Andrei Grachev, an early booster of a Trump crypto providing, has cycled via a number of alleged funding scams and was convicted on fraud prices in Russia.

Advert Coverage

World Liberty Monetary’s web site touts WLF1, its Trump-sanctioned “governance token.”

(Gabby Jones / Bloomberg through Getty Photos)

Final yr, President Donald Trump and his sons teamed with the crypto funding agency World Liberty Monetary (WLF) to advertise a Trump-approved token. The sale began with a trickle, however after outstanding crypto figures like Tron founder Justin Solar poured in $75 million, a stampede ensued amongst crypto backers eager to take advantage of even a passing connection to the American president, through his crypto model. Below WLF’s steering, the Trumps have taken in a whole lot of hundreds of thousands of {dollars}—maybe far more—from token purchases, charges, and supposed investments, a few of it from unknown sources abroad. With WLF counting Trump diplomatic envoy Steve Witkoff and two of Witkoff’s sons as cofounders, the corporate has the potential to be the chief enterprise arm—or the bribery car—of the second Trump administration.

One of many members on this speculative gold rush was Andrei Grachev, the Uzbek-born, United Arab Emirate– and Switzerland-based, 37-year-old managing accomplice of DWF Labs. Grachev’s firm is a outstanding crypto market–making and funding agency with a murky historical past, and Grachev directed the corporate to purchase $25 million value of $WLFI, WLF’s prized “governance token.” The token is meant to permit holders to vote on modifications to the WLF platform, however they can’t promote or transfer their tokens elsewhere. It’s primarily a donation, and Grachev appeared proud to make it, touting his affiliation with the crypto firm the place President Trump is listed as “chief crypto advocate.”

On April 16, 2025, the Abu Dhabi–based mostly DWF Labs introduced that it might be opening an workplace in New York Metropolis, and that it had acquired $25 million in $WLFI tokens. (Twelve days earlier, an eagle-eyed blockchain sleuth noticed that DWF had transferred $25 million value of USDC stablecoin tokens to World Liberty Monetary, indicating that the transaction had already taken place.) DWF additionally stated that it might be offering liquidity for USD1, Trump’s new stablecoin undertaking, which has already been tied to a $2 billion deal involving a UAE funding fund and the world’s largest crypto change, Binance, whose former CEO Changpeng Zhao is presently looking for a pardon after spending 4 months in federal jail for violating US money-laundering legal guidelines.

“With World Liberty Monetary, it has completely different noises round, completely different rumors round, however look, it’s nonetheless the one coin that has President Trump’s household behind it,” Grachev instructed the influencer Mario Nawfal in an interview. “It can’t be a rip-off, proper? And we’ve got to speculate.”

DFW first appeared on the scene in 2022, amid the collapse of multibillion-dollar frauds like Terraform Labs, Celsius, and FTX. That timing struck some business watchers as sketchy—and Grachev’s personal finance background invited further scrutiny. Nonetheless, the corporate launched with a bang, saying that it was buying and selling a whole lot of pairs of tokens throughout dozens of exchanges, with workplaces in Singapore, Switzerland, Dubai, Hong Kong, and China. The supply of the cash powering all this buying and selling exercise was unclear.

Grachev, for his half, was already a controversial presence on the Russian crypto scene. In 2018, he was made the CEO of the Russian department of the Huobi crypto change. Earlier than that, he had been accused of being concerned in assorted crypto and funding scams. As CEO of Huobi, he stated he was working to listing OneCoin, a $4 billion worldwide Ponzi scheme that collapsed and despatched considered one of its creators to US federal jail for 20 years.

Present Concern

Grachev’s temperament seemingly hadn’t advanced since he took the helm of DWF Labs. As The Wall Road Journal reported final yr, investigators at Binance discovered that DWF was much less a market-maker—shopping for and promoting tokens to supply liquidity for merchants—than a possible market manipulator, artificially inflating the amount of some tokens with the intention to drive up their value. As a substitute of cracking down on DWF, Binance fired a few of its in-house investigative workforce. The Block, a crypto commerce publication, equally reported that DWF Labs supplied token issuers “value administration” providers, together with “synthetic quantity.”

It seems that Grachev’s legal historical past is extra intensive than beforehand identified, in accordance with a evaluation of public information, leaked Russian authorities paperwork, and Russian and English-language social media postings. Grachev additionally has some notable ties to Russian state banks—and considered one of his colleagues could have collected a group of luxurious belongings on Grachev’s behalf. Properly earlier than he was investing hundreds of thousands within the U.S. president’s crypto ventures, Andrei Grachev was a confessed fraudster turned crypto hustler.

