Canada’s

job market

seems to have stood up remarkably properly to

Donald Trump’s tariff conflict

to this point, with the economic system displaying a shock surge in jobs in June and the

unemployment fee

ticking down.

“It appears too good to be true,” Andrew Grantham, a senior economist with the

Canadian Imperial Financial institution of Commerce

, stated in a report this week. “Sadly, that’s in all probability as a result of it’s.”

Grantham argues that the job market is probably going weaker than “marketed” in Statistics Canada’s Labour Market Survey and the

Financial institution of Canada

is getting a mistaken studying. What’s actually taking place in Canada’s labour market is that weak point is widespread and largely unrelated to the struggles of industries hit by Trump’s commerce conflict.

“The notion that Canada’s labour market is in good well being, other than comprehensible weak point in commerce delicate areas resembling manufacturing, is simply too simplistic and sure incorrect,” he stated.

“Precise employment progress over the previous 12 months could have been a lot slower than marketed by the LFS, together with in sectors that ought to be much less delicate to commerce uncertainties.”

Grantham argues that the Labour Market Survey has overstated

inhabitants progress

and that might result in employment progress being revised all the way down to a fraction of what’s presently reported.

“We suspect that precise inhabitants progress, and by extension employment, has been weaker than marketed by the LFS,” he stated.

Canada’s unemployment fee has climbed from 6.6 per cent to six.9 per cent this 12 months and Grantham stated it’s simple to imagine manufacturing job losses introduced on by the tariff conflict drove the rise. However trying deeper into the information, “solely 20 per cent of the decline in manufacturing employment seems to have been mirrored within the unemployment fee.”

Some employees on this sector may have retired, quickly left the labour power or discovered work in different sectors.

This tallies with information that recommend the true purpose for the rise within the unemployment fee over the previous 12 months is just not individuals shedding their jobs, a lot as individuals getting into the workforce having issue discovering work, he stated.

Ontario, which has suffered the most important enhance in unemployment, reinforces this case. Jumps within the unemployment fee in industrial cities like Windsor and Oshawa accounted for less than a fraction of the province-wide rise, he stated. Whereas larger Toronto, with its numerous economic system, contributed to about half of it.

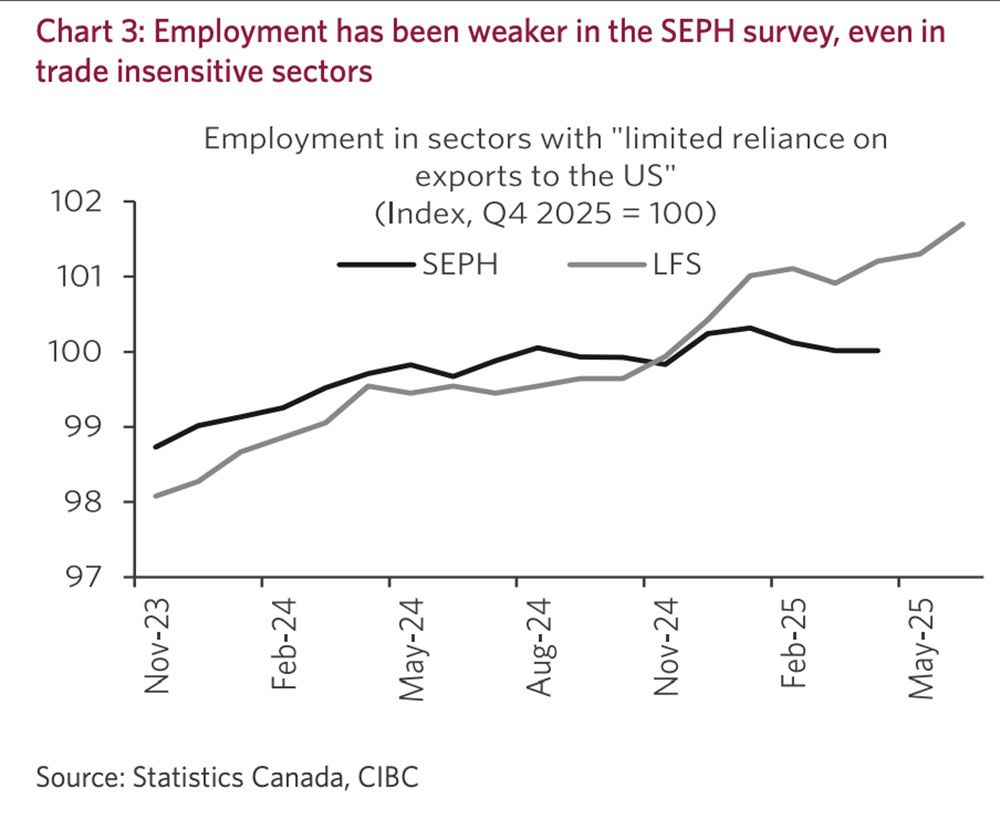

The concept labour market weak point is extra widespread than reported is supported by the “stall” seen within the payrolls survey of employment (SEPH) over the previous 12 months, stated Grantham.

Getting a transparent image of what’s actually taking place within the labour market is vital as a result of the Financial institution of Canada has used the power in Labour Power Survey employment to justify holding rates of interest at 2.75 per cent, he stated.

