In what’s the final quarter the place Apple will solely take a minimal hit from grossly elevated tariffs, the corporate posted $94 billion in earnings with a notably better-than-expected iPhone, progress in China, and robust Mac enterprise segments.

Apple has revealed its quarterly monetary outcomes for Q3 2025, and it has crushed expectations as soon as once more. The quietest quarter in Apple’s seasonally-affected financials schedule, the interval is significantly higher than first thought.

The outcomes arrive forward of the normal convention name with analysts and traders, which is hosted by CEO Tim Prepare dinner and new CFO Kevan Parekh. Throughout the name, the duo will focus on extra particulars in regards to the figures, in addition to the affect of tariff adjustments towards the enterprise.

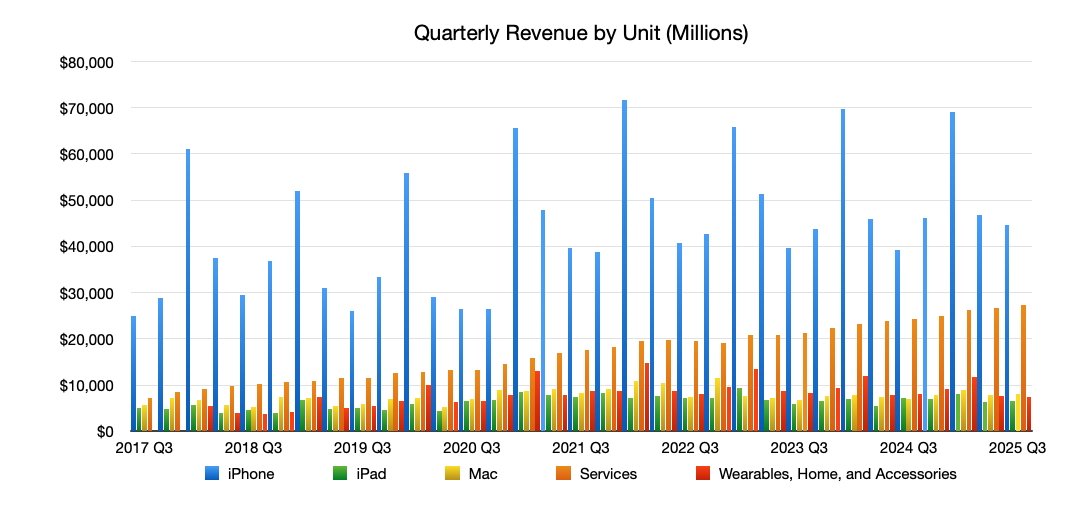

Apple quarterly income and internet revenue as of Q3 2025

For the second quarter, Apple’s income reached $94.04 billion, up from the $85.78 billion reported in Q3 2024. The earnings per share of $1.57 can be up from the year-ago $1.40.

In pre-financials forecasts, the Wall Road consensus put income at round $89.1 billion, with a variety between $92.1 as a excessive and $86.9 as a low. The EPS forecast was at $1.43, with a excessive of $1.54 and a low of $1.32.

Apple’s unit income, as per Q3 2025

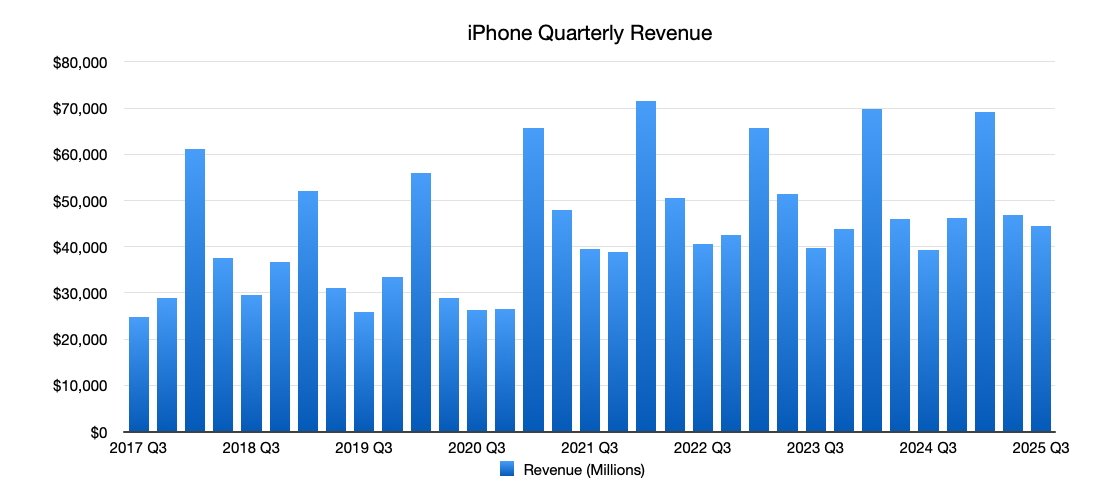

For the interval, iPhone went from $39.3 billion within the year-ago quarter to $44.58 billion this time. Income from iPad at $6.58 billion is down from the $7.16 billion reported in Q3 2024.

Mac income grew from $7.01 billion to $8.05 billion. Wearables, House, and Equipment moved from $8.09 billion final 12 months to $7.4 billion this 12 months.

Companies continued its ever-ongoing upward progress development, shifting from $24.2 billion for Q3 2024 to $27.4 billion for Q3 2025.

“Immediately Apple is proud to report a June quarter income document with double-digit progress in iPhone, Mac and Companies and progress all over the world, in each geographic section,” mentioned Tim Prepare dinner.

Kevan Parekh mentioned Apple is “very happy” with its enterprise efficiency for the June quarter, which generated earnings per share progress of 12%.

Apple’s quarterly iPhone income, as of Q3 2025

Apple’s set up base of gadgets has additionally reached a brand new all-time excessive throughout all product classes and geographic segments. Nevertheless, whereas Parekh does not state how a lot that is within the ready assertion, it might come up through the name with analysts.

Parekh does attribute this impact to “very excessive ranges of buyer satisfaction and loyalty.”

Apple’s board of administrators has declared a money dividend of $0.26 per share of the Firm’s widespread inventory.