As Canada’s workforce turns into extra numerous, it seems the advantages packages supplied to workers usually are not maintaining with the rising wants of employees, significantly amongst ladies.

Almost 1 / 4 of Canadians with persistent bodily circumstances or developmental disabilities report that their protection plans are inadequate to fulfill their wants, whereas 28 per cent of Canadians with a psychological well being incapacity agree,

in response to a latest survey from RBC Insurance coverage.

“These findings are a name to motion for employers and advantages suppliers alike, as there’s an actual alternative to shut the hole between what workers want and what they obtain,” Tony Bruin, head of group advantages at RBC Insurance coverage, mentioned in a information launch.

“The extra an employer tailors and prioritizes extra inclusive and related profit options, the extra they will really assist their workers.”

Relating to ladies, 75 per cent of respondents need or want employer advantages particularly tailor-made towards their well being, resembling providers for fertility and menopause, however are discovering work profit plans fail to offer the correct protection.

The survey reported that 31 per cent of ladies discovered their work protection to be inadequate, whereas 25 per cent had a tough time reserving an appointment, each of which had been at a better charge than males.

To handle the shortcomings in protection, extra Canadians are on the lookout for specialised add-ons to their plans.

A latest report from Perigon Life

discovered that 62 per cent of workers need their office to supply non-obligatory add-ons to their plans, with most keen to spend $15 to $50 per thirty days for the added protection.

The survey reported that youthful Canadians are additionally having a more durable time accessing the correct care. RBC reported that 20 per cent of Canadians aged 18-34 are uncertain of their worker advantages, greater than different age demographics.

“Because the workforce turns into extra numerous throughout age, gender and well being wants, employers and group advantages suppliers have a possibility to reimagine what fashionable assist appears like,” Bruin mentioned.

“When employers give attention to investing in additional inclusive, tailor-made advantages, they will increase worker satisfaction whereas constructing more healthy, extra engaged groups.”

As employees search for expanded care, extra employers need to save.

An April survey from MercerMarsh Advantages polled almost 350 Canadian firms and located that 88 per cent need to preserve advantages plans inexpensive as 82 per cent of firms look to raised perceive worker wants.

Enroll right here to get Posthaste delivered straight to your inbox.

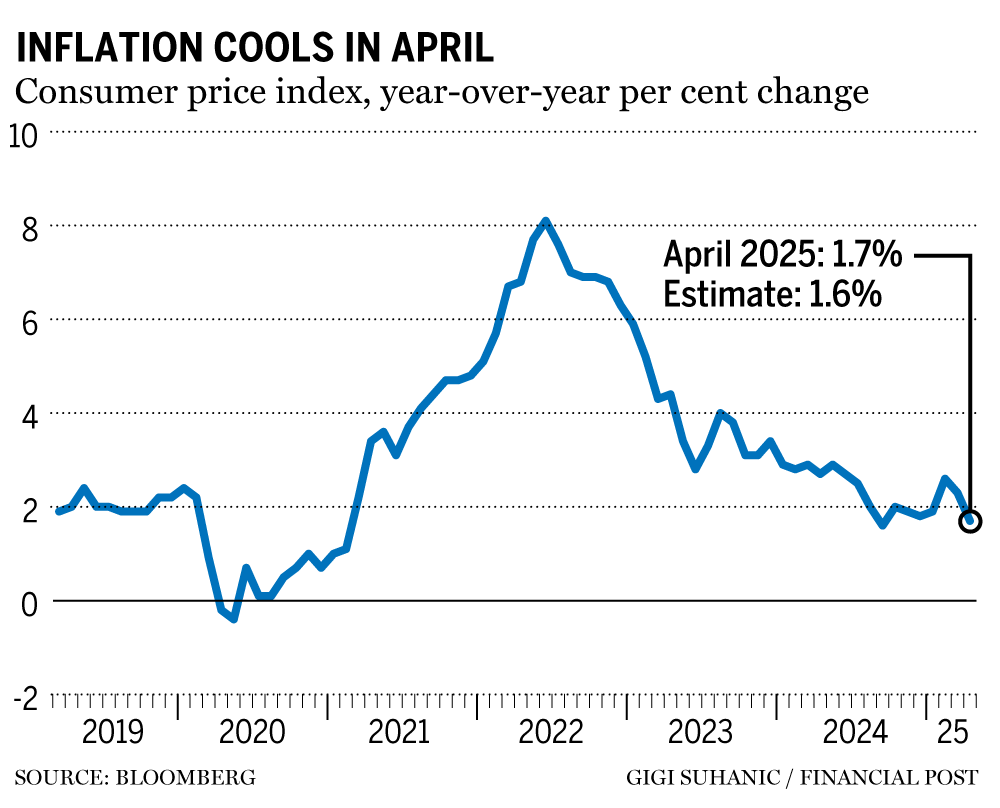

Canada’s inflation charge fell to 1.7 per cent in April, because the elimination of the buyer carbon tax and low oil costs helped drive inflation decrease for the month.

Excluding vitality, Canada’s inflation charge would’ve reached 2.9 per cent, in comparison with 2.3 per cent in March.

Fuel costs led the way in which in declining client costs, falling 18.1 per cent within the month.

The numbers have some economists calling for one more rate of interest pause in June, although they anticipate rates of interest to fall to 2.25 per cent by the tip of the summer season.

Learn extra right here.

G7 Finance Ministers assembly continues Premiers from Western Canadian provinces and territories to fulfill in Yellowknife Canadian Membership Toronto hosts a panel dialogue on ’Outlook on the Canadian Auto Business: Navigating a New Period of U.S. Tariffs,’ that includes MP Chrystia Freeland Right now’s Information: New housing worth index for April Earnings: Lowe’s Firms Inc., Goal Corp., Snowflake Inc., Zoom Communications Inc., Canada Goose Holdings Inc.

Canada’s inflation charge cools to 1.7% as client carbon tax ends Financial institution of Canada faces dilemma as core inflation heats up Canada Publish employees difficulty strike discover, poised to hit picket traces Friday TotalEnergies indicators deal to purchase LNG from venture in Canada

There are a number of elements to contemplate when deciding whether or not to contribute to an RRSP or TFSA account. For somebody retiring and relying on their very own circumstances, it might be prudent to contemplate an even bigger RRSP contribution and utilizing the tax refund to top-up a TFSA account, writes licensed monetary planner Allan Norman.

Learn right here.

Are you apprehensive about having sufficient for retirement? Do you’ll want to regulate your portfolio? Are you beginning out or making a change and questioning methods to construct wealth? Are you attempting to make ends meet? Drop us a line at wealth@postmedia.com along with your contact information and the gist of your downside and we’ll discover some consultants that can assist you out whereas writing a Household Finance story about it (we’ll preserve your title out of it, after all).

McLister on mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Publish column

might help navigate the advanced sector, from the most recent tendencies to financing alternatives you gained’t wish to miss. Plus examine his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date every day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

Right now’s Posthaste was written by Ben Cousins with further reporting from Monetary Publish employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? Electronic mail us at

.

Excessive down funds preserve Canadians out of homeownership

Automotive possession has gotten dearer and it may worsen

Bookmark our web site and assist our journalism: Don’t miss the enterprise information you’ll want to know — add financialpost.com to your bookmarks and join our newsletters right here