The promoters of rip-off foreign money spent extra money than every other group in 2024. They’re now realizing an enormous return on funding in Donald Trump’s White Home.

King of the shill: A mural of President Donald Trump outdoors a cryptocurrency workplace in Hong Kong.(Mladen Antonov / AFP through Getty Photographs)

This text seems within the

June 2025 difficulty, with the headline “Coin Operated”

On February 11, 2025, Consultant Sean Casten, an Illinois Democrat who sits on the Home Monetary Providers Committee, questioned crypto trade executives at a public listening to in regards to the risks of the president of the US launching a memecoin. These crypto tokens are often known as “shitcoins” since they’re extensively thought-about nugatory, a software for pump-and-dump schemes. As a result of the foundations of congressional decorum had not accommodated themselves to the vulgar conventions of Twenty first-century monetary applied sciences, Casten needed to phrase his query fastidiously.

“It’s arduous to speak about memecoins with the language that the trade makes use of to speak about them,” Casten mentioned. “We’ll discuss with them as ‘fecal cash’ for the needs of this listening to. Is it protected to say out of your smiles that you simply usually share the view of the trade that this isn’t one thing that has any innate worth?”

“Sure,” an trade consultant replied.

“The president of the US issued one thing that has no innate worth,” Casten mentioned, earlier than occurring to speak about how retail merchants could have misplaced billions speculating on the $TRUMP fecal coin.

Crap money: The shitcoin marking the euphemism Consultant Sean Casten debuted on the Home Monetary Providers Committee.(X person @fecalcoins)

Crap money: The shitcoin marking the euphemism Consultant Sean Casten debuted on the Home Monetary Providers Committee.(X person @fecalcoins)

On social media, crypto boosters have been much less excited by Casten’s cost that the president was swindling Individuals than they have been galvanized into reworking Casten’s cheeky euphemism into the very form of nugatory monetary instrument it sought to explain. Lower than two hours later, somebody had created a memecoin underneath the ticker image $FECAL and began an X account and Telegram group to pump the token, exhorting speculators to purchase. $FECAL’s worth by no means rose above $0.00007, however about $6 million price of the made-up coin was traded that day earlier than it sputtered towards irrelevance. It was the type of shitcoin pump-and-dump that occurs a whole lot of instances a day, however this one was related to the phrases and actions of a congressman. Its emblem had Casten’s face on it.

Present Problem

The $FECAL episode was a small however telling signal of how crypto, regardless of being a relative flop commercially, has infiltrated American politics. As soon as the memecoin appeared, Casten’s unremarkable remark became a chance for graft and self-dealing, nonetheless ludicrously conceived and executed. Casten acknowledged as a lot. If he weren’t a identified critic of the crypto foyer, Casten mentioned, the token may need provoked some suspicion—that, say, the congressman was in on the grift. “Try to be asking me arduous questions on that, proper?” he mentioned in an interview. “It’s insane.”

If no a part of society is immune from the omnipotent hand of the market, the identical may now be mentioned of crypto. By no means has a lot energy, authority, and a spotlight been afforded to such an economically unproductive trade. By no means has a lot vitality and human potential been wasted chasing illusory earnings in a enterprise that depends on Ponzi economics. And by no means have politicians had so many alternatives for clandestine private enrichment, in a parallel monetary system that they’ve largely let run amok.

(Jonathan Raa / NurPhoto through AP)

(Jonathan Raa / NurPhoto through AP)

The cryptocurrency trade is about as previous because the iPhone, but it has completed little or no, devouring a whole lot of billions of actual {dollars} to prop up a know-how that also lacks a lot of a rationale to be launched as authorized foreign money. By means of a number of bubbles, crypto has didn’t scale past a base of hardcore believers and retail speculators who preserve the on line casino operating. It’s created extra heartache than shared prosperity. It’s higher identified for its rising checklist of fraudulent corporations than for its profitable ones. In the US, there are two publicly traded crypto exchanges: Coinbase and Bakkt. Coinbase is a significant Trump supporter, whereas the Trump household has been reportedly negotiating to accumulate Bakkt—partially owned by Trump ally and Small Enterprise Administration director Kelly Loeffler—for its personal crypto portfolio. But the trade is on the peak of its political affect.

