc.

Nationwide Financial institution’s $5 billion megadeal was a long time within the making for Dominic Paradis Can Canada restore ties with China? How the 2 nations might finish the tariffs battle and increase commerce Don’t assume additional fee cuts from the Financial institution of Canada, Poloz warns

With the price of properties on the rise, the everyday first-time homebuyer in Canada appears to be like totally different than previously. The

Monetary Publish takes a glance

at who’s shopping for and what it takes for them to personal their first residence.

Are you frightened about having sufficient for retirement? Do it is advisable to regulate your portfolio? Are you beginning out or making a change and questioning methods to construct wealth? Are you making an attempt to make ends meet? Drop us a line at wealth@postmedia.com together with your contact information and the gist of your drawback and we’ll discover some consultants that will help you out whereas writing a Household Finance story about it (we’ll hold your title out of it, in fact).

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Publish column

might help navigate the complicated sector, from the newest traits to financing alternatives you gained’t wish to miss. Plus examine his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

Right this moment’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Publish workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? Electronic mail us at

.

Canada residence costs are heading into correction territory

Simply once you thought Toronto’s condominium market could not get any worse …

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable to know — add financialpost.com to your bookmarks and join our newsletters right here