This Canada Day whenever you mirror on being Canadian listed below are a couple of extra traits you may not have identified about, due to comparability web site Evaluate the Market AU.

In honour of Canada’s nationwide vacation, the family finance comparability web site regarded again at its surveys on driving, well being, journey and finance “to have a good time what the nation does effectively.”

Canadian drivers, for instance, are the least more likely to have a automobile accident, based on a

survey evaluating Canadians, Australians and People.

Drivers within the U.S. have been the one group who reported the next than 50 per cent fee of automobile accidents. Canadian drivers got here in because the most secure, with 60 per cent of respondents saying they’d not been in a automobile accident in their very own automobile.

Nevertheless, Canadians usually tend to lose their baggage when flying than both People or Australians.

Canadian respondents

reported the very best fee of misplaced baggage

with 30.4 per cent answering sure. Australian flyers reported the bottom fee at 20.4 per cent, whereas People have been within the center with a misplaced baggage fee of 25.9 per cent.

Most Canadians although acquired their baggage again finally, whereas residents of the opposite nations had the next danger of by no means seeing their baggage once more.

America, which lacks a public well being system, had the very best share of respondents who stated

they owed cash for healthcare prices.

Seventeen per cent of Canadians, nevertheless, additionally stated they have been in debt over medical charges, larger than the 12 per cent of Australians who’ve a blended public-private system.

Canadians are additionally probably to

assist out their grownup youngsters financially.

Greater than a 3rd of adults, 37 per cent, surveyed by Evaluate the Market, stated that their dad and mom lent or gave them cash for purchases or usually despatched cash to help with bills. That’s in comparison with 33 per cent of the People and 23 per cent of the Australians.

“Our analysis has discovered that Canadians have rather a lot to be pleased with. They’re safer drivers, have inexpensive healthcare, and are extra beneficiant in supporting their grownup youngsters financially. It’s a nation of those that care and look out for one another, and that’s one thing to have a good time,” stated Evaluate the Market spokesperson Chris Ford.

And this 12 months, confronted with U.S. President Donald Trump’s tariff threats and feedback concerning the 51st state, the celebration can be particularly significant, based on one other ballot.

Virtually half of Canadians stated this Canada Day can be extra significant to them than typical, with 81 per cent saying they plan to have a good time, based on a survey by

Petro-Canada and Harris Ballot.

Joyful Canada Day! Posthaste will return Wednesday after the vacation.

Enroll right here to get Posthaste delivered straight to your inbox.

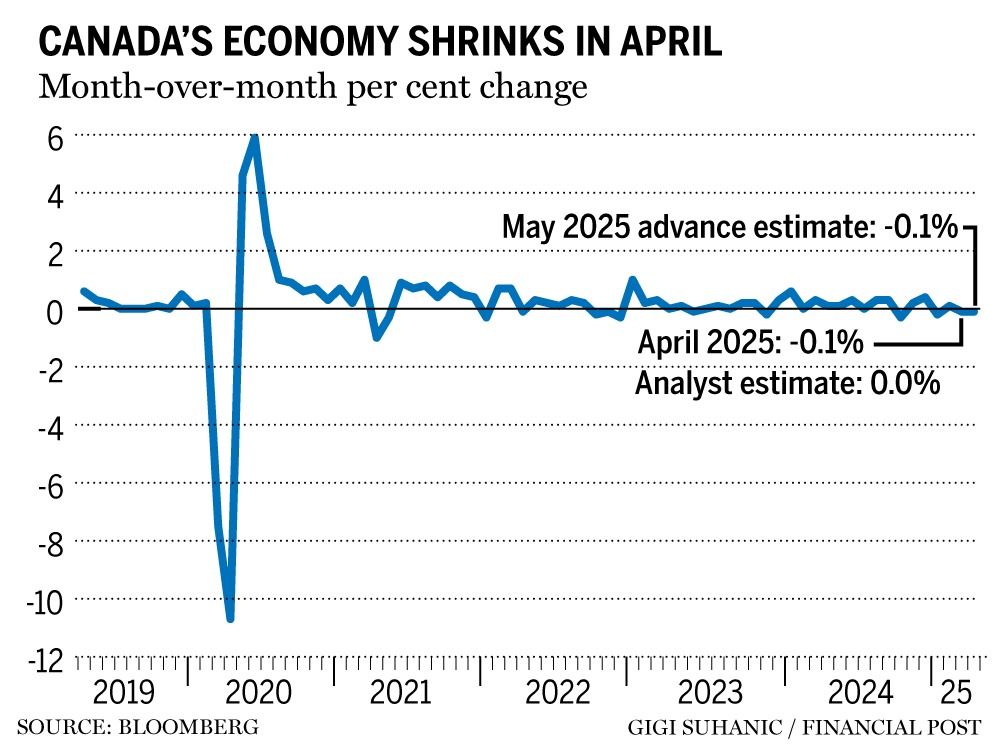

Canada’s economic system is shedding momentum, information confirmed Friday.

Gross home product shrank

by 0.1 per cent in April and the identical once more in Could, based on an early estimate by Statistics Canada, setting the stage for contraction within the second quarter.

GDP might decline at about an 0.5 per cent annual fee for this quarter and contract once more within the third, stated Douglas Porter, chief economist for BMO Capital Markets.

“Actually not excellent news, but in addition a much less dire final result than anticipated a couple of months again on the top of the tariff drama,” he wrote in a observe after the info.

Nonetheless the studying raised market odds of a Financial institution of Canada rate of interest reduce in July.

Hudson’s Bay has till at present to vacate its 80 shops and 16 extra that have been operated beneath the Saks banner. Canada’s oldest retailer wrapped up liquidation gross sales and closed its doorways at first of June, however has since been emptying its shops of fixtures, furnishings and tools. Earnings: Cogeco Communications Inc.

What’s Canada’s digital providers tax and why is it infuriating Trump? Canada’s economic system begins to lose momentum

Is Canada setting itself up for an enormous house value spike in 2030?

Spousal registered retirement financial savings plans (RRSPs) have been round for many years, and for a lot of {couples}, these plans can play an vital function in lowering tax upon retirement. However, they are often difficult, and it’s vital to know how they work and when they’re most appropriately utilized in retirement. Tax skilled Jamie Golombek takes us by the contribution guidelines, and appears at a couple of of the most typical causes for utilizing spousal RRSPs.

Learn on

Ship us your summer season job search tales

Final week, we revealed a function on the

dying of the summer season job

as pupil unemployment reaches disaster ranges. We wish to hear instantly from Canadians aged 15-24 about their summer season job search.

Ship us your story, in 50-100 phrases, and we’ll publish the perfect submissions in an upcoming version of the Monetary Put up.

You possibly can submit your story by electronic mail to

beneath the topic heading “Summer season job tales.” Please embody your identify, your age, town and province the place you reside, and a cellphone quantity to succeed in you.

Are you fearful about having sufficient for retirement? Do you should alter your portfolio? Are you beginning out or making a change and questioning learn how to construct wealth? Are you making an attempt to make ends meet? Drop us a line at wealth@postmedia.com together with your contact data and the gist of your downside and we’ll discover some specialists that will help you out whereas writing a Household Finance story about it (we’ll preserve your identify out of it, in fact).

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

might help navigate the advanced sector, from the most recent tendencies to financing alternatives you received’t wish to miss. Plus verify his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

In the present day’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

Why extra economists assume the Financial institution of Canada is completed chopping rates of interest

Canada is in for a tough couple of quarters, say economists

Bookmark our web site and help our journalism: Don’t miss the enterprise information you should know — add financialpost.com to your bookmarks and join our newsletters right here