Canadian companies are displaying early indicators of misery underneath the turmoil

Donald Trump’s tariff conflict

has thrust on the economic system.

Equifax Canada’s

enterprise credit score report

out right this moment reveals delinquencies are rising for companies throughout the nation, with the speed in some sectors reaching ranges not seen for the reason that monetary disaster in 2009.

Greater than 309,000 companies, or 11 per cent of credit score lively companies in Canada, missed no less than one fee within the first quarter, an nearly 15 per cent improve from the 12 months earlier than, stated Equifax.

Some sectors are displaying extra pressure than others, notably these depending on shopper spending. The delinquency price for lodging and meals providers rose to nearly 17 per cent.

“This appears to be a basic ripple impact,” stated Jeff Brown,

Equifax Canada’s

head of economic options. “Equifax information suggests when households pull again, eating places, retailers and native service suppliers really feel it first — and hardest. This may then journey up the availability chain, the place everybody from producers to move firms feels its results.”

A

earlier report by the credit score reporting company

final month discovered that greater than 1.4 million shoppers missed no less than one fee throughout the quarter.

One other signal of hassle is decrease credit score demand. Companies making use of for brand spanking new credit score within the first quarter dropped 6 per cent from the 12 months earlier than, which Equifax stated suggests rising warning.

Companies are additionally tending to pay their suppliers first and their financial institution or monetary establishments final. Development in delinquency charges on loans and contours of credit score have been increased than on cash owed to suppliers.

“Companies are paying suppliers, however with little to spare, they might be lacking banking obligation funds. This will sign that companies are strategically recalibrating, with many companies prioritizing provider relationships to maintain operations shifting,” stated Brown.

Delinquency charges are up nationally however some provinces and industries “are flashing pink,” the report stated.

Ontario and British Columbia had the very best monetary commerce arrears, up nearly 19 per cent and 20 per cent, respectively.

However Quebec and Prince Edward Island confirmed a spike in industrial commerce delinquencies, up 26.6 per cent and 15.9 per cent, respectively, suggesting stress within the credit score relationships with suppliers.

A number of sectors too confirmed increased will increase in missed funds than the nationwide common. Agriculture’s delinquency price rose by nearly 20 per cent, transportation & warehousing was up 19 per cent and actual property up 17 per cent.

Enroll right here to get Posthaste delivered straight to your inbox.

