The

Financial institution of Canada

‘s benchmark

rate of interest

has remained at 2.75 per cent since March 12, however the stability hasn’t given younger Canadians a lot reduction in the case of their payments.

Canadians aged 18–34 are taking drastic measures to make ends meet, together with high-interest short-term loans when different methods fail, in keeping with a current report from the Credit score Counselling Society (CCS).

“A gentle rate of interest doesn’t undo years of economic pressure,” CCS chief govt Peta Wales stated

“Many younger Canadians are already deep in debt. They’re borrowing small quantities simply to cowl necessities, and over time, these borrowing selections stack up.”

The variety of younger Canadians to achieve out to CCS has climbed seven per cent since 2023, now amounting to 25 per cent of all shoppers. The survey additionally reported that they face a mean debt load of $24,000, up 9 per cent from 2023.

“The sheer quantity of individuals of their 20s and 30s we’re listening to from speaks to how a lot monetary strain they’re feeling from their mounting debt,” stated Isaiah Chan, a vp at CCS. “They’re doing what they’ll — working, budgeting, slicing again — however it’s not sufficient to offset at the moment’s value of residing.”

Whereas younger Canadians battle with total debt,

mortgage debt

seems to be on the decline.

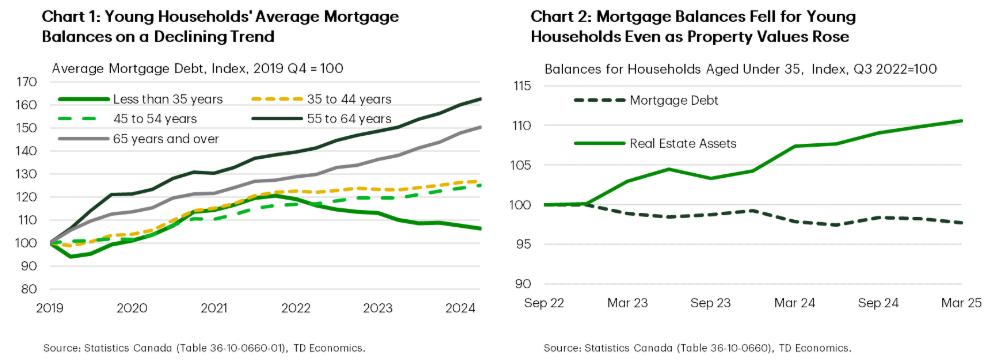

A current report from TD Economics

exhibits that mortgage balances amongst Canadians below age 35 has dropped, whereas these of all different age teams have risen.

There are a number of attainable explanations, the report stated, together with youthful Canadians choosing inexpensive houses when coming into the

housing market

or downsizing on account of value pressures.

The report additionally factors to the opportunity of younger Canadians receiving mortgage assist from older relations. Older Canadians have taken on extra debt, however information doesn’t present a spike in new funding properties or renovations, that means the debt is is attributable to one thing else.

A 2021 examine from Statistics Canada confirmed that 17.3 per cent of householders born within the Nineteen Nineties co-owned with their dad and mom, whereas 20 per cent of first-time residence consumers had been gifted a down fee, in keeping with the Financial institution of Canada.

These struggling to pay down their debt might have to attend for some assist as

economists stated final week

that any motion on charges in September is unlikely, although it’s unclear what would possibly occur with the opposite two charge bulletins in 2025.

CCS is urging anybody feeling overwhelmed with debt to achieve out for skilled assist.

“You don’t have to hit all-time low to get assist,” Chan stated. “Should you’re uncertain what to prioritize, the right way to juggle funds, and even what options can be found to you, that’s precisely when to speak to somebody. You don’t need to determine it out alone.”

Join right here to get Posthaste delivered straight to your inbox.

