This text was produced for ProPublica’s Native Reporting Community in partnership with the Tennessee Lookout. Join Dispatches to get tales like this one as quickly as they’re revealed.

We’re persevering with to report on flex loans. Have you ever been sued by Advance Monetary, Harpeth Monetary or one other flex mortgage lender? To share your expertise, name or textual content reporter Adam Friedman at 615-249-8509.

Reporting Highlights

Wave of Lawsuits: Since introducing the Flex Mortgage in 2015, Tennessee-based lender Advance Monetary has filed over 110,000 lawsuits towards its debtors.

Excessive Curiosity and Charges: Flex Loans supply debtors as much as $4,000 at 279.5% curiosity, trapping 1000’s of individuals in debt that may land them in court docket.

Sidestepped Federal Regulators: Advance Monetary lobbied lawmakers to create the brand new Flex Mortgage to keep away from federal client safety laws.

These highlights had been written by the reporters and editors who labored on this story.

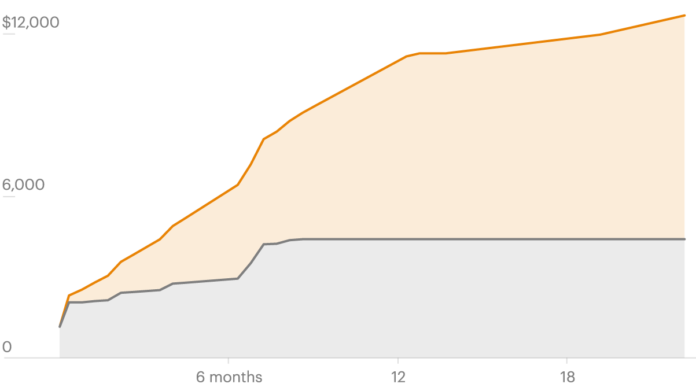

Rosita Hansen was working a night shift at a tubing manufacturing unit in 2023 when a sheriff’s deputy confirmed up and handed her a court docket summons. She was being sued for failing to repay a mortgage of $2,050. What confused Hansen was she had already paid a pair thousand greater than she borrowed. However now the corporate, Advance Monetary, mentioned she owed extra. Between what she’d already paid the corporate and the lawsuit, Advance stood to obtain over $12,500 from Hansen, data present.

Hansen, 57, had taken out the mortgage in 2021 after her mortgage firm threatened to foreclose on her modest three-bedroom home exterior Morristown, a small metropolis in East Tennessee. Hansen made sufficient cash to help herself, however after taking in her 4 grandchildren, she struggled to cowl the prices of additional meals and faculty provides, and she or he stopped paying her mortgage. That’s when she turned to Advance.

“I used to be offering for all of them,” Hansen mentioned. “Financially, it was tough.”

Like most debtors, Hansen couldn’t afford an legal professional to deal with the go well with, however she hoped to work out a cost plan with Advance. When she arrived on the Hamblen County courthouse in Morristown in Might 2023, she was directed to a line of half a dozen individuals ready to fulfill with an legal professional representing the corporate.

Throughout Tennessee, Advance has sued over 110,000 individuals since 2015, considerably greater than another payday lender, making it one of many largest plaintiffs of any Tennessee-based firm gathering debt. In Hansen’s Appalachian county of 66,000, the place practically half the households make lower than $50,000, the corporate has filed one case per each 32 residents over that point, the Tennessee Lookout and ProPublica discovered.

Advance started submitting 1000’s of lawsuits quickly after Tennessee lawmakers accredited the Flex Mortgage, a product pioneered by Advance in Tennessee. The mortgage’s $4,000 cap is 9 occasions greater than the restrict for many payday loans, and the corporate expenses the equal of a 279.5% annual rate of interest. Earlier than Flex Loans grew to become authorized in 2015, payday lenders might solely lend $425, and the borrower might by no means be required to pay again greater than $500. Since then, these protections have been eradicated and 1000’s of debtors have been defaulting.

