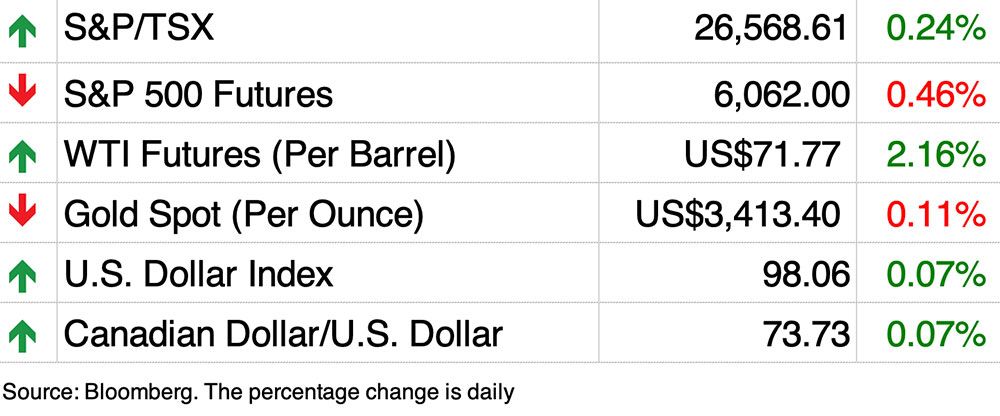

Canada’s inventory market has been on a tear recently.

Since simply earlier than america election in November, the

S&P/TSX composite

index has outperformed each the S&P 500 and the EAFE (Europe, Australasia, and the Far East), based on BMO Capital Markets, and hit a file excessive this month.

So is that this a superb omen for the Canadian financial system?

BMO senior economist Robert Kavcic regarded on the causes behind the rally in a current notice entitled “

Is the TSX Glitter Financial Gold?

”

Tariff bother?

Traders don’t like uncertainty and the turmoil thrown up by U.S. President

Donald Trump’s

commerce battle has been large. The very first thing to recollect, although, is markets are at all times wanting a minimum of three to 6 months forward. Kavcic mentioned the worst-case situation for tariffs was arguably priced in months in the past and since then Canada’s exemptions beneath the

Canada-United-States-Mexico Settlement

and a relative move on Liberation Day has signalled that the tariff bark might be worse than its chunk.

The

direct hit of tariffs

on the nation has been slender, he mentioned.

Metal and aluminium producers

face hefty 50 per cent duties, and a few auto components have been penalized, however these industries symbolize solely about 1 per cent of the TSX index.

Get ’em whereas they’re low-cost

Earlier than the commerce battle broke out, the TSX’s ahead earnings a number of was round 15x, in contrast with above 22x for the S&P 500, “a large hole from a historic perspective,” mentioned Kavcic.

Financial institution of Canada beats the gang

Canada’s central financial institution reduce earlier and deeper than most different superior economies, leaving its coverage price at a way more impartial stage than the Federal Reserve’s.

“The 225 bps of easing previously 12 months might be taking the brakes off the financial system (with a six-to-12-month lag) simply when it wants some assist, and the TSX might be reflecting that,” he mentioned.

What our market is product of

Over the previous 25 years, the correlation between TSX efficiency and financial development has been optimistic, however not as sturdy as in america, the place the S&P 500 proves a greater bellwether, mentioned Kavcic.

This comes right down to composition. The TSX is dominated by financials and vitality/supplies. Whereas the previous picks up on financial situations, the latter has much less sway within the financial system than it used to, he mentioned.

Working example are gold shares which had been 5 of the highest 10 contributors to the TSX’s enhance this 12 months, and account for a few third of the acquire 12 months up to now.

The massive weapons of the financial system, industrials, client spending and actual property symbolize solely 12 per cent, 7 per cent and a couple of per cent of the index, respectively.

“The TSX is notoriously not an ideal reflection of the underlying Canadian financial system given its composition,” mentioned Kavcic.

The underside line

Whereas the resilience of the Canada’s fairness market on this tumultuous time is spectacular, Kavcic mentioned BMO could be cautious in passing that power into the financial outlook.

Nonetheless, “if the market is certainly discounting a manageable final result — we’ll take it.”

Enroll right here to get Posthaste delivered straight to your inbox.

