Speak of a Canadian

recession

is cropping up within the notes of 1 high Bay Road economist.

“By no means earlier than within the annals of recorded Canadian financial historical past has the financial system managed to flee an official recession with such a dramatic transfer off the cycle low,” David Rosenberg, chief government at Rosenberg Analysis and Associates Inc., mentioned in a notice, referring to the dramatic downturn in Canada’s labour image.

Among the many sobering numbers from Friday’s

labour drive survey

was a lack of 66,000

jobs in August

. That, coupled with the lack of 41,000 positions in July, means the financial system has shed a web 40,000 jobs because the starting of March, which is “the steepest downturn since August 2020,” he mentioned.

There’s extra. The non-public sector continued to shed positions in August from July, whereas full-time

employment

additionally pulled again.

“That is key as a result of it’s full-time employment that’s in the end the driving force of

shopper confidence

and spending,” Rosenberg mentioned.

Extra broadly, solely 65 per cent of people that began searching for work over the previous 12 months had been capable of finding employment as the extent of joblessness rose by practically eight per cent. If not for the less folks trying to find jobs, he estimates Canada’s

unemployment fee

would have risen to 7.2 per cent quite than 7.1 per cent. As it’s, the unemployment fee has soared 230 foundation factors from the “cycle low” of 4.8 per cent in July 2022.

The job market is exhibiting another recessionary traits, too. Desjardins Economics, in a report final Thursday, mentioned the present

youth unemployment fee

“is now at a stage extra generally seen throughout a recession.”

The unemployment fee for these aged 15 to 24 in August was 14.5 per cent, in accordance with Statistics Canada, in comparison with 9 per cent in July 2022.

Youth unemployment is usually larger than that for employees aged 25 to 54, the Desjardins economists mentioned, including that youthful employees are inclined to bear extra of the brunt throughout occasions of financial uncertainty and weak spot.

The economists, Kari Norman, LJ Valencia and Randall Bartlett, mentioned the poor prospects for younger persons are one thing of a canary within the coal mine.

“Trying again over the previous half-century, we see that every of the earlier upticks in Canada’s youth unemployment fee corresponded with a recession,” they mentioned. “The hole between youth and core‑aged unemployment charges additionally widened throughout financial downturns.”

Younger persons are probably the most susceptible when the financial system shouldn’t be assembly its output potential, particularly since their work is usually half time, seasonal and “precarious.” They may be bearing the brunt of a rise in overseas employees,

synthetic intelligence

and the rise of gig work.

The sluggish information popping out of the US is another excuse Canadians ought to be fearful, provided that roughly 70 per cent of Canada’s exports circulate to the U.S.

Rosenberg mentioned recessionary shadows are dogging the U.S. labour market based mostly on that nation’s poor jobs report, which additionally got here out on Friday.

“That is the kind of job market sample one sometimes sees earlier than an official recession takes maintain, however no one appears to consider an financial downturn will ever happen once more,” he mentioned. “The bull market stays in hubris and complacency.”

The U.S. financial system added 22,000 jobs in August, properly off the estimates for 75,000 further jobs, whereas the provision of individuals accessible to work continued to construct in August from July.

“What actually stood out,” Rosenberg mentioned, was the continued revisions to the job numbers in June. These numbers — notorious for resulting in the firing of the pinnacle of the Bureau of Labor Statistics — now point out a lack of 13,000 positions in contrast with a achieve of 147,000 once they had been first launched, and a preliminary revision to an virtually negligible achieve of 14,000 positions.

“Including to the angst and anxiousness evident on this report was the information that full-time employment from the companion Family Survey collapsed by 357,000 after a 440,000 plunge in July,” he mentioned, including that nearly a million full-time jobs have disappeared over the previous 4 months.

“The Family Survey is unquestionably flashing a recession sign, and the payroll survey shouldn’t be far behind,” he mentioned.

Join right here to get Posthaste delivered straight to your inbox.

