Housing affordability

has improved in lots of locations throughout Canada, however the small window that opened just lately seems to be quickly closing, says a brand new survey.

Affordability began to erode in Could in eight of the 13 main metropolitan markets as a result of

house costs

rose and borrowing charges stayed the identical, in response to Ratehub.ca, a web based mortgage aggregator, thereby placing upward stress on the quantity of revenue wanted to turn into a home-owner.

The

Canadian Actual Property Affiliation

(CREA) stated

gross sales in Could rose

3.6 per cent month over month as homebuyers emerged from their protecting shell. It was the primary month-over-month enhance in gross sales since November. Costs additionally rose month over month 1.9 per cent, CREA stated.

Rising international financial uncertainty unleashed by United States President

Donald Trump

pressured many Canadian

homebuyers

to park their actual property aspirations, resulting in falling costs and

house gross sales

throughout the nation.

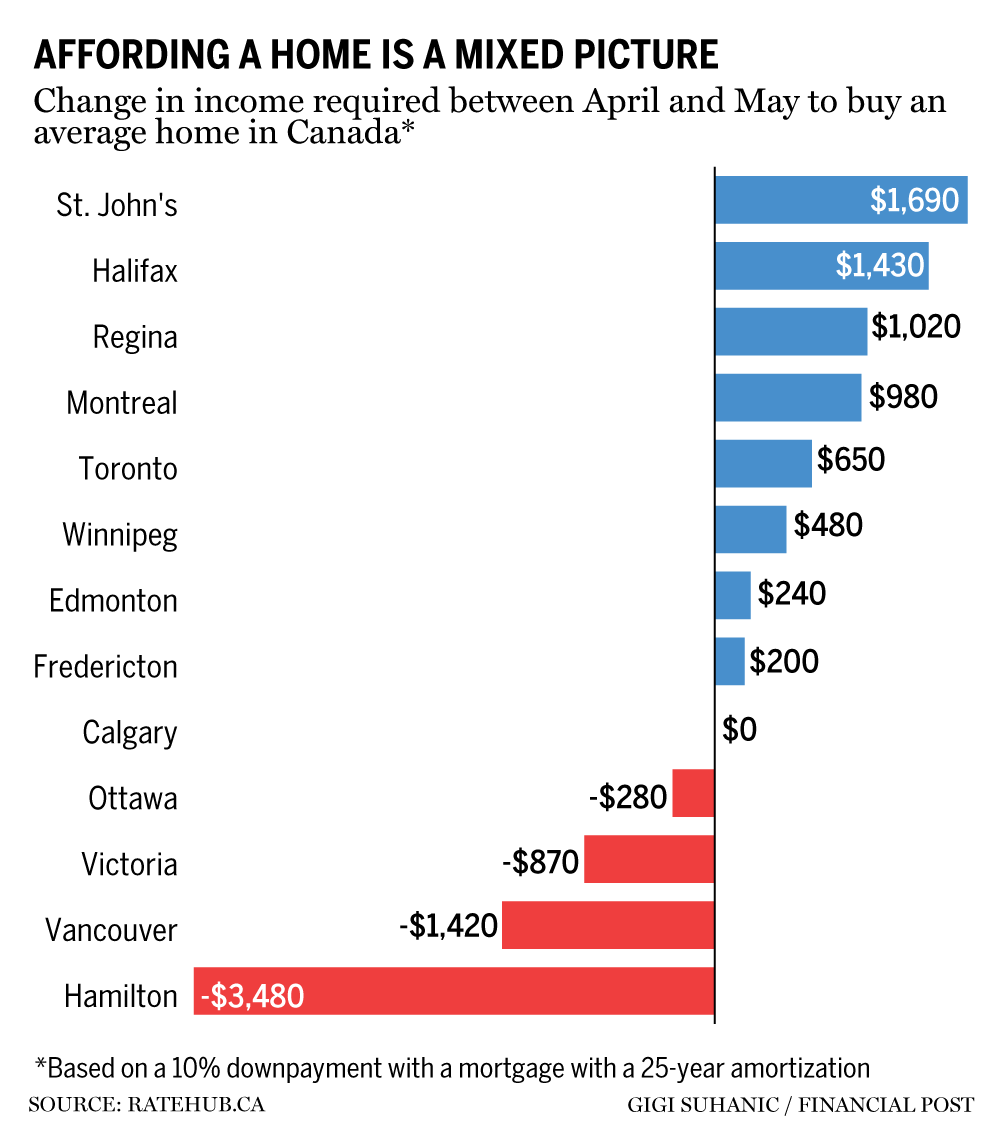

The highest three value will increase have been recorded in St. John’s, N.L., the place costs jumped $8,900 in Could from April to a mean value of $378,300; Halifax, the place costs rose $7,600 to $570,600; and Regina, the place they have been up $5,400 to $340,800.