Flex Loans solely cease rising after they’re utterly paid off, when a flex lender declares the mortgage is in default or when it sues the borrower. If the loans do find yourself in court docket, the legislation permits lenders to recoup attorneys charges — which may’t be performed with payday loans — a observe that may add as much as a 3rd of the mortgage quantity. Court docket judgments towards prospects are sometimes 1000’s of {dollars}, with some exceeding $10,000, data present. About 40% of all circumstances find yourself with a wage garnishment, court docket data present.

The implications of Flex Loans had been predicted when the Tennessee legislature legalized them 10 years in the past, and the Client Monetary Safety Bureau wished to manage merchandise like Flex Loans when Congress created the company in 2011. The Trump administration’s efforts to dismantle the CFPB are at the moment being reviewed by the courts.

Advance has argued that the brand new product would assist customers by providing them loans which might be technically cheaper than a payday mortgage. It downplayed considerations from client advocates that these high-interest loans focused and trapped low-income debtors in debt they might by no means repay. The corporate’s leaders made their case simply as federal regulators deliberate to crack down on different Tennessee lenders for making completely different high-interest loans to individuals they knew couldn’t pay them again.

After just some years, proof began mounting that the loans had been exacting a excessive toll on low-income debtors whereas producing enormous income for lenders. Since then, the Flex Mortgage has buried tens of 1000’s of Tennesseans equivalent to Hansen in a deep monetary gap.

Gabe Kravitz, a client finance researcher at The Pew Charitable Trusts, mentioned loans above $1,000 paired with triple-digit rates of interest are exhausting to repay.

“It will get very costly in a short time,” he mentioned.

Just a few different states have accredited merchandise just like the Flex Mortgage however, in contrast to Tennessee, when different states noticed issues with the loans, they acted to rein them in.

Virginia allowed banks to make line-of-credit loans however had by no means seen the necessity to cap rates of interest as banks competed for patrons. However quickly after Advance confirmed up, regulators seen the corporate submitting 1000’s of lawsuits. The state legal professional basic’s workplace investigated the corporate for misleading practices in 2020, in the end labeling the corporate as “predatory” and serving to to go laws to close down Flex Mortgage-like merchandise within the state. Advance declined to reply a query concerning the Virginia legal professional basic’s investigation. California and North Dakota additionally handed payments capping rates of interest on open-ended traces of credit score after Advance and different corporations started to function in these states.

The Lookout and ProPublica despatched Advance Monetary detailed questions on its operations, together with every of the circumstances cited within the article.

Cullen Earnest, the senior vice chairman of public coverage at Advance Monetary, declined to reply particular questions and mentioned he couldn’t talk about particular person circumstances as a consequence of privateness considerations. Earnest mentioned in an e-mail that the corporate has an A+ score from the Higher Enterprise Bureau. He added that the Tennessee Division of Monetary Establishments has obtained simply 91 complaints on versatile credit score lenders since 2020, representing lower than 0.001% of all new flex mortgage agreements, and that this knowledge displays the satisfaction of the overwhelming majority of Advance’s prospects.

Firm data present Hansen made her twice-a-month funds on time, paying over $6,600 in 10 months. The required minimal month-to-month funds are purported to act like a security web, making certain debtors pay sufficient to cowl the curiosity, charges and three% of the principal.

However many occasions after Hansen made a cost, the corporate allowed her to right away borrow the principal again, which she typically did, extending the time it will take to repay the mortgage. After nearly a 12 months of funds, she nonetheless owed greater than $3,000.

One Borrower Owed Over $8,000 in Curiosity and Court docket Charges

Curiosity and Court docket Charges

$8,272

Curiosity and

Court docket Charges

$8,272

Sources: Rosita Hansen’s mortgage billing statements and court docket data.

Credit score:

Lucas Waldron/ProPublica

Hansen mentioned she knew the mortgage was pricey — each mortgage assertion warns, “That is an costly type of credit score. Solely borrow what you possibly can afford to pay again” — however she didn’t notice how exhausting it will be to maintain up with the curiosity and charges.