In April 2015, a Moscow legal court docket charged Grachev and an confederate with fraud. He and a colleague have been accused of making a pretend logistics and transport agency, recruiting unwitting drivers, and utilizing them to steal cargo, together with a multimillion-ruble cargo of canned meals. The pair admitted their guilt. Grachev obtained a suspended three-year jail sentence, 5 years of probation, and a high-quality of 450,000 rubles. “Considering the social hazard of the crime dedicated, the court docket considers it needed to determine an extended probationary interval for the defendants, throughout which they need to show to society their rehabilitation,” wrote the decide, in accordance with a machine-translated sentencing doc.

Whereas on probation, Grachev was accused of taking part in three crypto scams, together with two during which he allegedly absconded with traders’ funds.

By 2017, Grachev was buying and selling cryptocurrencies and began an organization known as Crypsis Blockchain Holding, whose majority shareholder was a Russian girl named Olga Dementieva. A pitch deck discovered on a Russian enterprise web site promised fantastical returns of two,000 %.

In what grew to become a sample, Grachev developed crypto companies, solicited traders, made sensationalist social media posts, and promised ICOs, or Preliminary Coin Choices—just for nearly nothing to occur. That they had names like Shoptimizer, B2B United Commerce, and Export.On-line and left behind a path of useless web sites, cheated traders, and failed-to-launch crypto tokens.

In 2019 a Russian-language crypto media outlet reported that members of a St. Petersburg–based mostly funding membership had accused Grachev of stealing 10 million rubles that have been purported to go towards Export.On-line’s ICO. As well as, the members of the membership misplaced 8 million rubles in one other funding initiative that Grachev had promised would generate an annual 120 to 400 % return. In response to a member of the funding membership, Grachev took their cash, “went into hiding and didn’t reply the cellphone.”

One other Russian crypto government stated that Grachev borrowed $10,000 from him and by no means repaid it. He publicly denounced Grachev on Fb, writing, “I hope that perhaps this submit will save somebody from trusting you.”

Regardless of the path of controversy, Grachev rose increased in Russia’s crypto business. In Might 2018, he grew to become vice chairman of buying and selling at RACIB, a nonprofit crypto business group created by German Klimenko, a tech entrepreneur who on the time was an adviser to Russian President Vladimir Putin. RACIB supported authorities crypto initiatives, and its board included executives from state firms.

In September 2018, Grachev was named CEO of the Russian department of Huobi, a Singapore-based crypto change that will later be renamed HTX—and whose international adviser is Justin Solar, a high investor in Trump’s crypto initiatives whose SEC fraud case was paused earlier this yr. Below Grachev, Huobi Russia shaped a partnership with VEB financial institution, a state-connected agency that employed Vladimir Demin, who additionally sat on the board of RACIB. Whereas at Huobi, Grachev related with a Swiss high-frequency buying and selling buying and selling agency known as Digital Wave Finance. The Swiss firm started buying and selling tens of hundreds of thousands of {dollars} value of crypto on Huobi Russia every day, offering some much-needed liquidity for the change. Grachev would ultimately go away Huobi to commerce on behalf of Digital Wave Finance below the “synthetic model” of VRM Commerce, as he described it. Grachev based VRM Commerce with Demin and enlisted Ilya Rynenkov, who labored for VTB, a state-owned Russian financial institution.

Advert Coverage

Digital Wave Finance spawned various firms in varied jurisdictions, together with the UAE-based DWF Labs, the place Grachev grew to become managing accomplice. In different phrases, when DWF Labs appeared to burst out of nowhere onto the crypto scene in fall 2022, it was really the newest undertaking from veteran crypto boosters—on this case, merchants Marco and Remo Schweizer and Michael Rendchen. The Schweizer brothers every owned 27 % of DWF Labs, as did Grachev. With an emphasis on tapping less-regulated Asian markets, DWF Labs poured cash into a whole lot of crypto initiatives, each main and obscure. When Sam Bankman-Fried’s FTX collapsed in November 2022, Digital Wave Finance was listed among the many firm’s collectors, having bought some shares in a 2021 providing.

Well-liked

“swipe left beneath to view extra authors”Swipe →

As DWF Labs grew, it attracted rumors on social media and criticism from friends. Grachev “had completely no enterprise to be on that panel,” wrote Cristian Gil, the chairman of crypto agency GSR, after Grachev, in his DFW affiliation, appeared at a convention alongside different outstanding market makers. “It’s very unhappy that in late 2023 unhealthy actors like @DWFLabs can nonetheless get a lot airtime.” (Gil and GSR didn’t reply to requests for remark.)