In St. John’s, the revenue required to qualify for a mortgage climbed $1,690 to $86,450 per 12 months. These calculations are based mostly on a

mortgage

with a ten per cent down fee, 25-year amortization, mortgage price of 4.38 per cent and stress take a look at price of 6.38 per cent.

In

Montreal

and

Toronto

, costs rose $5,200 and $3,400, respectively, to $580,100 and a bit greater than $1 million. The required revenue to qualify for a mortgage elevated by $980 and $650, respectively, to $124,620 and $206,500.

Winnipeg, Edmonton and Fredericton had the smallest value beneficial properties.

Nevertheless, 5 different cities recorded falling costs and improved affordability.

The most important value drop was recorded in Hamilton, about an hour west of Toronto, the place costs fell $18,300 to a mean value of $783,100. It had the most important enchancment in affordability for the second consecutive month.

In

Vancouver

, one in every of Canada’s costliest housing markets, costs fell $7,500 to virtually $1.2 million.

Costs in Victoria and Ottawa fell $4,600 and $1,400, respectively, to $892,700 and $629,800.

In Calgary, costs have been flat at $583,000.

In Hamilton, Ratehub stated month-to-month mortgage funds in Could dropped by $93 and that the quantity of revenue required to qualify for a mortgage was $163,020, down $3,480.

A majority of homebuyers have indicated they’re prepared to regulate the place they might stay to realize some affordability if costs proceed to rise of their desired location.

For instance, 52 per cent of potential homebuyers surveyed by Zoocasa stated they have been open to residing in a secondary metropolis reminiscent of London, Ont., or Fredericton, however must do extra analysis to verify life there may be extra inexpensive.

The survey additionally stated individuals maintain an more and more dim view of housing affordability in Canada, with 67 per cent indicating they consider housing on this nation is considerably to a lot much less inexpensive in contrast with different international locations.

The survey of 1,000 Zoocasa weblog readers and e-newsletter subscribers was performed between Jan. 30 and April 28. It has a margin of error of two per cent.

Join right here to get Posthaste delivered straight to your inbox.