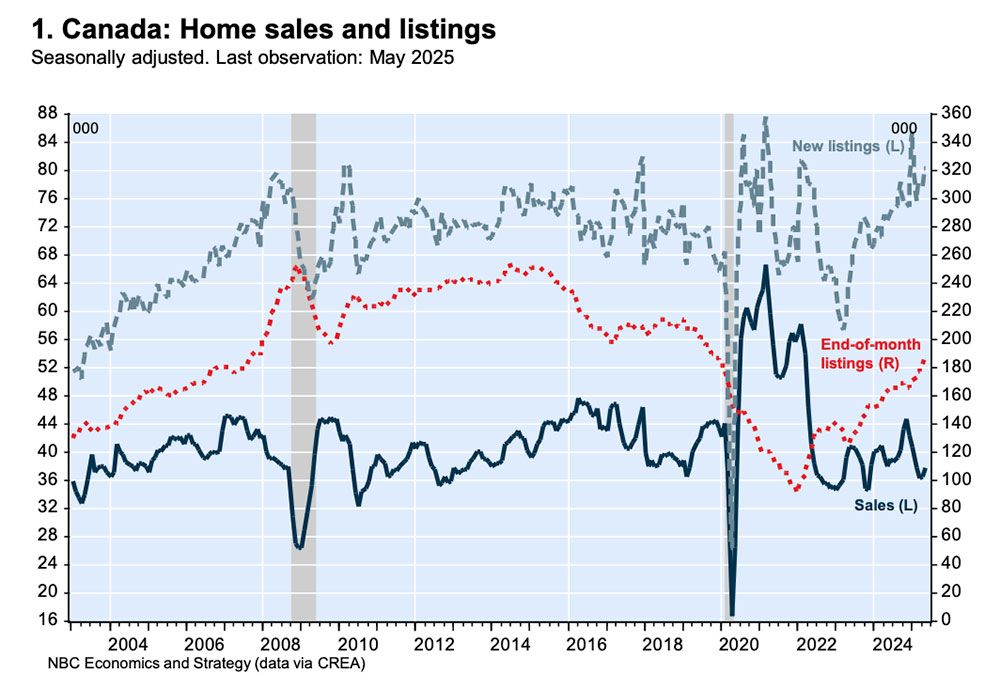

Confidence seems to be slipping again into Canada’s housing market as knowledge Monday confirmed

house gross sales rose in Could

from the month earlier than for the primary time in additional than six months.

“Whereas one good month of house gross sales doesn’t make a pattern, there could also be indicators of cautious optimism for the resale marketplace for these consumers who stay little affected by the continued commerce battle,” mentioned Kari Norman, an economist with Desjardins Group.

“The mix of decrease costs, extra stock and fewer financial uncertainty might proceed to entice extra homebuyers again into the market this summer time.”

New listings elevated by over 3 per cent, however the variety of months of stock edged again for the primary time in six months from 5.0 in April to 4.9 in Could.

G7 summit in Kananaskis, Alta. continues At the moment’s Information: Canada worldwide securities transactions, United States retail gross sales, industrial manufacturing and NAHB Housing Market Index

Trump mentioned he nonetheless favours tariffs in opposition to Canada as negotiators sit down at G7

The bond market’s lengthy hunch: What it means for traders Canada’s house gross sales rise for the primary time in additional than six months

The U.S. bond market is in uncharted territory. The drawdown over 58 consecutive months is by far the longest such stretch in recorded historical past throughout which the market has endured a peak-to-trough decline of -17.2 per cent, a staggering determine for an asset class historically seen as a secure haven, writes investing professional Martin Pelletier.

It’s a stark reminder for traders that even probably the most stable-seeming property will not be resistant to structural shifts. The message is evident: The outdated guidelines might now not apply, and adaptation is just not elective, it’s important.

Learn on for methods

Ship us your summer time job search tales

Final week, we printed a characteristic on the

demise of the summer time job

as pupil unemployment reaches disaster ranges. We wish to hear instantly from Canadians aged 15-24 about their summer time job search.

Ship us your story, in 50-100 phrases, and we’ll publish the most effective submissions in an upcoming version of the Monetary Publish.

You possibly can submit your story by electronic mail to

beneath the topic heading “Summer season job tales.” Please embody your title, your age, the town and province the place you reside, and a telephone quantity to achieve you.

Are you frightened about having sufficient for retirement? Do you have to modify your portfolio? Are you beginning out or making a change and questioning how one can construct wealth? Are you making an attempt to make ends meet? Drop us a line at wealth@postmedia.com together with your contact data and the gist of your drawback and we’ll discover some consultants that can assist you out whereas writing a Household Finance story about it (we’ll hold your title out of it, after all).

McLister on mortgages

Need to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Publish column

will help navigate the complicated sector, from the newest developments to financing alternatives you received’t wish to miss. Plus test his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

At the moment’s Posthaste was written by Pamela Heaven with further reporting from Monetary Publish employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E mail us at

.

Canadians on the lookout for extra rate of interest reduction could be out of luck

Toronto apartment gross sales drop 75%, leaving traders bleeding money, CMHC says

Bookmark our web site and help our journalism: Don’t miss the enterprise information you have to know — add financialpost.com to your bookmarks and join our newsletters right here