The mortgage from Advance solely made Hansen’s monetary state of affairs worse. Because the funds grew to become an excessive amount of to deal with, she misplaced the home. However the Flex Mortgage continued to develop, nearly doubling in measurement by the point she obtained a court docket summons a 12 months later.

Who Is Advance?

Michael and Tina Hodges began their payday lending enterprise within the Nineteen Nineties with a couple of shops in Nashville.

The corporate, then known as Advance Pay Day, steadily expanded, making payday loans and providing merchandise like bus passes, examine cashing and cash transfers. In 2009, the Hodges advised a neighborhood information outlet that they wished to shed the picture of a “easy payday advance firm,” so the corporate took on a brand new identify, Advance Monetary.

By 2010, Advance had generated a modest $15 million in income from about two dozen shops, in keeping with statements it made in information studies on the time.

Not lengthy after, the rising enterprise collided with the Client Monetary Safety Bureau, a federal regulator Congress created after the banking disaster. The CFPB had began to take intention at high-interest payday lenders, releasing a 2013 report on the risks of the loans as debt traps. A subsequent company report discovered that payday lenders, notably in Tennessee, relied closely on providing loans to those that couldn’t afford them. Advance declined to reply to a query concerning the CFPB report.

Advance Monetary lobbied Tennessee lawmakers to approve larger loans that accumulate greater charges, saying the brand new providing can be “slightly bit costlier” however arguing it will be good for customers.

Credit score:

Stacy Kranitz for ProPublica

On the lookout for another product that wouldn’t fall beneath the CFPB’s looming laws, Advance turned to Tennessee lawmakers, who’ve energy over statewide rates of interest. The corporate employed Earnest, the previous high aide for the Tennessee Division of Monetary Establishments, which regulates payday lenders. It additionally opened up a political motion committee and started to push lawmakers to permit it to create the Flex Mortgage.

In a listening to discussing the Flex Mortgage laws earlier than its passage, Earnest advised a Tennessee Senate committee the brand new mortgage was like a line of credit score you would get at a financial institution, acknowledging it will be “slightly bit costlier.”

However the proposal added important potential prices. To permit lenders to bypass the state’s rate of interest cap, the legislature merely known as the curiosity one thing else: a “customary payment.” The legislation would allow flex lenders to cost 24% curiosity plus a every day payment till the mortgage is paid off. The payment is calculated by multiplying the mortgage quantity by 0.7%. Over one year the payment provides 255.5% to the price of the mortgage. Advance’s personal documentation tells debtors that though the state and Advance name it a payment, the federal authorities sees it for what it’s, an rate of interest.

The invoice handed the state Senate with out opposition. Within the Home, solely Democratic state Rep. Mike Stewart spoke towards the invoice, which handed overwhelmingly and was later signed by Republican Gov. Invoice Haslam.

Stewart identified the brand new legislation allowed corporations to recoup attorneys charges in court docket, one thing payday lenders had not been allowed to do, and a observe he knew as a lawyer would seemingly improve the variety of lawsuits.

“The laws was structured to maximise the amount of cash they might extract from these debtors,” Stewart, who has since left the legislature, mentioned in an interview.

After legalization of the Flex Mortgage, Advance Monetary’s enterprise boomed. The corporate expanded to all corners of Tennessee, rising to 105 areas by the tip of the 2010s.

As a personal firm, Advance will not be required to launch monetary info. However Advance and the Hodges had been vocal about their success, not less than at first. The corporate self-reported to the Nashville Enterprise Journal in 2019 that it made $392 million, quintupling its income from the 12 months earlier than it began providing the Flex Mortgage, and making greater than 25 occasions as a lot because it had initially of the last decade. Advance’s income not appeared on any of the enterprise journals’ lists after 2019.

These numbers parallel the expansion of the flex mortgage trade in Tennessee. By 2019, all flex lenders throughout the state had generated about $730 million in working earnings, a quantity that has continued to develop, in keeping with state data. In 2022, the newest accessible 12 months of knowledge, flex lenders earned $880 million in working earnings.