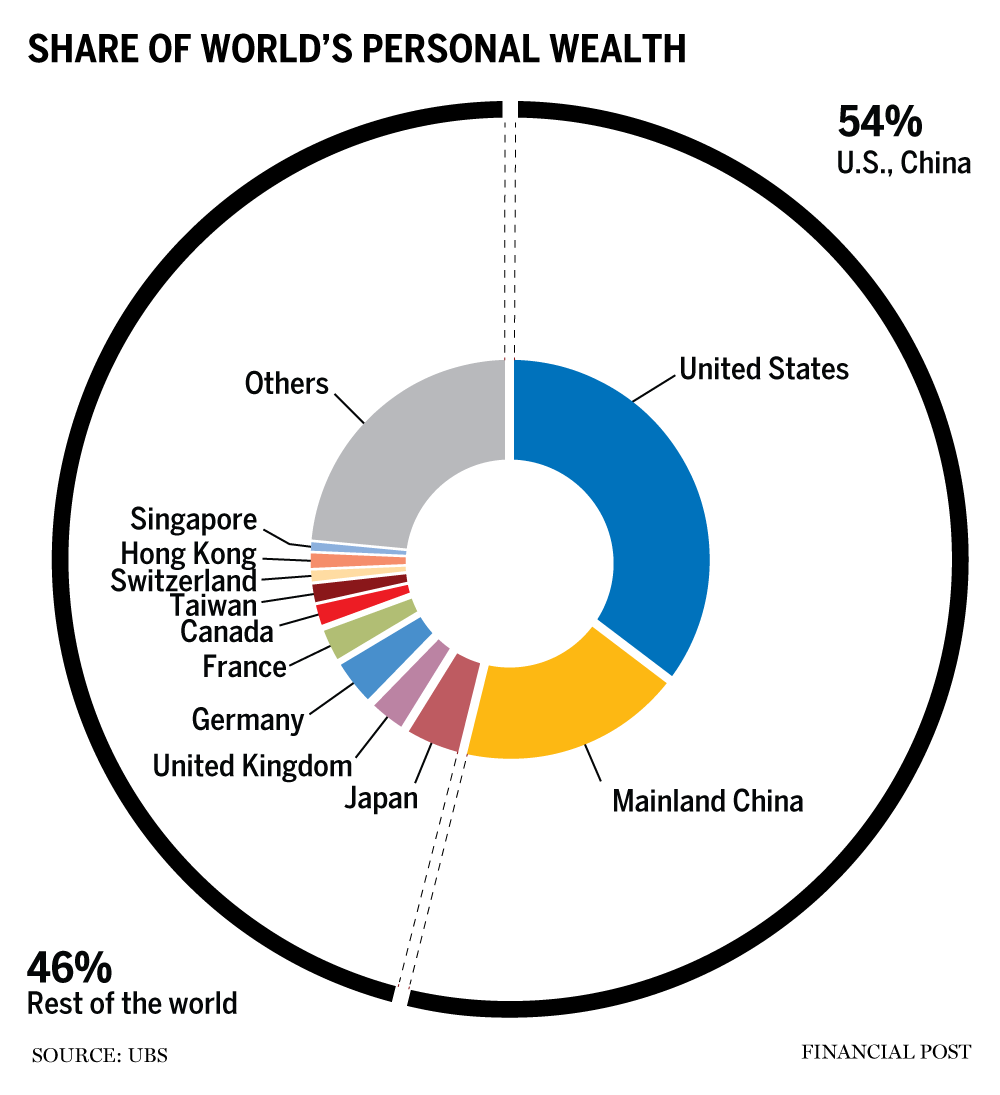

The world is getting wealthier, with the ranks of these with US$1 million or extra persevering with to broaden, in response to a latest report from Swiss monetary providers agency UBS Group AG.

In Canada, median wealth per grownup ballooned by almost 10 per cent in native foreign money in 2024, the report said.

Actual property appreciation and a sturdy inventory market final 12 months are among the many components contributing to this, stated Josh Sheluk, portfolio supervisor at Verecan Capital Administration.

“I believe so long as you’re having progress of economies globally, you’re going to see spillover results to Canada and, fairly frankly, to most areas of the world,” Sheluk stated. “I believe we’re properly positioned right here in Canada to learn.” — Serah Louis, Monetary Submit

Learn extra right here.

Toronto Tech Week continues Right this moment’s Knowledge: Statistics Canada experiences Could inflation. U.S. Philadelphia Fed non-manufacturing exercise, present account steadiness Earnings: BlackBerry Ltd., Salesforce Inc., The Campbell’s Firm, Greenback Tree Inc., Foot Locker Inc., American Eagle Outfitters Inc., Greenback Normal Corp., Tilly’s Inc., Victoria’s Secret & Co.

David Rosenberg: How did the Canadian market hit a brand new document? Gold publicity has helped Hovering prices are forcing some Canadians to restrict vet visits and even surrender their pets M&A in Canadian oil and gasoline accelerating: ‘We see a whole lot of consolidation’ says Keyera CEO

The typical Canadian household will save $280 on their taxes subsequent 12 months from the Liberal authorities’s deliberate

revenue tax

reduce, the

parliamentary price range officer

stated in an evaluation.

Discover out extra right here.

Are you nervous about having sufficient for retirement? Do you must regulate your portfolio? Are you beginning out or making a change and questioning the way to construct wealth? Are you attempting to make ends meet? Drop us a line at

together with your contact information and the gist of your drawback and we’ll discover some specialists that can assist you out whereas writing a Household Finance story about it (we’ll maintain your identify out of it, after all).

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

may help navigate the complicated sector, from the newest developments to financing alternatives you received’t need to miss. Plus verify his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

Right this moment’s Posthaste was written by SUHANIC GIGH with extra reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this article? E-mail us at

.

Posthaste: Canadians would pay yearly $20 Canada Submit subsidy to assist cross-country service, ballot finds

Posthaste: Canadian renters are ready for house costs to drop earlier than shopping for — they may very well be dissatisfied

Bookmark our web site and assist our journalism: Don’t miss the enterprise information you must know — add financialpost.com to your bookmarks and join our newsletters right here