“If the Canadian labour market is weaker than marketed, this slack ought to ultimately place downward strain on core measures of inflation and produce a pair extra

rate of interest cuts

from the Financial institution of Canada later this 12 months.”

Join right here to get Posthaste delivered straight to your inbox.

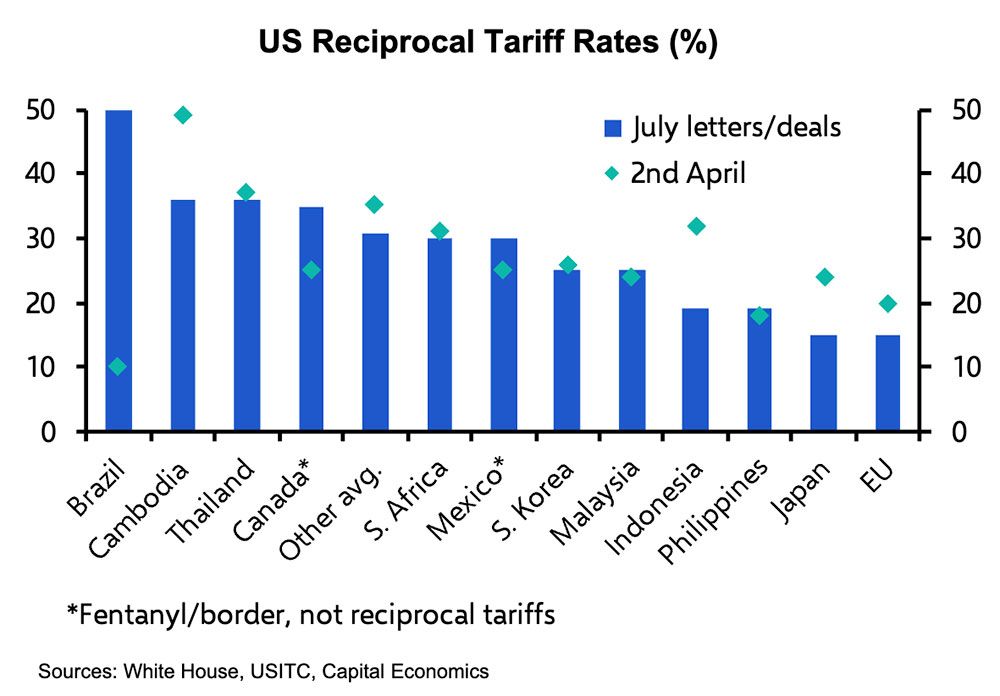

The clock is ticking all the way down to U.S. President’s

tariff deadline

Friday, with nonetheless no information on a deal for Canada. At the moment’s chart reveals how the nation’s tariff fee ranks towards different nations, some which have reached offers and a few which haven’t.

Thus far, Trump’s commerce offers “are actually dangerous omens for Canada,” William Pellerin, a commerce lawyer and companion on the agency McMillan LLP, advised the Canadian Press.

“(It reveals) that the tariffs, significantly the sectoral tariffs, are stickier than we’d have thought,” Pellerin stated. “If none of these nations have been capable of safe a drop within the sectoral tariffs, that’s definitely dangerous information.”

Tariffs on Canadian imports are to rise to 35 per cent on Friday, however most won’t be affected as a result of they’re compliant with the

Canada-United-States-Mexico Settlement.

At the moment’s Information: Canada GDP for Might, United States private revenue and spending Earnings: Bombardier Inc., Lightspeed Commerce Inc., Cenovus Vitality Inc., TMX Group Ltd., Gildan Activewear Inc., Colliers Worldwide Group, Eldorado Gold Corp., Aecon Group Inc., Baytex Vitality Corp.

Financial institution of Canada holds fee at 2.75%, however leaves door open for additional fee aid

Toronto rental glut forces extra landlords to lure tenants with incentives like free hire, says Urbanation

Canada commits funding to joint AI security effort with the U.Okay.

The household cottage has traditionally provided a singular mix of emotional and monetary returns: a spot to create reminiscences and a promising secondary funding. However as of late actual property is not the automated wealth builder it as soon as was. Rebecca Broadley, a senior wealth adviser at Richardson Wealth, outlines what you ought to be taking a look at to find out if shopping for a cottage will probably be an excellent funding or simply an costly luxurious.

Learn extra

Are you anxious about having sufficient for retirement? Do it’s essential regulate your portfolio? Are you beginning out or making a change and questioning how one can construct wealth? Are you attempting to make ends meet? Drop us a line at wealth@postmedia.com together with your contact information and the gist of your drawback and we’ll discover some consultants that will help you out whereas writing a Household Finance story about it (we’ll preserve your identify out of it, after all).

McLister on mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

may also help navigate the advanced sector, from the most recent tendencies to financing alternatives you gained’t wish to miss. Plus test his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

At the moment’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Submit employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

If a 15% tariff is the ‘new regular,’ would that be a ‘robust capsule’ for Canada?

The hidden prices of the ‘Purchase Canadian’ motion

Bookmark our web site and help our journalism: Don’t miss the enterprise information it’s essential know — add financialpost.com to your bookmarks and join our newsletters right here