The corporate is among the high marketing campaign donors to Tennessee politicians, having spent roughly $2.5 million since 2014. Advance has additionally spent over $3 million lobbying state lawmakers over the previous decade.

The Hodges have additionally made roughly $10 million in political donations to federal candidates since 2014, together with over $3 million to help President Donald Trump’s campaigns. In a 2019 recording obtained by The Washington Submit, Hodges advised a payday lending trade group his political donations granted him higher entry to Trump. Hodges advised the Submit he was an enthusiastic supporter of Trump and by no means used his standing to ask the Trump administration for assist.

A Trump-appointed CFPB director rescinded many of the payday lending laws in 2020.

The brand new Trump administration has tried to intestine the CFPB, however an appeals court docket on April 28 upheld a decrease court docket ruling stopping the performing CFPB director from firing about 90% of the division’s workers.

At present, Advance’s solely product is the Flex Mortgage.

A Wave of Lawsuits

Earlier than the Flex Mortgage, court docket data present that payday lenders like Advance not often took debtors to court docket. The low $500 cap on mortgage quantities and the prohibition on gathering attorneys charges typically made suing individuals unprofitable.

The Flex Mortgage legislation modified all that, unleashing a wave of lawsuits.

Throughout the 59 counties the place digital court docket data can be found — dwelling to over four-fifths of the state’s roughly 7 million individuals — Advance has introduced one lawsuit for each 50 residents since 2015, in accordance to an information evaluation by the Tennessee Lookout and ProPublica.

For Tonya Davis, a single mom who works at a neighborhood hospital, Advance waited six years to sue. Tennessee’s debt assortment legislation permits lenders to file a go well with inside six years and, if the corporate wins a judgment in court docket, to pursue the debt for one more decade.

Davis lives in Davidson County, the place Advance operates extra shops than in another county in Tennessee. Advance has filed over 22,000 lawsuits in Davidson over the last decade because it started providing Flex Loans, its highest county complete. Its shops in Nashville, which is situated in that county, are typically in neighborhoods the place households have decrease incomes.

Davis mentioned Advance contacted her in 2018, claiming she owed cash on a Flex Mortgage taken out the earlier 12 months. Davis mentioned she by no means borrowed the cash and was the sufferer of id theft, a declare the corporate advised her it will look into after she advised Advance in a cellphone name that the Social Safety quantity on the account wasn’t hers.

The corporate by no means reached again out to her, she mentioned, and for years, she heard nothing from Advance, however in 2024, she obtained a summons declaring it was suing her for nearly $4,800.

Tonya Davis says she by no means borrowed cash from Advance and was a sufferer of id theft. The corporate advised her it will look into the matter after which, nearly six years later, sued her for $4,785.

Credit score:

Stacy Kranitz for ProPublica

On the time Davis was caring for her dying mom and missed her court docket listening to. As a result of she didn’t seem, Advance gained a default judgment towards her for the complete quantity.

Davis couldn’t afford an legal professional, so she filed an attraction on her personal, however she by no means bought an opportunity to problem the judgment. Quickly after the listening to started, attorneys for Advance famous that Davis had filed her attraction in the future previous the submitting deadline and the choose denied her attraction.

The corporate’s default judgment means Davis is required to pay Advance $175 a month.

“I’m not a lawyer,” Davis mentioned in an interview. “I’m making an attempt to do the very best I can with what I’ve. I don’t know something about this, or I’d have paid, however they didn’t even give me the chance to current my info.”

Difficult Advance in court docket might be daunting. When Advance goes to court docket for a Flex Mortgage, it wins a majority of the time, partially as a result of debtors typically fail to point out up and partially as a result of the corporate has extra authorized assets. The corporate has gained over $200 million in judgments for the reason that begin of 2015.

Mandy Spears, the deputy director of the Tennessee-based assume tank The Sycamore Institute, mentioned in court docket that lenders have all the benefits as a result of they’ve attorneys with huge expertise within the system.

