Canada’s 5 largest

pension funds

might transfer the needle on the

Canadian greenback

if they begin hedging their publicity to property in the USA, says one foreign money strategist.

At the moment, Canada’s massive 5 pension plans maintain $1.1 trillion in overseas property, $0.9 trillion of which is unhedged and contains their U.S. greenback publicity.

“If pension funds increase their hedge ratios even marginally, the

loonie

would considerably outperform its conventional drivers like

rate of interest

differentials,” Mirza Shaheryar Baig, a overseas alternate strategist at Desjardins Group, stated. “Maybe this has already begun.”

There are a few methods the pension funds can hedge. One is to transform overseas property equivalent to U.S. equities to native property, which is able to enhance valuations for Canadian property and the loonie. The opposite is to provoke a overseas alternate swap — an settlement to alternate one foreign money for an additional — which might additionally increase the worth of the Canadian greenback.

“If that $0.9 trillion turns into $0.8 trillion, that’s nonetheless $100 billion, so simply the scale of those numbers is so massive that even a small shift within the share would imply a really great amount of overseas alternate transaction,” Shaheryar Baig stated.

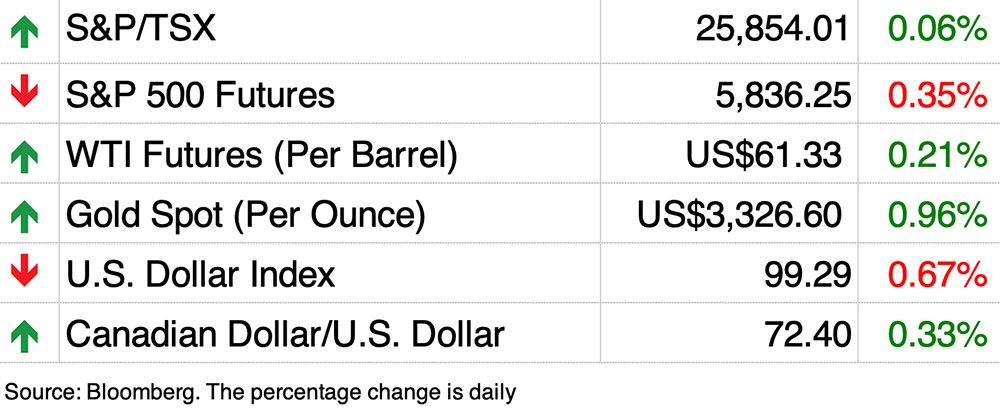

At the moment, the loonie is up nearly 5 per cent in opposition to the U.S. greenback from its lowest shut in slightly below a decade on Jan. 31, when it appeared the economic system can be mauled by U.S.

tariffs

. The

U.S. greenback

index, in the meantime, is down eight per cent this yr in opposition to a basket of world currencies that features the loonie.

“The Canadian greenback has really strengthened relative to the U.S. greenback,” he stated.

Shaheryar Baig stated that may be a unusual incidence as a result of rate of interest differentials normally information how currencies are valued in opposition to one another, and U.S. rates of interest are in the intervening time a lot larger and extra engaging to traders at 4.5 per cent versus 2.75 per cent in Canada.

“One of many explanations for why that disconnect is occurring is maybe long-term traders are beginning to contemplate the U.S. greenback as lower than a protected foreign money, or they really feel overexposed to U.S. property,” he stated.

The explanations behind that embody the consequences of the tariff wars on the U.S. economic system and the scale of that nation’s

which stands at US$36 trillion, or 122 per cent of gross home product.

Prior to now, Canada’s prime 5 pension funds have relied on the dollar’s haven standing and on the destructive correlation between the U.S. markets and the U.S. greenback — the place one goes up and the opposite goes down and vice versa — to guard their U.S. holdings.

That correlation seems damaged, Shaheryar Baig stated.

“One of many key issues that’s occurred previously few months, particularly since Liberation Day, is that the U.S. greenback correlation with the inventory market has fully flipped,” he stated. “And so if traders have been hoping that the foreign money would defend them in a market downturn, now they’re really seeing their losses compounded by way of the foreign money as properly.”

Shaheryar Baig stated that shift is creating boardroom discussions and some extent of angst amongst portfolio managers about the truth that their “bare U.S. greenback publicity” is now costing them cash.

Join right here to get Posthaste delivered straight to your inbox.