Crypto has been profitable in two areas: as a software for crime—money-laundering, sanctions evasion, funding scams—and in its conquest of the American political scene. The 2 achievements appear deeply intertwined. Within the 2024 political marketing campaign cycle, crypto was the most important donor by trade, elevating greater than $197 million. The crypto trade gained almost each race it received behind, and a few of its leaders later claimed accountability for serving to to return Consultant Jamaal Bowman, Consultant Katie Porter, and Senator Sherrod Brown, all progressive Democrats, to the non-public sector.

Crypto supporters usually declare that we’re getting ready to a monetary revolution—if solely the federal government would get out of the best way and permit these heroic monetary innovators to do their factor. Now the trade will get its likelihood. With each homes of Congress underneath Republican management and an orange-pilled Trump within the White Home, crypto is on the verge of getting the bespoke regulatory and authorized regime it’s lengthy demanded. Congress is now contemplating laws to spice up the marketplace for stablecoins (crypto tokens which are pegged to the greenback, typically backed by unaudited abroad holdings parked in sketchy banks). Underneath the supervision of enterprise capitalist turned crypto and AI czar David Sacks, the federal authorities is even going to start out stockpiling digital tokens as a strategic asset.

That shall be an issue for the remainder of us, who should take care of the collective catastrophe more likely to be wrought by the bursting of one other crypto bubble. This time, skeptics fear about crypto’s inroads into mainstream finance, the place crypto is now on company steadiness sheets, in public workers’ retirement accounts, and fueling extremely leveraged bets. One other digital-asset crash may spur a wider financial calamity. With the Republicans in cost and a divided Democratic opposition forsaking its conventional mandate of client safety, it appears we may have no alternative however to undergo a gratuitous financial downturn engineered by a make-believe medium of alternate.

Donald Trump as soon as referred to as Bitcoin a rip-off, however underneath the tutelage of his sons and venture-capitalist donors, he modified his thoughts. Beginning a number of crypto companies over the previous 12 months, he embraced this century’s hottest get-rich-quick scheme with a fulsomeness that stunned even some true believers. (The inauguration weekend launch of the $TRUMP shitcoin was handled by some MAGA crypto figures as a bit unseemly—they’d seen this film earlier than.) The Republican Get together had already gotten there, with Senators Cynthia Lummis of Wyoming and Ted Cruz of Texas and Home majority whip Tom Emmer of Minnesota serving because the trade’s most devoted partisans. With Trump on board, crypto is poised to turn out to be totally woven into US financial and industrial coverage.

The Republicans had a couple of like-minded Democratic colleagues, notably Senator Kirsten Gillibrand and Consultant Ritchie Torres of New York and Consultant Ro Khanna of California. However total, liberals have been divided on crypto. Some didn’t perceive it; some thought there have to be “one thing” there, an actual innovation to domesticate; a couple of have been within the trade’s pocket; and others feared the trade’s rising clout.

Lately, whereas trying to whip fellow Home Democrats to vote towards a Republican decision to overturn a Biden-era rule that categorised some crypto entities as brokers with IRS reporting necessities, Casten discovered himself preventing towards his colleagues’ apprehension of an trade that would simply flood their opponents with money donations.

“I didn’t discover a single Democrat who disagreed with me that this CRA (Congressional Evaluate Act vote) was horrible coverage,” Casten mentioned. “Nobody pushed again on it. However I heard lots of them saying, ‘Look, you already know I’m in a susceptible seat. I don’t wish to have a bunch of crypto cash’” donated to their opponent. “That’s actually scary.”

With its disregard for establishments and their valuable norms, crypto ended up being an ideal cultural match for Trump and MAGA. Even within the grubby, cutthroat political area, crypto didn’t function like most industries. Its main executives blasted regulators on social media and filed lawsuits in help of crypto builders accused of money-laundering, reminiscent of Twister Money, a “cryptocurrency mixer” that was chargeable for laundering greater than $7 billion and was on the Workplace of Overseas Asset Management’s sanctions checklist—that’s, till a three-judge appellate panel sided with Twister Money customers in a Coinbase-funded lawsuit. The crypto VC agency Paradigm donated $1.25 million to help within the prison protection of certainly one of Twister Money’s founders.

