The impression of the commerce battle on

Canada’s financial system

was evident in April, because the manufacturing sector registered its largest drop in 4 years.

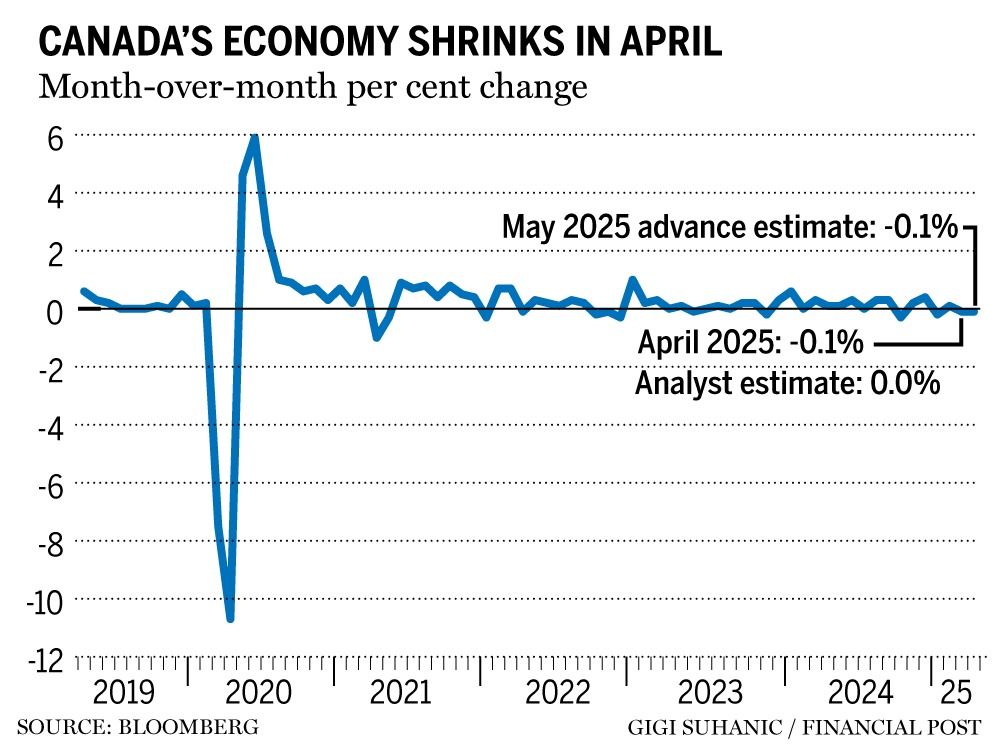

Canada’s gross home product fell 0.1 per cent in April,

on Friday, falling in need of the company’s advance estimate for a small improve in development.

The manufacturing sector dropped 1.9 per cent that month, with broad-based declines throughout each sturdy and non-durable items.

Transportation tools manufacturing was the most important contributor to the decline in sturdy items manufacturing, recording its largest month-to-month lower since September 2021 at 3.7 per cent.

Different transportation tools contracted 21.6 per cent, its first decline in six months. Motorcar manufacturing additionally declined by 5.2 per cent as

U.S. tariffs on automobiles

imported from Canada resulted in decrease exports and precipitated some producers to reduce manufacturing.

April marks the beginning of a “commerce war-induced recession” that can probably proceed via the top of the 12 months except Canada and the U.S. can attain a commerce deal that reduces tariffs considerably, mentioned Tony Stillo, director of Canada economics at Oxford Economics, and senior economist Michael Davenport.

“We count on the downturn will quickly unfold from trade-exposed items sectors to the broader home financial system amid heightened uncertainty, mounting job losses, and better costs from the commerce battle,” Stillo and Davenport mentioned in a observe.

Canada’s financial system hasn’t posted consecutive month-to-month declines in exercise in nearly three years, mentioned Royce Mendes, managing director and head of macro technique at Desjardins Capital Markets.

“Earlier than the pandemic, the final such occasion was in 2017. Our monitoring for Q2 GDP now extra clearly factors to a slight contraction,” Mendes mentioned in a observe.

The wholesale commerce sector had its largest month-to-month decline since June 2023 at 1.9 per cent. Each imports and exports dropped in April, inflicting motorized vehicle and motorized vehicle components and equipment wholesaler-distributors to say no 6.8 per cent. Equipment, tools and provides declined by 1.6 per cent as exports and imports of a number of associated merchandise fell.

The

Financial institution of Canada

will take the April studying in stride forward of its subsequent rate of interest determination on July 30 because it weighs “softer financial development in opposition to ongoing underlying inflation pressures,” Marc Ercolao, economist at TD Economics, mentioned in a observe.

Nevertheless, Ercolao mentioned the central financial institution wants extra proof to make a “decisive transfer.”

“With Canada’s labour market exhibiting cracks, customers reigning in spending, and the housing market visibly strained, we predict the Financial institution of Canada has headroom to chop the coverage price two extra instances this 12 months,” he mentioned.

The finance and insurance coverage sector grew 0.7 per cent in April, led by 3.5 per cent development in monetary funding providers, funds and different monetary automobiles.

U.S. President Donald Trump

’s “Liberation Day” tariff announcement on April 2 led to “unusually excessive exercise on Canadian fairness markets” that month, mentioned Statistics Canada.

“Promoting exercise on the Toronto Inventory Change and different monetary markets within the 4 buying and selling days following the announcement was the primary contributor to April’s elevated exercise,” the company famous.

After Trump introduced a 90-day pause on tariffs on April 9, the rebound in North American fairness markets added additional to the “atypically excessive quantity of exercise” that month.

The federal election on April 28 gave a brief enhance to the general public sector mixture, led by 2.2 per cent development in federal authorities public administration.

Jobless price to hit 7.3% as tariffs chunk: Deloitte

Financial institution of Canada’s inflation worries linger

The humanities, leisure and recreation sector had its largest improve since March 2022, rising 2.8 per cent in April due to a lift in attendance ranges at arenas as 5 Canadian

Nationwide Hockey League

groups certified for the playoffs.

An advance estimate for Might has GDP declining by 0.1 per cent, with decreases in mining, quarrying, oil and fuel extraction, public administration and retail commerce anticipated to be partially offset by development in actual property and rental and leasing.

• E mail: jswitzer@postmedia.com