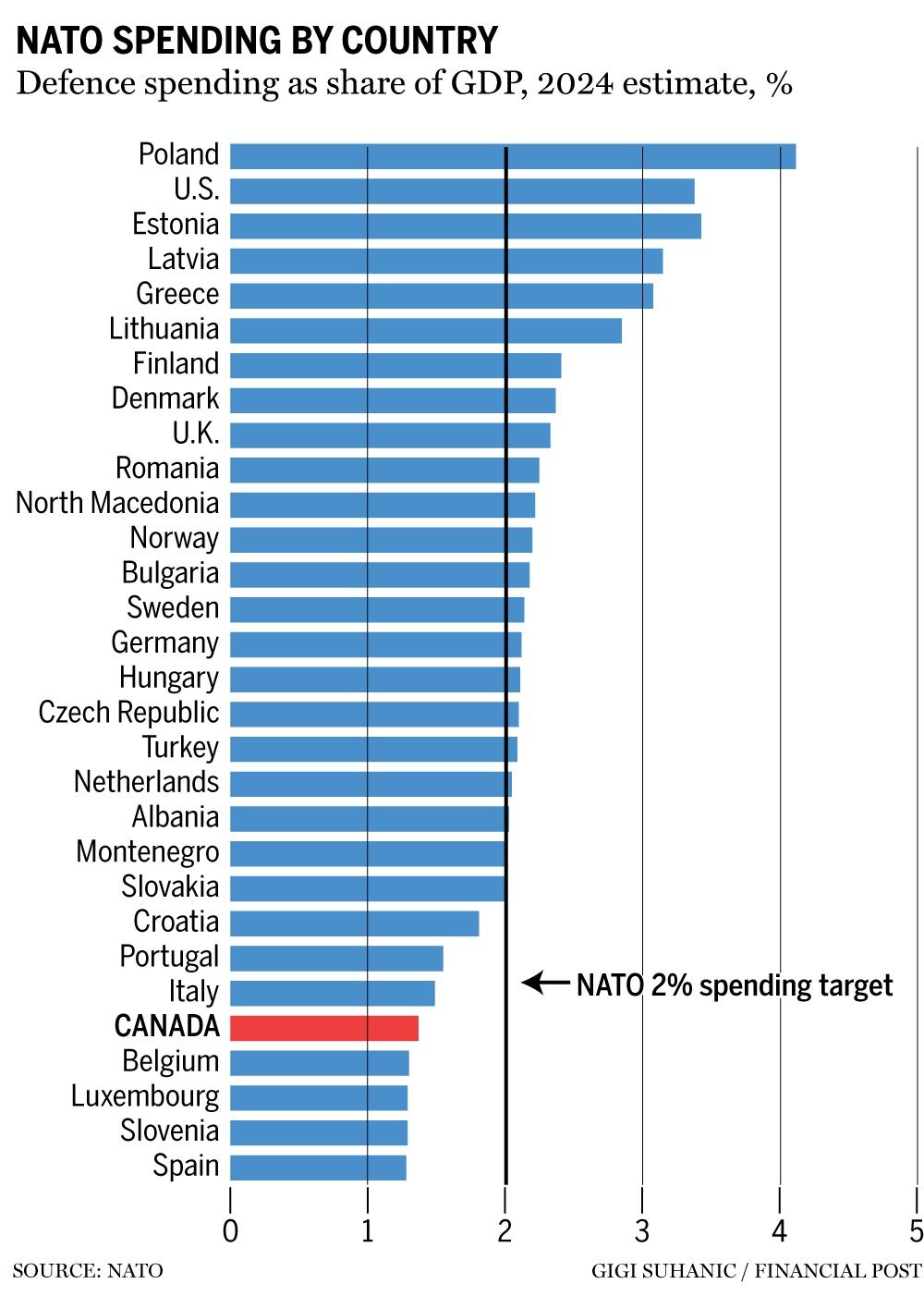

Prime Minister Mark Carney

vowed to spice up defence spending

yesterday in order that Canada meets its NATO goal this 12 months, 5 years forward of schedule.

Canada, which final 12 months spent simply 1.4 per cent of gross home product on defence, has lagged NATO’s 2 per cent goal and most different NATO members, as right this moment’s chart reveals.

Carney had promised throughout his marketing campaign to satisfy the goal by 2030 or earlier.

The federal government’s pledge, nonetheless, should show too little, too late.

Monday’s announcement got here simply forward of a serious NATO assembly within the Netherlands later this month by which allied nations are anticipated to undertake a plan to hike the spending goal to 5 per cent of GDP — a stage Canada has not reached for the reason that Fifties.

The International Vitality Present begins right this moment in Calgary right this moment with individuals from 100 nations anticipated to attend. The pinnacle of OPEC will ship the keynote tackle on the convention which will even characteristic chief executives from main Canadian and worldwide vitality firms and several other political leaders, together with Alberta Premier Danielle Smith. At the moment’s Knowledge: United States NFIB small enterprise optimism Earnings: JM Smucker Co.

Who’s the standard first-time residence purchaser in Canada and the way a lot cash do they want? Right here’s why the Financial institution of Canada is rolling the financial cube if it stays on sidelines any longer

Why it’s a ‘sensible’ time to purchase a house

Canadians have an enormous share of their wealth wrapped up in actual property and plenty of hope their property will assist fund their retirement. However monetary adviser Jason Heath warns owners banking on a turnaround in residence costs to be cautious. If you’re valuing your own home right this moment primarily based on the 2022 peak that was 10 per cent or 20 per cent increased, your retirement plan is probably not lifelike, he writes.

Learn extra

Are you nervous about having sufficient for retirement? Do it’s worthwhile to modify your portfolio? Are you beginning out or making a change and questioning find out how to construct wealth? Are you attempting to make ends meet? Drop us a line at wealth@postmedia.com together with your contact data and the gist of your drawback and we’ll discover some consultants that will help you out whereas writing a Household Finance story about it (we’ll hold your identify out of it, in fact).

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

may help navigate the complicated sector, from the newest traits to financing alternatives you received’t wish to miss. Plus verify his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

At the moment’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? Electronic mail us at

.

Why the Canadian greenback goes up when the economic system goes down

Simply if you thought Toronto’s apartment market could not get any worse …

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it’s worthwhile to know — add financialpost.com to your bookmarks and join our newsletters right here