Claiming that they have been preventing for his or her trade’s life, crypto leaders attacked Democratic politicians and regulators with trollish vehemence. The vocal cadre of single-issue crypto voters adopted swimsuit. Just like the ride-hailing and meal-delivery start-ups earlier than them, crypto corporations used their apps to rally customers towards their native representatives’ supposedly regressive insurance policies, portraying themselves as populist insurgents cornered by a corrupt institution.

“We had enforcement people who have been personally attacked by the trade for having been related to crypto instances,” mentioned Corey Frayer, who was a senior adviser to former Securities and Alternate Fee (SEC) chair Gary Gensler—crypto’s chief antagonist—through the Biden administration. “Credible threats coming by. Folks’s private info being doxed, posted on-line. That’s not the type of factor you see from the standard monetary companies trade, as confrontational as these instances or these interactions could be. That’s simply remarkable.”

Altering of the guard: Former SEC head Gary Gensler (L); Commerce Secretary Howard Lutnick within the Oval Workplace with Trump and RFK Jr.(left: Jacquelyn Martin / AP Picture; proper: Yuri Gripas / Abaca / Bloomberg through Getty Photographs)

Altering of the guard: Former SEC head Gary Gensler (L); Commerce Secretary Howard Lutnick within the Oval Workplace with Trump and RFK Jr.(left: Jacquelyn Martin / AP Picture; proper: Yuri Gripas / Abaca / Bloomberg through Getty Photographs)

After Trump gained the 2024 election with overwhelming backing from the trade, crypto executives started exerting their newfound affect. Coinbase CEO Brian Armstrong, an everyday presence on Capitol Hill within the months main as much as the election, mentioned that his firm wouldn’t work with any regulation agency that employed former SEC attorneys. “It’s an ethics violation in my e book to attempt to unlawfully kill an trade whereas refusing to publish clear guidelines,” Armstrong wrote on X.

In February, the SEC reportedly closed its investigation into Gemini, the crypto firm run by the Winklevoss twins, finest referred to as the failed social media rivals to Mark Zuckerberg’s Fb empire. Gemini had additionally been sued by New York Legal professional Common Letitia James in a $3 billion fraud case. Tyler Winklevoss demanded that the SEC ought to title, disgrace, and fireplace staffers who labored on crypto enforcement and reimburse their firm thrice its authorized prices. “It will begin to make amends for the injury you have got achieved to us, our trade, and America,” Winklevoss wrote.

Underneath Trump, the SEC is ready to be led by Paul Atkins, a crypto trade marketing consultant. The SEC’s high litigator was transferred to the company’s IT division, as profession workers are being punished for implementing the insurance policies of a earlier administration and because the company races to drop lawsuits and pause enforcement actions.

Though it hasn’t been very profitable economically, crypto punches above its weight culturally, tapping into long-standing conservative shibboleths. “A lot of the financial and political thought on which Bitcoin is predicated emerges straight from concepts that journey the gamut from the sometimes-extreme Chicago Faculty economics of Milton Friedman to the express extremism of Federal Reserve conspiracy theorists,” wrote David Golumbia in The Politics of Bitcoin: Software program as Proper-Wing Extremism. “Bitcoin and the blockchain know-how on which it rests fulfill wants that make sense solely within the context of right-wing politics.”

In contrast to their counterparts on Wall Avenue, these monetary executives aren’t within the stability of the state. They’d somewhat see it destroyed, if not do the job themselves. Creating non-public cash, issued by Silicon Valley start-ups, pseudonymous scammers, and shell corporations primarily based in island tax shelters, is by its nature a broadside towards the sovereignty of the state and its governing authority over the cash provide. Regularly calling fiat cash—US {dollars}—the “actual Ponzi scheme,” crypto partisans inhabit a special ideological area, one which places them in computerized battle with the liberal regulatory state.

The crypto trade’s blunt disregard for presidency bureaucrats and laws builds on a right-wing custom of calling for the federal government to be shrunk by any means, its capability hollowed out. This difficult-right libertarian worldview is now being put into harmful follow with Elon Musk’s DOGE undertaking, which has allowed the world’s richest man to launch an administrative coup within the title of rooting out waste and fraud. Like Musk, crypto perpetuates the very corruption it claims to be excising.