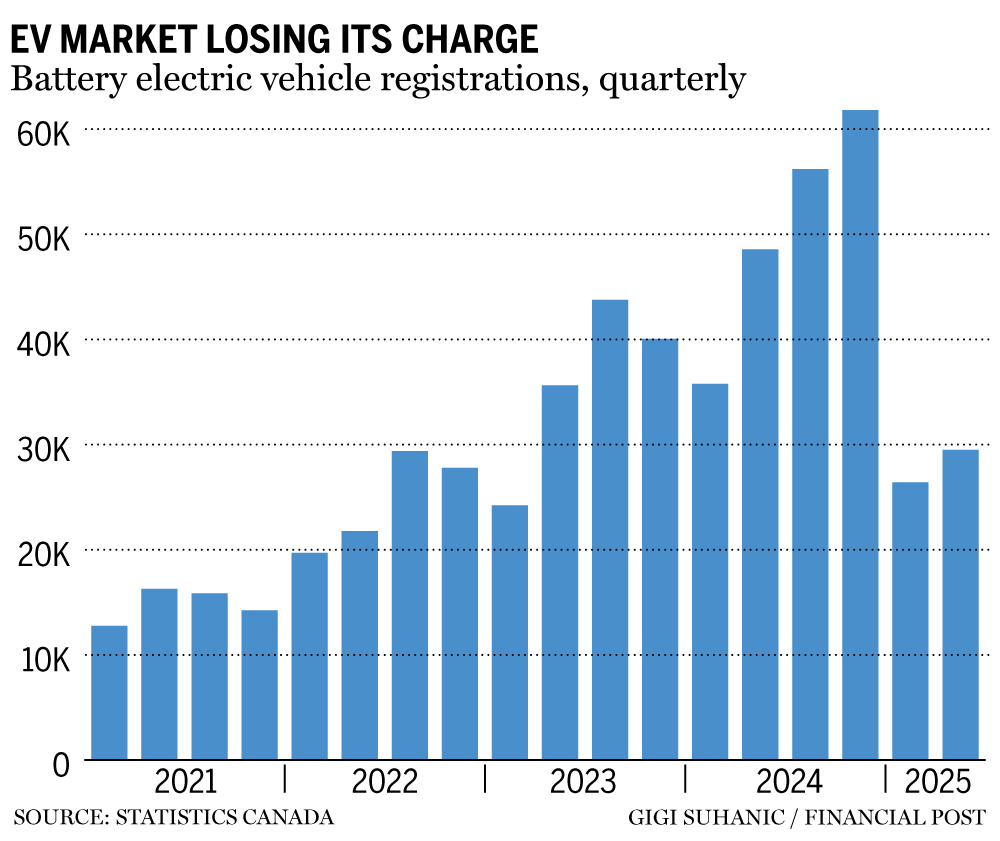

Electrical car gross sales in Canada plummeted within the second quarter whilst general auto gross sales remained brisk.

Registrations of recent battery-EVs dropped 39.2 per cent 12 months over 12 monthswhereas plug-in hybrid EV registrations fell 2.2 per cent, in accordance with Statistics Canada information on Monday. — Gabriel Friedman, Monetary Put up

Learn the complete story right here.

As we speak’s Knowledge: U.S. NFIB small enterprise optimism and preliminary benchmark payrolls revision Earnings: GameStop Corp., Oracle Corp.

Strathcona ups supply for MEG, calls Cenovus’ rival bid a ‘automobile crash’ Canadians hit the brakes on EV purchases in second quarter whilst general auto gross sales stay brisk Capitalism for giant companies, threat for everybody else: Why the funding panorama wants a reset

Taking out a mortgage is also known as one of many larger monetary transactions Canadians will undertake of their lifetimes. So it wouldn’t appear misplaced to hunt out recommendation on methods to proceed. Mortgage knowledgeable Robert McLister not too long ago requested the query: How a lot is sweet recommendation actually price with regards to mortgage purchasing? Learn his column

right here

to seek out out extra.

Are you apprehensive about having sufficient for retirement? Do you could regulate your portfolio? Are you beginning out or making a change and questioning methods to construct wealth? Are you making an attempt to make ends meet? Drop us a line at

along with your contact information and the gist of your downside and we’ll discover some specialists that will help you out whereas writing a Household Finance story about it (we’ll preserve your identify out of it, after all).

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

may help navigate the complicated sector, from the newest developments to financing alternatives you gained’t wish to miss. Plus, try his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

As we speak’s Posthaste was written by SUHANIC GIGH with further reporting from Monetary Put up workers, Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report or a suggestion for this text? E-mail us at

.

Posthaste: Is a Financial institution of Canada fee lower within the bag given the cratering job market?

Posthaste: Canadians could be shocked at simply how low U.S. tariffs on Canada’s exports actually are

Bookmark our web site and help our journalism: Don’t miss the enterprise information you could know — add financialpost.com to your bookmarks and join our newsletters right here

ивц сочи ветеринарная клиника Ветеринарная клиника в Сочи, работающая круглосуточно, – это ваш надежный партнер в заботе о здоровье питомца. Мы предлагаем широкий спектр услуг и профессиональную помощь в любое время!