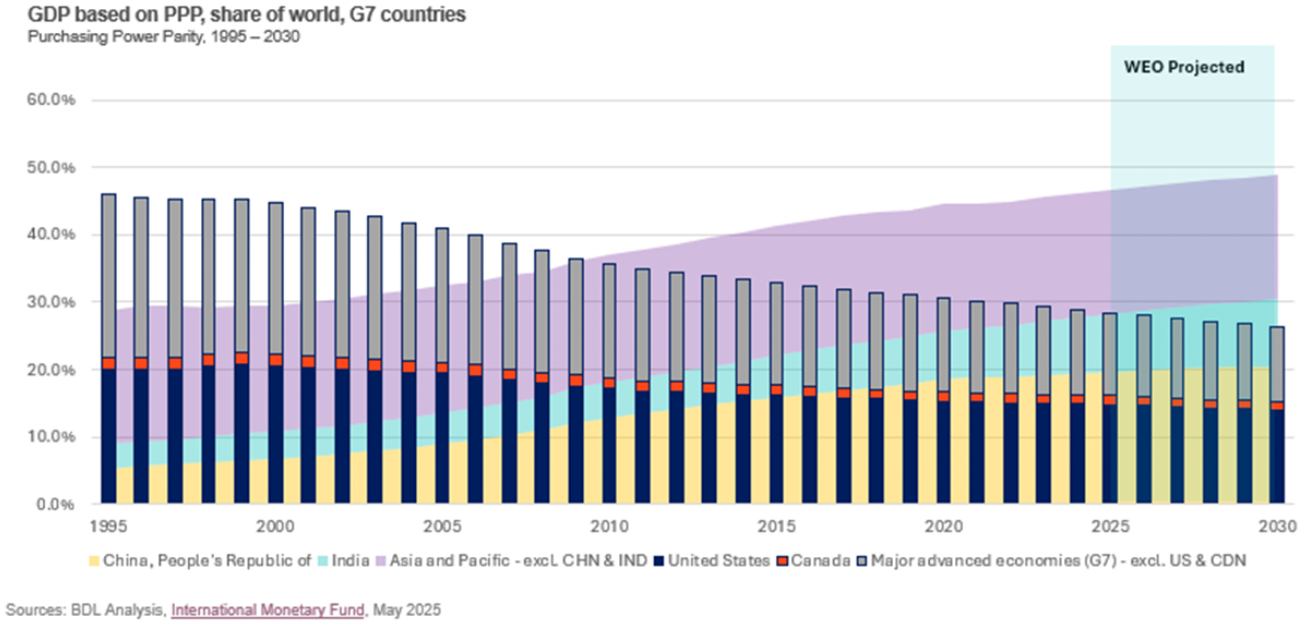

The Group of Seven nations are dropping the race for financial dominance.

This chart, launched after the G7 assembly of finance ministers in Banff wrapped up on Thursday, reveals that G7 members are falling behind rising economies together with China, India and different Asia-Pacific nations, that are surging forward by making the most of youthful populations, fast-paced industrialization and centralized manufacturing and international commerce.

“By 2030, Asia-Pacific economies are anticipated to account for almost 50 per cent of world GDP, with China and India alone projected to generate 30 per cent of world output inside simply 5 years,” Marwa Abdou, senior analysis director on the Canadian Chamber of Commerce, stated in a launch.

In the beginning of the following decade, she additionally estimates that the mixed GDP of the USA and Canada will exceed that of all of the G7 members, “signalling an opportunity for North American management.”

“If G7 nations need to form the following chapter of the worldwide economic system reasonably than watch from the sidelines, daring, united motion is required.”

The temporary for Canada is begin investing in productiveness, innovation and commerce diversification to remain within the sport, she stated.

Ambassadors to Canada from G7 nations will sit down with two of Alberta’s leaders on worldwide engagement, Gary Mar of the Canada West Basis and Martha Corridor Findlay of the College of Calgary’s College of Public Coverage, to debate the most important points on the G7 summit and what it means for Alberta, Canada and the world. At the moment’s Information: Canada retail gross sales for March. U.S. new houses gross sales and constructing permits.

Meet Tim Hodgson, the brand new vitality minister Mark Carney hopes can bridge the hole with the West TD Financial institution to chop 2% of workforce in restructuring Right here’s a plan to repair Canada’s auto sector as its largest buyer tries to show away

The 2024 tax season is now over for many of us. However what in case you made a mistake or discovered an errant tax slip? Tax professional Jamie Golombek walks you thru learn how to cope with correcting an error. Learn extra right here.

Are you fearful about having sufficient for retirement? Do you must regulate your portfolio? Are you beginning out or making a change and questioning learn how to construct wealth? Are you making an attempt to make ends meet? Drop us a line at

along with your contact data and the gist of your downside and we’ll discover some specialists that can assist you out whereas writing a Household Finance story about it (we’ll preserve your identify out of it, in fact).

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Publish column

will help navigate the complicated sector, from the newest traits to financing alternatives you gained’t need to miss. Plus examine his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

At the moment’s Posthaste was written by SUHANIC GIGH with further reporting from Monetary Publish workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this article? Electronic mail us at

.

Bother is brewing on the planet’s largest bond market — and that is not good for anybody

Canada residence costs are heading into correction territory

Bookmark our web site and help our journalism: Don’t miss the enterprise information you must know — add financialpost.com to your bookmarks and join our newsletters right here