Cobbled collectively from a pastiche of right-wing philosophy and American financial jingoism, crypto’s turns of phrase have seeped into the substrate of Republican discourse. “The liberty to transact”—the principal liberty from which all different liberties and rights move, based on the prevailing ideology—is now invoked by politicians like Arkansas Republican Consultant French Hill as a key financial proper that may be secured solely with higher entry to crypto. After being accused of counterfeiting and destabilizing the greenback and of enabling world cybercrime, stablecoin issuers like Tether started speaking about how their merchandise would “lengthen greenback hegemony.” The thought has been taken up by Trump and his high officers. “As President Trump has directed, we’re going to preserve the U.S. the dominant reserve foreign money on this planet, and we’ll use stablecoins to do this,” mentioned Scott Bessent, his treasury secretary.

The suitable’s prepared absorption of crypto-speak reveals how the trade has effected the identical neat trick of political positioning that Trump has: Crypto boosters laud themselves as countercultural political actors, clawing away the deadwood of incumbent establishments whereas absorbing the institution status that comes with huge marketing campaign contributions—an uptick in Beltway standing that’s additionally made them closely depending on the political favors and patronage of Republican elites. There’s a purpose, in any case, that one of many hottest tickets of Trump’s inaugural weekend was the lavishly funded Crypto Ball.

The trade’s Janus-faced self-image additionally helps clarify a coverage agenda that’s everywhere in the map. Crypto leaders could fancy themselves revolutionary upstarts who’re difficult the present Wall Avenue–led, SEC-supervised financial order—however they’d additionally very very similar to entry to mainstream finance’s merchandise, traces of credit score, and institutional buyers. Crypto boosters declare that they are going to supply a hedge towards the greenback in a brand new multipolar world buying and selling regime—however they may also in some way lengthen the greenback’s standing because the world’s reserve foreign money. These whiplash-inducing swerves in coverage considering aren’t meant to be taken way more significantly than the most recent shitcoin choices—like these ploys, they simply provide an alibi for buyers seeking to minimize and run the second that token costs begin dropping.

Inside man: David Sacks, the administration’s crypto and AI czar, boasts ties to the crypto trade.(Samuel Corum / Sipa / Bloomberg through Getty Photographs)

Inside man: David Sacks, the administration’s crypto and AI czar, boasts ties to the crypto trade.(Samuel Corum / Sipa / Bloomberg through Getty Photographs)

Though its roots are in right-wing libertarian and cypherpunk thought, crypto wasn’t all the time a right-wing political phenomenon. In the course of the first Trump administration, tech-friendly Democrats embraced the trade and its doubtful promise of economic empowerment and innovation. Within the 2022 midterms, simply earlier than his crypto empire imploded, Sam Bankman-Fried, the now-imprisoned fraudster who based the FTX crypto alternate, made greater than $100 million in political donations; he floated the potential for spending $1 billion within the 2024 races. On the similar time, his colleague Ryan Salame led a dark-money marketing campaign focusing on Republican politicians whereas Bankman-Fried met privately with GOP leaders like Senator Mitch McConnell. Bankman-Fried was the face of crypto’s public marketing campaign to legitimize itself—to carry the casinos onshore right into a pleasant authorized atmosphere allowing extra money to enter the system. Till FTX’s collapse and the publicity of what a federal prosecutor described as the biggest marketing campaign finance crime in historical past, many Democrats have been all too glad to go alongside. For years, Democratic politicians and profession civil servants gamely tried to work with the crypto trade, solely to come across repeated intransigence from crypto barons. The trade argued that it required “regulatory readability.” In its view, crypto was novel and unsuited to the present authorized and regulatory framework, however Gensler’s SEC—and the broader Biden administration—maintained that current legal guidelines have been capacious and versatile sufficient to control crypto. It was the crypto corporations who refused to adjust to current securities and banking legal guidelines and claimed they wanted new guidelines to accommodate them.

This dynamic performed out publicly in crypto’s dealings with the SEC. Gensler invited crypto corporations—together with monetary corporations contemplating shifting into crypto—to return in and register with the company underneath current securities laws. Maybe some minor rule disputes might be labored out, regulators thought. The initiative was useless within the water: A procession of corporations got here in to speak, however none of them registered with the SEC—their enterprise fashions wouldn’t permit it.