“It’s simply sophisticated for the common individual versus a extra subtle enterprise or legislation agency,” she mentioned. “It’s actually a spot in information and experience.”

Many defendants don’t notice that after they fail to seem in court docket, the corporate doesn’t have to supply detailed paperwork proving what a borrower owes.

Tessa Shearon, a 27-year-old mom in McMinnville, thought she paid off her mortgage with Advance Monetary in 2020. When the corporate sued her nearly three years later, she missed her court docket listening to as a result of she was eight months pregnant and on mattress relaxation. A choose dominated her in default and Advance gained a judgment for $4,700.

Tessa Shearon thought she paid off her mortgage with Advance in 2020. The corporate sued her three years later.

Credit score:

Stacy Kranitz for ProPublica

Shearon didn’t hold any documentation after paying off her mortgage, however she mentioned she reached out to Advance’s lawyer to dispute the lawsuit. The corporate has not sought to garnish her wages. However she stays in limbo: Below the legislation, the corporate can select to file a wage garnishment any time within the subsequent 10 years to recuperate the judgment quantity.

“My solely fear is them making an attempt to gather,” Shearon mentioned. “I don’t have something.”

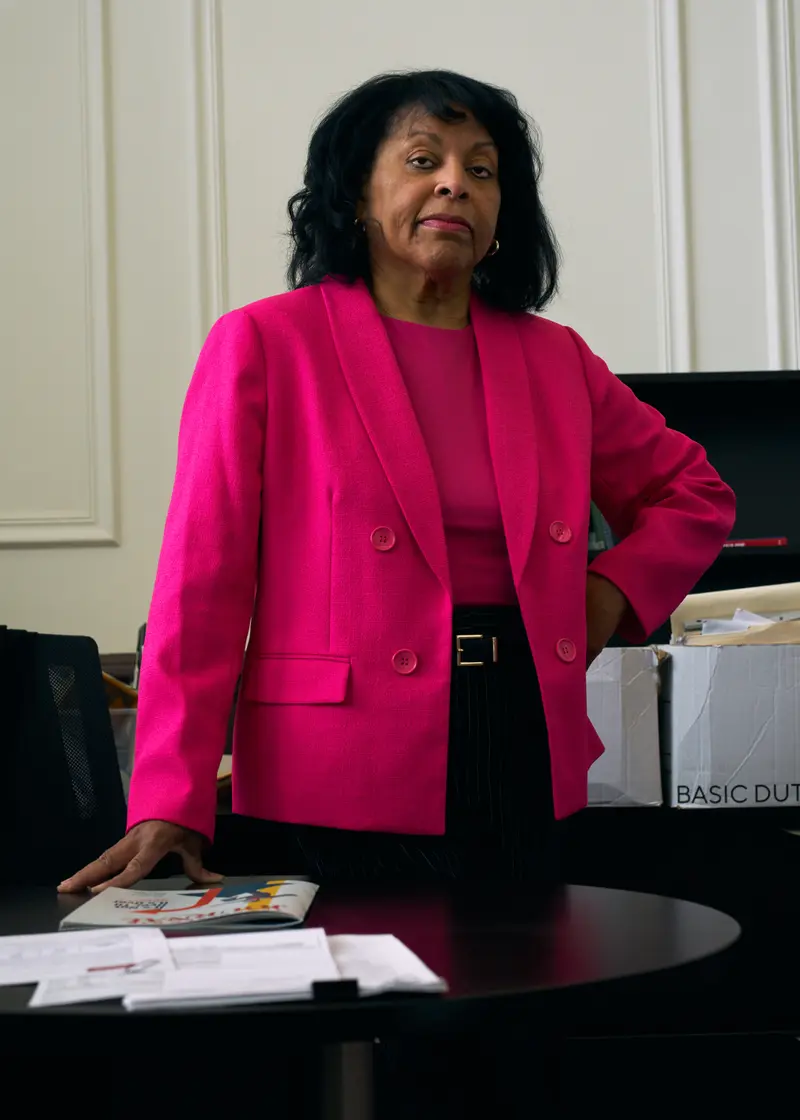

Marla Williams, a client legislation legal professional for the Authorized Help Society of Center Tennessee, is certainly one of a handful of attorneys who’ve helped defend debtors towards Advance.