Such skepticism didn’t cease DWF Labs’ rise. In 2023, the corporate shaped a partnership with Justin Solar’s TRON, a prelude to the businesses later collaborating on Trump’s stablecoin. Showing at conferences with Solar and different crypto bigwigs, posting images of himself in Dubai with Eric Trump, Grachev reveals each signal of becoming a member of crypto’s ruling internal circle. In March, DWF Labs introduced a $250 million funding fund “aimed toward accelerating the adoption and enlargement of mid and large-cap crypto initiatives.” Three weeks later, it made its $25 million $WLFI buy.

Primarily based on his public appearances and social media postings, Grachev appears to spend so much of time in Switzerland and the UAE, however he additionally has some outstanding hyperlinks to his previous life in Russia. His former affiliate Olga Dementieva, the bulk proprietor of Grachev’s Crypsis enterprise, has acquired 5 luxurious automobiles and an house in a Moscow high-rise constructing—all within the final 4 years, in accordance with Russian car and actual property information. Grachev, who’s closely tattooed with a scraggly beard, has posted images of DWF-branded sports activities automobiles. He has additionally posted references to the Marvel superhero film Deadpool—akin to images of Deadpool-themed boxing gloves and an image of Deadpool forming his fingers right into a coronary heart across the DWF Labs brand. In response to a database of images of Russian automobiles, Dementieva’s 2021 Porsche Panamera GTS contains a full-body Deadpool vinyl wrap, together with the character’s face and two weapons on the hood.

Some Democratic members of Congress and watchdog teams have taken discover of Trump’s crypto dealings. In April, the group Accountable.US, citing a report in Rolling Stone, despatched a letter to members of Congress asking for an investigation into the $25 million deal between World Liberty Monetary and DWF Labs. The following month, Connecticut Democratic Senator Richard Blumenthal despatched a letter to WLF cofounder Zach Witkoff relating to a “preliminary inquiry into potential conflicts of curiosity and violations of the legislation from President Trump’s cryptocurrency ventures.” Blumenthal cited considerations about WLF’s dealings with overseas firms together with DWF Labs. “DWF Lab’s administration beforehand managed Russian companies accused of enabling Russian banks to bypass sanctions, along with having different ties to Russian banks,” wrote Blumenthal. (A member of Blumenthal’s comms employees didn’t reply to a request for remark.)

Andrei Grachev didn’t reply to requests for remark despatched via X and LinkedIn.

Requested about what Democrats are doing to research Trump’s dealings with DWF Labs and different companies, Illinois Consultant Sean Casten, who sits on the Home Monetary Providers Committee, stated in a press release: “President Trump’s cryptocurrency enterprise ventures are extremely alarming and lift numerous authorized questions.… A DOJ that isn’t blindly loyal to the president would instantly launch an investigation into the president’s crypto dealings. I’m profoundly disenchanted that the DOJ has refused to reply to my demand, alongside 36 members of Congress, that they accomplish that. It shouldn’t be partisan to imagine that the president shouldn’t settle for hundreds of thousands upon hundreds of thousands of {dollars} from overseas actors whose true identities largely stay nameless.”

Outraged calls for from elected Democrats may have minimal affect on the brand new regulatory enjoying area for the crypto business. Trump and the GOP-led Congress have dismantled the prior restraints on crypto-related offenses—and the investigative groups charged with implementing them—to say nothing of presidential malfeasance and broader problems with crypto-enabled corruption. If any crime has been dedicated in reference to the DFW and WLF deal, it could not matter.

In response to a latest court docket submitting, Trump supposed to promote some portion of DT Marks DEFI LLC, the car that held his possession share of World Liberty Monetary. It’s not clear if Trump really made that deal—and if that’s the case, who the client was.

For Grachev and DWF Labs, nonetheless, there will be little doubt that the $25 million they handed over to the president’s crypto agency for noncirculating $WLFI tokens was cash effectively spent. “I do imagine it was an amazing funding deal we made,” Grachev instructed Nawfal, “whereas others are ready.”

Jacob Silverman

Jacob Silverman is the writer of Phrases of Service: Social Media and the Worth of Fixed Connection and the coauthor of Straightforward Cash: Cryptocurrency, On line casino Capitalism, and the Golden Age of Fraud. He’s engaged on a ebook about Silicon Valley and the political proper.