“Going by that course of again and again and over, even when it wasn’t acknowledged explicitly, it turned fairly clear what the battle was. We don’t wish to separate these companies out into the standard set of intermediaries that function at arm’s size, as a result of the conflicts of curiosity are what made the trade worthwhile,” mentioned Frayer, the previous SEC adviser. He was referring to the various roles—market maker, clearinghouse, broker-dealer—that have been divided up in conventional monetary markets however that in crypto tended to exist underneath one roof. This “concentrated enterprise construction,” as Frayer referred to as it, wasn’t allowed in US capital markets, but it surely gave the impression to be key to crypto’s plans.

Advert Coverage

Casten had comparable experiences, seeing an trade decided to pursue its self-interest with out accommodating itself to the foundations of public markets. “I’m nonetheless ready for the primary particular person from the crypto trade to return to my workplace and say, ‘We completely need one thing the place it isn’t simpler to launder cash than it could be with common {dollars}; it isn’t simpler to destabilize the monetary system than it’s with common {dollars}; it isn’t simpler to defraud buyers than it’s with different securities and commodities,’” he mentioned. “Nobody from the trade has but provided that up. And I discover myself left saying, ‘OK, then is there a authorized use case for these things the place you may make cash?’ As a result of it doesn’t seem to be anyone is advocating for one.”

Casting the Biden administration as the last word oppressor, the crypto trade appeared past negotiation or compromise. Any makes an attempt at regulation or enforcement—or at what the trade derisively calls “regulation by enforcement”—have been handled as existential threats. The SEC was accused of selectively going after sure crypto corporations; in actuality, the company was husbanding restricted assets towards a mandate to guard capital markets that have been far bigger than crypto’s market cap of lower than $3 trillion.

“As we did make casual requests from sure crypto-native corporations, we received letters from Congress saying, ‘How dare you take a look at these? They’re outdoors your jurisdiction,’” Frayer recalled, referring obliquely to actions by GOP Home majority whip Tom Emmer. “After which after FTX crashed, we received letters saying, ‘The place have been you? Why didn’t you present up earlier than this crash occurred?’”

Well-liked

“swipe left under to view extra authors”Swipe →

Given its persistent intransigence within the face of regulatory our bodies, crypto hasn’t operated like different {powerful} industries or curiosity teams. “Typically, there’s this very good-faith back-and-forth between the workers and the trade, as a result of even when there’s completely different variations of opinion, there’s a need to get these things proper, a need to take care of the integrity of the markets, as a result of that works to all people’s profit,” Frayer mentioned. “Crypto was not excited by preserving that norm.”

By the point the 2024 political marketing campaign revved into gear, Bankman-Fried was a convicted felon and the crypto bubble had burst. However beginning final 12 months, whilst client curiosity remained tepid, digital-asset costs started to get well, and crypto corporations primarily rebooted their political affect marketing campaign, this time specializing in Republicans. Led by Coinbase, the enterprise capital agency Andreessen Horowitz, the buying and selling agency Soar, and others, crypto corporations started pouring tens of millions of {dollars} into Republican-aligned tremendous PACs. Attracted by the stench of legalized corruption, lobbyists materialized, creating crypto commerce organizations and messaging campaigns. The political vitality and donations coalesced round Republicans who preached in regards to the evils of presidency from the ground of Congress. And Democrats turned the enemy.

Token consultant: Center East envoy Steve Witkoff cofounded the Trump-connected crypto firm World Liberty.(Evan Vucci / AP Picture)

Token consultant: Center East envoy Steve Witkoff cofounded the Trump-connected crypto firm World Liberty.(Evan Vucci / AP Picture)

Surrounded by all method of crypto touters, Trump swept to victory on a tide of crypto money and a promise to trade leaders that they’d get no matter they wished. In any case, he was now certainly one of them—the Structure’s emoluments clause appears to have been rendered a quaint authorized artifact—so what was good for the crypto trade ought to be good for Donald Trump. The president stocked his administration with crypto trade executives, VCs, and reactionary tech moguls. Steve Witkoff, the actual property billionaire and longtime buddy of Trump, is each the president’s Center East envoy and one of many forces behind World Liberty Monetary, the crypto firm that has raked in a whole lot of tens of millions of {dollars} for the Trump household. In his capability as a authorities official, Witkoff helped negotiate a prisoner swap with Russia that introduced residence the imprisoned American Marc Fogel in alternate for Alexander Vinnik, who was serving a 20-year sentence for laundering $4 billion by BTC-e, a Russian crypto alternate.

