It’s summertime and the meltdowns are simple.

The third quarter is usually a harmful time for markets. Traditionally most of the largest crises have began in late summer season when liquidity is skinny and the VIX is vulnerable to spike.

Markets have been remarkably resilient this yr, however there is no such thing as a scarcity of catalysts ready within the wings, mentioned Henry Allen, macro strategist for Deutsche Financial institution Analysis.

Donald Trump’

s commerce warfare is ready to climax on Aug. 1, the deadline for

reciprocal tariffs

to take impact on a number of nations. On prime of that, the U.S. president has begun to announce plans for sectoral duties on such

merchandise as copper and prescribed drugs.

“Markets presently aren’t pricing this in in any respect,” mentioned Allen.

Trump’s frequent shifts and the prospect that offers can be reached earlier than the deadline has made the market skeptical of this risk, he mentioned.

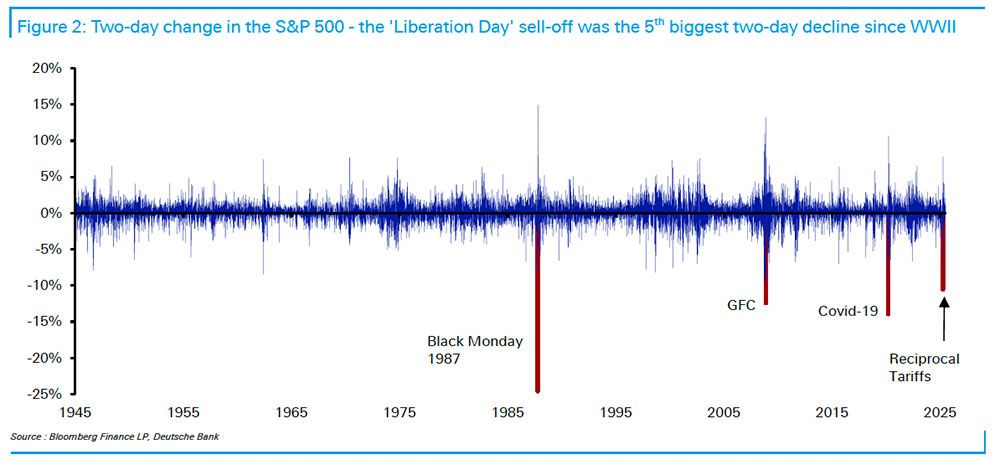

However we’ve got already seen the carnage that comes when traders are stunned by United States’ aggression. Shares tumbled after Liberation Day on April 2 and when

Trump slapped Canada and Mexico

with a 25 per cent tariff in March.

“So a sharper-than-expected tariff spike in August will surely slot in that class and will spark a recent sell-off,” mentioned Allen.

Inflation is one other set off

. Thus far the impact of tariffs has not proven up in the US, nevertheless it wasn’t anticipated to till June and July after corporations had time to regulate their costs. The primary of that information comes out subsequent week.

Hotter inflation would maintain the

Federal Reserve

on the sidelines and markets, who’re anticipating two extra charge cuts this yr, would react, he mentioned.

A 3rd is weak financial information and this one is a hair-trigger. Final summer season the U.S. unemployment charge rose greater than anticipated, breaching what’s generally known as the Sahm rule. The market response was swift and brutal, with the S&P 500 shedding greater than 6 per cent in simply three buying and selling periods.

Allen mentioned what’s fascinating about this sell-off was the information wasn’t even that unhealthy, nevertheless it tapped into

recession fears

that had been brewing for awhile.

“For at this time, what that reveals is it may simply take a couple of days in a row of underwhelming information releases to ramp up these recession fears, even when subsequent information doesn’t justify it,” mentioned Allen.

“That’s notably so given the broad optimism that there isn’t going to be a recession in the meanwhile, in a state of affairs the place world equities are close to report highs and credit score spreads are tight by historic requirements.”

Rising fears about nations’s debt hundreds is one other vulnerability. Now we have already seen bond yields spike this yr in the US after the Moody’s credit score downgrade and in the UK final week.

The issue with fiscal fears is they’ll change into self-fulfilling, mentioned Allen. An increase in bond yields raises doubt about debt sustainability, which then can push yields even increased.

That’s what occurred in the summertime of 2011, when the US was embroiled in a cliff-hanging debt ceiling dispute and confronted a S&P credit score downgrade. Considerations about debt had been additionally rising in Europe.

The S&P 500 fell 5.7 per cent that August and one other 7.2 per cent in September.

The explanation markets have held up so effectively this yr is that coverage makers have proven a willingness to step in when issues go sideways and not one of the shocks have truly affected the financial system, mentioned Allen.

All people was frightened about recession after Liberation Day, however when Trump prolonged the tariff deadline, partially due to bond market stress, these fears pale.

To get a long-lasting market sell-off there must be a shock that impacts macro fundamentals and that coverage makers can’t repair, he mentioned.