Extra from The Nation

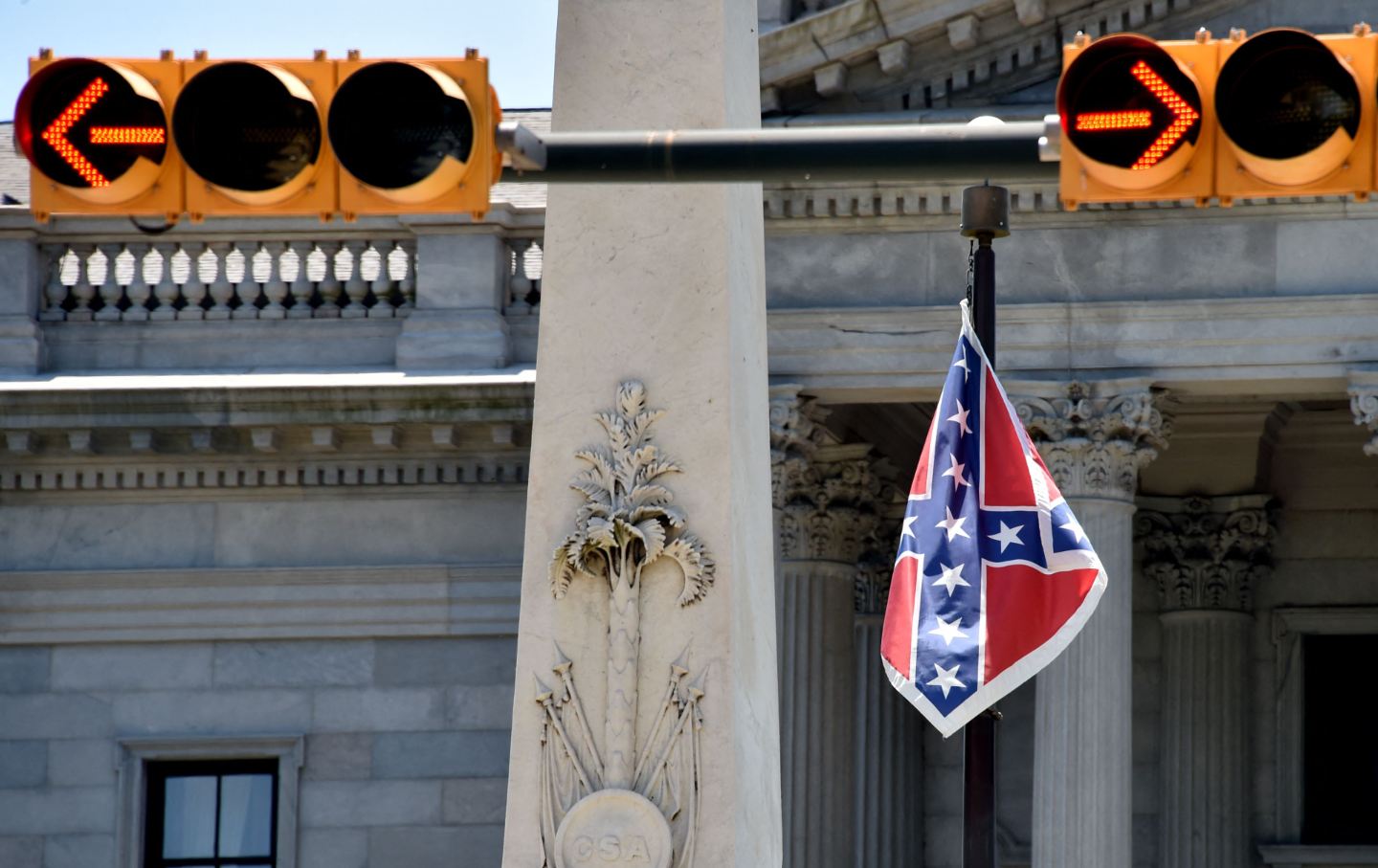

Ten years after the Charleston bloodbath, reverence for the Confederacy that Roof idolized goes robust.

Elizabeth Robeson

By treating IT and AI as impartial instruments, we obscure our potential to see—and resist—energy. If simply one of many large three tech giants collapses, societal mayhem may comply with.

Column

/

Zephyr Teachout

The quickest means for the USA to turn into fascist is by politicizing the navy.

Jeet Heer

Sanford Levinson maintains {that a} peaceable breakup can be preferable to a divided polity, whereas Tarence Ray argues that the working class should stay united throughout state traces.

Column

/

Sanford Levinson and Tarence Ray

Given advance warning of an impending warfare crime, the previous cheerleader for the Iraq warfare determined his precedence was to guard his scoop.

JoAnn Wypijewski