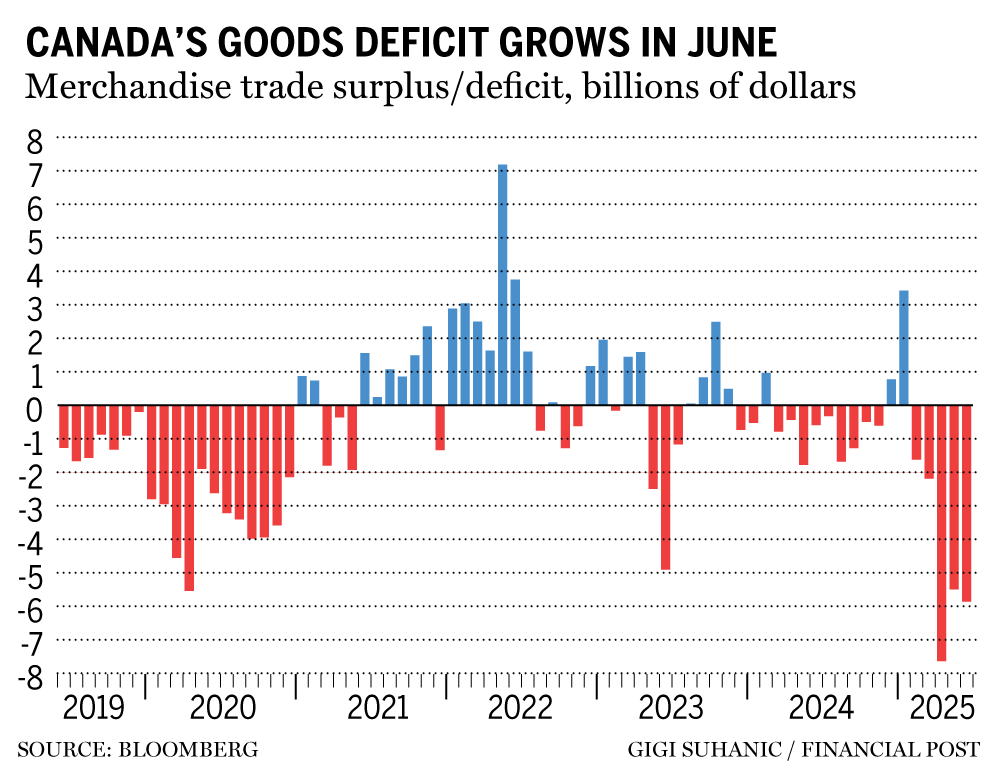

The most recent commerce numbers exhibits that

U.S. tariffs

are taking a toll on exporters, notably within the metal, aluminum and car industries.

Statistics Canada information launched Tuesday exhibits Canada’s commerce deficit ballooned to $5.9 billion in June,

from $5.5 billion in Might.

“Canada’s deficit in items commerce was little modified in June, albeit with loads of shifting items within the element on account of U.S. tariff coverage,” Andrew Grantham, an economist with CIBC Capital Markets, stated in a observe.

Exports to the U.S. fell 12.5 per cent year-over-year, whereas imports from the U.S. had been down 4.2 per cent.

Learn extra right here.

At the moment’s information: U.S. world provide chain strain index for July Earnings: Novo Nordisk A/S, McDonald’s Corp., Walt Disney Co., Uber Applied sciences Inc., Shopify Inc., Sony Group Corp., DoorDash Inc., Brookfield Asset Administration, Thomson Reuters Corp., Airbnb Inc., Manulife Monetary Corp., Honda Motor Co. Ltd., Nutrien Ltd.

Canada’s commerce struggles to ‘discover new footing’ as exports to U.S. drop 12.5% Right here’s why the CRA ought to preserve taxing ideas even because the U.S. shies away from it Canada Publish employees reject ’remaining provides’ — what occurs subsequent? Brookfield buys stake in Duke Power’s Florida utility for $6 billion

Regulators are warning customers to watch out about taking monetary recommendation from on-line influencers or so-called “finfluencers.” Monetary planner Jason Heath says that whereas the criticism is usually justified it additionally ignores a few of the advantages of following monetary influencers and a few of the issues with relying solely on the monetary business itself.

Discover out extra

Are you fearful about having sufficient for retirement? Do you should alter your portfolio? Are you beginning out or making a change and questioning the right way to construct wealth? Are you attempting to make ends meet? Drop us a line at wealth@postmedia.com along with your contact data and the gist of your drawback and we’ll discover some consultants that will help you out whereas writing a Household Finance story about it (we’ll preserve your identify out of it, in fact).

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Publish column

can assist navigate the complicated sector, from the newest traits to financing alternatives you gained’t wish to miss. Plus verify his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the power sector and extra.

At the moment’s Posthaste was written by Ben Cousins with further reporting from Monetary Publish workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

Why the Financial institution of Canada may nonetheless lower rates of interest — finally

Cracks widen in Canadians’ record-breaking wealth creation

Bookmark our web site and assist our journalism: Don’t miss the enterprise information you should know — add financialpost.com to your bookmarks and join our newsletters right here