The worldwide financial system is headed for a downturn, and North America will probably be hardest hit,

the world’s financial watchdog warned

at the moment.

The

Organisation for Financial Co-operation and Improvement

stated Tuesday that obstacles to commerce, tighter monetary situations, weaker enterprise and client confidence and heightened coverage uncertainty will sap international development in 2025.

Slashing its forecast for the second time this yr, the group now sees international gross home product slowing from 3.3 per cent in 2024 to 2.9 per cent this yr and in 2026, assuming that U.S. President

Donald Trump’s tariff charges

are sustained regardless of authorized challenges.

“The slowdown is concentrated in the USA, Canada and Mexico, with China and different economies anticipated to see smaller downward changes,” stated the OECD.

Canada’s GDP

is forecast to develop 1 per cent in 2025 and 1.1 per cent in 2026, down from 1.5 per cent in 2024. Nonetheless, it was one of many few nations within the G20 to get an improve from the March forecast.

Nonetheless the outlook can hardly be known as cheery.

“Since February 2025, commerce tensions and elevated tariffs on imports to the USA closely weigh on Canada’s exterior views, given the interlinkages of the 2 economies,” it stated.

After beginning the yr on “strong” footing, Canada’s outlook has deteriorated. The OECD expects development to drop within the second quarter as exports to the USA fall sharply and family consumption and enterprise funding are hit by commerce disruptions and uncertainty. The

housing market

is predicted to stay broadly flat within the first half of the yr.

Tariffs imposed by Trump’s administration on different nations on this planet will additional dampen demand for exports, it stated.

The OECD expects the

Financial institution of Canada

to chop one other 50 foundation factors to carry its rate of interest to 2.25 per cent this yr. “The central financial institution might want to fastidiously stability the opposing impacts on

inflation from tariffs: upward stress from increased import costs and downward stress from decrease demand,” it stated. The impression of decrease rates of interest received’t present up within the financial system till 2026.

The US took the most important downgrade amongst G7 nations. The OECD sees its development slowing sharply from 2.8 per cent in 2024 to 1.6 per cent this yr, and 1.5 per cent subsequent.

Inflation attributable to increased import costs is predicted to close 4 per cent by the tip of the yr, protecting Federal Reserve charge cuts on maintain till 2026, it stated.

“Weakened financial prospects will probably be felt world wide, with nearly no exception. Decrease development and fewer commerce will hit incomes and gradual job development,” stated OECD chief economist Álvaro Pereira.

Agreements to ease commerce obstacles and tensions are instrumental to turning development round, he stated. “That is by far crucial coverage precedence.”

Join right here to get Posthaste delivered straight to your inbox.

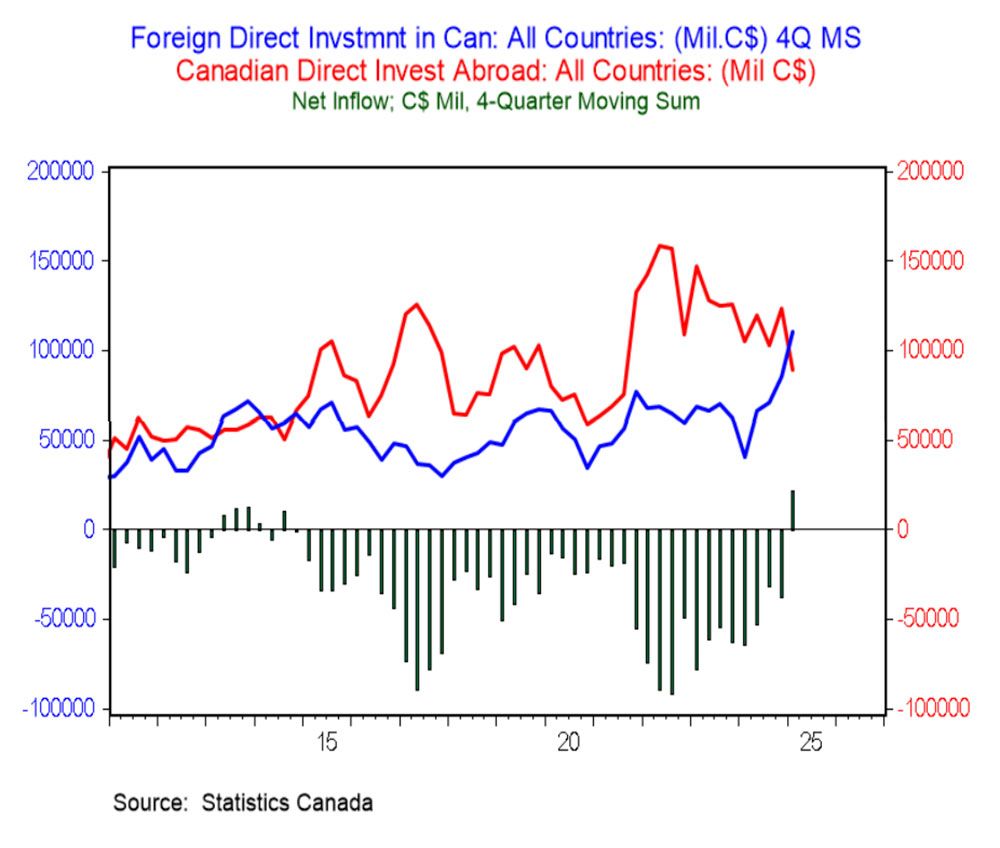

International funding is flowing into Canada on the second quickest tempo in 20 years. Within the first quarter, inflows totalled $28 billion, whereas outflows fell to $7 billion, stated Douglas Porter, chief economist of BMO Capital Markets.

Wanting on the previous 4 quarters, funding coming into Canada surged to $111 billion, a excessive not seen for the reason that mining mega mergers in 2007 and 2008, stated Porter, and funding overseas slowed to $90 billion.

The online influx over the previous yr of $21 billion is the primary international direct funding surplus in 11 years, he stated.

At this time’s Information: United States manufacturing facility and sturdy items orders Earnings: Greenback Normal Corp., Hewlett Packard Enterprise Co.

Canada’s metal business says Trump’s subsequent tariff hike threatens ‘mass disruption’ to produce chain

Canadian banks are resilient and delivering first rate outcomes, however actual property dangers loom Trump tariffs take Detroit and Windsor from ‘greatest associates’ to verge of break-up

Regardless of a difficult financial backdrop, Canada’s main banks proceed to ship first rate outcomes. But beneath the floor of earnings beats and dividend hikes, a rising undercurrent of danger is rising.

Discover out extra

from investing professional Martin Pelletier.

Are you apprehensive about having sufficient for retirement? Do you might want to modify your portfolio? Are you beginning out or making a change and questioning methods to construct wealth? Are you attempting to make ends meet? Drop us a line at wealth@postmedia.com along with your contact information and the gist of your downside and we’ll discover some specialists that can assist you out whereas writing a Household Finance story about it (we’ll hold your identify out of it, after all).

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Publish column

can assist navigate the complicated sector, from the newest traits to financing alternatives you received’t wish to miss. Plus examine his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

At this time’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Publish workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E mail us at

.

Markets anticipate a Financial institution of Canada pause, however these economists produce other concepts

What the tariff ruling that shook the world means to Canada

Bookmark our web site and help our journalism: Don’t miss the enterprise information you might want to know — add financialpost.com to your bookmarks and join our newsletters right here