That occurred in a summer season not so way back.

In late August of 2022, inflation was sky excessive and Fed chair

Jerome Powell

delivered a hawkish speech at Jackson Gap, adopted by a 3rd outsized charge hike in a row.

The S&P 500 fell over 4 per cent in August and 9.3 per cent in September.

Join right here to get Posthaste delivered straight to your inbox.

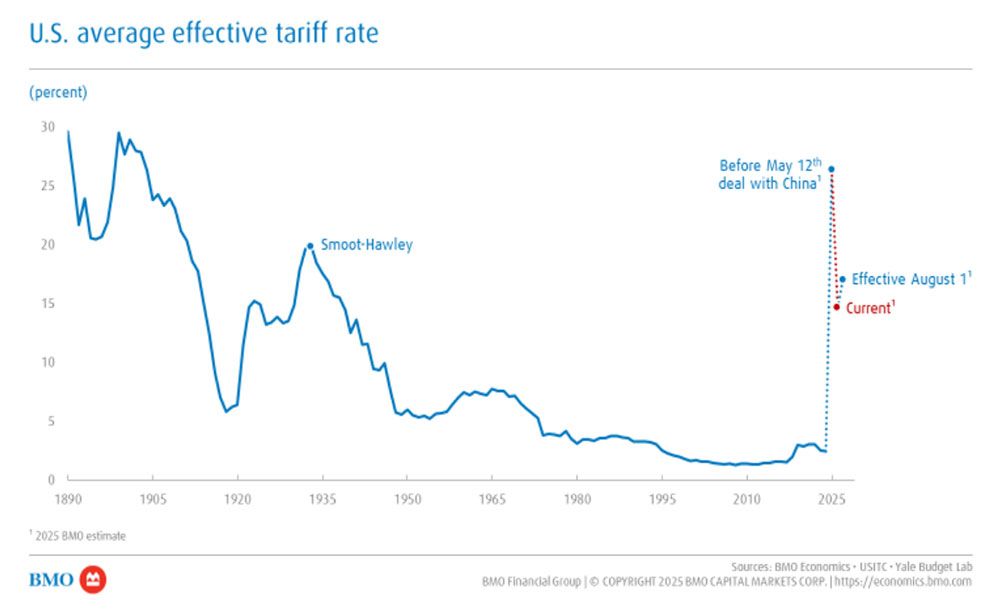

America’s efficient tariff charge is on its manner again up, after

President Donald Trump introduced reciprocal duties

starting from 25 to 40 per cent for 14 nations this week. While you issue within the Vietnam deal, the speed rises to 17 per cent, mentioned Sal Guatieri, senior economist with BMO Capital Markets.

Although that’s decrease than the 26 per cent peak in early Might earlier than the China settlement it is sufficient to do some harm to the U.S. financial system, mentioned the economist — within the vary of about half a per cent of annual progress.

Immediately Knowledge: United States preliminary jobless claims Earnings: Aritzia Inc., Conagra Manufacturers Inc., Delta Air Traces Inc., Richelieu {Hardware} Ltd.

Mutual fund gross sales tradition at banks raises crimson flags for market watchdogs

Canada’s copper commerce with the U.S. beneath risk as Trump dangles tariff on the metallic For some fortunate Canadians, their pensions and retirement outlooks have by no means been higher

A B.C. couple of their 40s with three rental properties surprise if it’s time to start out investing within the inventory market to assist fund their retirement or if they need to buy a fourth earnings property.

Household Finance crunches the numbers.

Ship us your summer season job search tales

Just lately, we printed a function on the

loss of life of the summer season job

as scholar unemployment reaches disaster ranges. We need to hear immediately from Canadians aged 15-24 about their summer season job search.

Ship us your story, in 50-100 phrases, and we’ll publish the perfect submissions in an upcoming version of the Monetary Put up.

You possibly can submit your story by electronic mail to

beneath the topic heading “Summer season job tales.” Please embody your identify, your age, the town and province the place you reside, and a telephone quantity to succeed in you.

Are you frightened about having sufficient for retirement? Do that you must regulate your portfolio? Are you beginning out or making a change and questioning methods to construct wealth? Are you attempting to make ends meet? Drop us a line at wealth@postmedia.com together with your contact information and the gist of your drawback and we’ll discover some consultants that will help you out whereas writing a Household Finance story about it (we’ll maintain your identify out of it, in fact).

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

may also help navigate the advanced sector, from the newest tendencies to financing alternatives you received’t need to miss. Plus examine his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the power sector and extra.

Immediately’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? Electronic mail us at

.

Canadians are nonetheless saving, however habits are shifting amid market turmoil

Copper theft is getting so unhealthy Bell Canada is sounding the alarm

Bookmark our web site and help our journalism: Don’t miss the enterprise information that you must know — add financialpost.com to your bookmarks and join our newsletters right here