In a number of circumstances, Williams has been in a position to block wage garnishments and scale back the customary payment the corporate expenses.

Marla Williams is a lawyer who has helped defend debtors towards Advance.

Credit score:

Stacy Kranitz for ProPublica

Williams mentioned that in a 2024 case, she was in a position to decrease the funds from an unaffordable a number of hundred {dollars} a month to round $50 per 30 days, which her shopper might afford. Advance fought the discount, however a choose dominated in her favor.

In one other case, Williams mentioned Advance tried to cost a borrower 1000’s of {dollars} in further charges months after he stopped paying the mortgage. After a listening to, which most debtors with out attorneys don’t ask for, a choose decreased the charges, calling the added expenses “unconscionable and unjust,” court docket data present.

Williams mentioned the corporate typically makes use of aggressive techniques in court docket, one thing that she’s noticed over the previous decade.

“That is their enterprise mannequin,” she mentioned.

Advance declined to debate its enterprise mannequin or authorized technique.

Generally Advance has already made cash off the borrower earlier than suing them, as within the case of Hansen. Over 10 months, Hansen paid Advance practically $2,200 greater than she borrowed, data present.

She nonetheless owed nearly $3,000 when she stopped paying Advance. The corporate waited round three months earlier than declaring her in default, letting her debt develop earlier than it sued her a number of months later. With the addition of attorneys charges and court-added curiosity, the corporate sued her for $6,000.

The Newest Trump and DOGE Casualty: Power Information

Hansen, who requested to make use of her maiden identify as a result of she’s not married, misplaced her dwelling in 2022, shifting into an condo, which she mentioned prices greater than her mortgage had.

Hansen mentioned she plans to pay Advance by the summer time. A February bonus examine, which the corporate garnished 25% of, has helped.

“I perceive it’s each individual for themselves, they usually’re out to make a buck,” Hansen mentioned about Advance. “However you recognize what, individuals on the market are struggling each single day, and that’s what they benefit from.”

How We Tracked Advance Monetary’s Lawsuits

For this story, the Tennessee Lookout and ProPublica used on-line portals to search out civil circumstances in Tennessee Basic Periods Courts for the 59 counties the place digital court docket data can be found. Greater than four-fifths of the state’s inhabitants lives in these counties. Our evaluation included circumstances filed and uploaded to the net portals from 2009 by way of 2024. We filtered the info for circumstances introduced by payday lenders in Tennessee, utilizing firm names, and located that Advance was submitting considerably extra fits than another payday lender, in keeping with court docket data.

Advance Monetary typically makes use of a associated firm known as Harpeth Monetary Providers to file lawsuits towards debtors. Not each case listed the kind of mortgage behind the lawsuit, however a sample emerged: After Advance began providing Flex Loans in 2015, the variety of lawsuits it filed considerably elevated.

Of the circumstances in our knowledge that had been filed by Advance, over half had a judgment quantity awarded, indicating the corporate gained its lawsuit. About three-quarters of the circumstances filed had info on whether or not a wage garnishment was or wasn’t filed towards a borrower. Our evaluation discovered that amongst circumstances the place that info was accessible, 40% included wage garnishment.

Have you ever taken out a flex mortgage and struggled to pay it again? Have you ever been sued by Advance Monetary, Harpeth Monetary or one other flex mortgage lender?

Reporters on the Tennessee Lookout and ProPublica wish to hear from you as they examine flex mortgage lenders, who’ve sued greater than 100,000 Tennesseans.

To share your expertise, name or textual content reporter Adam Friedman at 615-249-8509.

Mollie Simon contributed analysis and Joel Jacobs contributed knowledge reporting.