Trump has promised to determine a authorities crypto reserve compiled from the stockpile of Bitcoin seized from prison proceeds in addition to the handful of tokens, like Solana, which have Trumpworld connections. “They’re going to make some huge cash for the nation,” Trump mentioned as he signed an government order authorizing the brand new crypto reserve. “So is David,” he added, pointing to his crypto and AI czar David Sacks.

Trump claimed that the federal government will maintain on to its Bitcoin—consistent with the coiner’s philosophy to by no means promote—however the total intention appeared, per the usual crypto enterprise mannequin, to extract most market returns and let the satan take the hindmost. Sacks has mentioned that the federal authorities misplaced out on $17 billion in capital positive factors by promoting 195,000 Bitcoin through the years. The federal authorities is on its approach to changing into a participant in crypto markets, bailing out Trump’s enterprise capital donors whereas offering a worth ground for politically favored tokens. Trump’s plan for a digital-asset stockpile states that “the Secretaries of Treasury and Commerce are approved to develop budget-neutral methods for buying extra bitcoin, offered that these methods impose no incremental prices on American taxpayers.”

Whereas Sacks could have the crypto czar title, probably the most crypto-aligned determine within the administration is arguably Howard Lutnick, the brash Wall Avenue government who led Cantor Fitzgerald earlier than he was appointed as Trump’s secretary of commerce. In recent times, Cantor Fitzgerald has turn out to be the de facto US banker for Tether, the crypto trade’s most essential and most controversial firm. Tether makes the $1 securecoin referred to as USDT, which is crypto’s most generally traded token. It’s continuously described because the chip used in any respect the crypto casinos. A majority of crypto transactions are achieved in Tether, particularly within the calmly regulated sphere of decentralized finance. Tether can be extensively used for cash laundering, sanctions evasion, and terrorist financing, and in cybercrimes reminiscent of “pig butchering” schemes—romance and funding scams that contain pitches to purchase crypto tokens and ship them abroad.

The alleged sins of Tether have already generated a small library’s price of courtroom proceedings. Think about an offshore Federal Reserve–slash–shadow financial institution with huge attain and an impossibly checkered solid of characters behind it that when included little one actor and accused pedophile turned cryptocurrency mogul Brock Pierce. In addition to its affiliation with illicit finance, one of many predominant issues about Tether is its monetary reserves, which have by no means been audited. Tether has greater than $143 billion price of USDT tokens in circulation and will have a corresponding $143 billion in actual {dollars} and greenback equivalents within the financial institution. However the firm has been caught obfuscating its funds and has admitted in courtroom filings to printing tokens with out greenback backing—primarily, minting cash out of nothing. (The farcically named GENIUS Act, the invoice regulating stablecoins that’s presently being debated within the Senate, requires stablecoin issuers to have totally dollar-backed, audited reserves, which might be an issue for Tether.) Tether can be deeply concerned within the type of extremely leveraged lending enterprise that in 2022 helped take down Bankman-Fried, a Tether enterprise accomplice, and the broader client crypto market.

Hounded by investigators, Tether has confronted banking points all through its historical past. In recent times, the corporate claims, it has poured its cash into Treasury bonds—dollar-like devices which are thought-about protected and are straightforward to get out and in of. With $113 billion price of Treasuries, Tether claims to be one of many largest holders of US debt, touchdown someplace between the governments of Mexico and South Korea. Cantor Fitzgerald manages Tether’s Treasury holdings, despite the fact that Letitia James has banned Tether from doing enterprise in New York, the place Cantor is headquartered. Lutnick’s agency additionally purchased 5 p.c of Tether and introduced a multibillion-dollar Bitcoin-backed lending program with the corporate. The commerce secretary, in brief, is carefully affiliated with an organization whose product is a linchpin of prison money-laundering networks. Final fall, as Lutnick took conferences on Capitol Hill, his willingness to veer into private crypto enterprise alarmed Republican interlocutors, who duly issued nameless complaints to Politico. Lutnick’s crypto-shilling could have doomed his bid for treasury secretary, which he misplaced to the extra polished hedge funder Scott Bessent.

At the same time as crypto’s cash and public allegiance shifted towards Republicans, Democrats didn’t develop a coherent crypto coverage or electoral technique. Elected officers didn’t adequately perceive what crypto was and the distinctive political menace it posed—or, as Casten famous, they have been cowed by the trade’s bankroll.

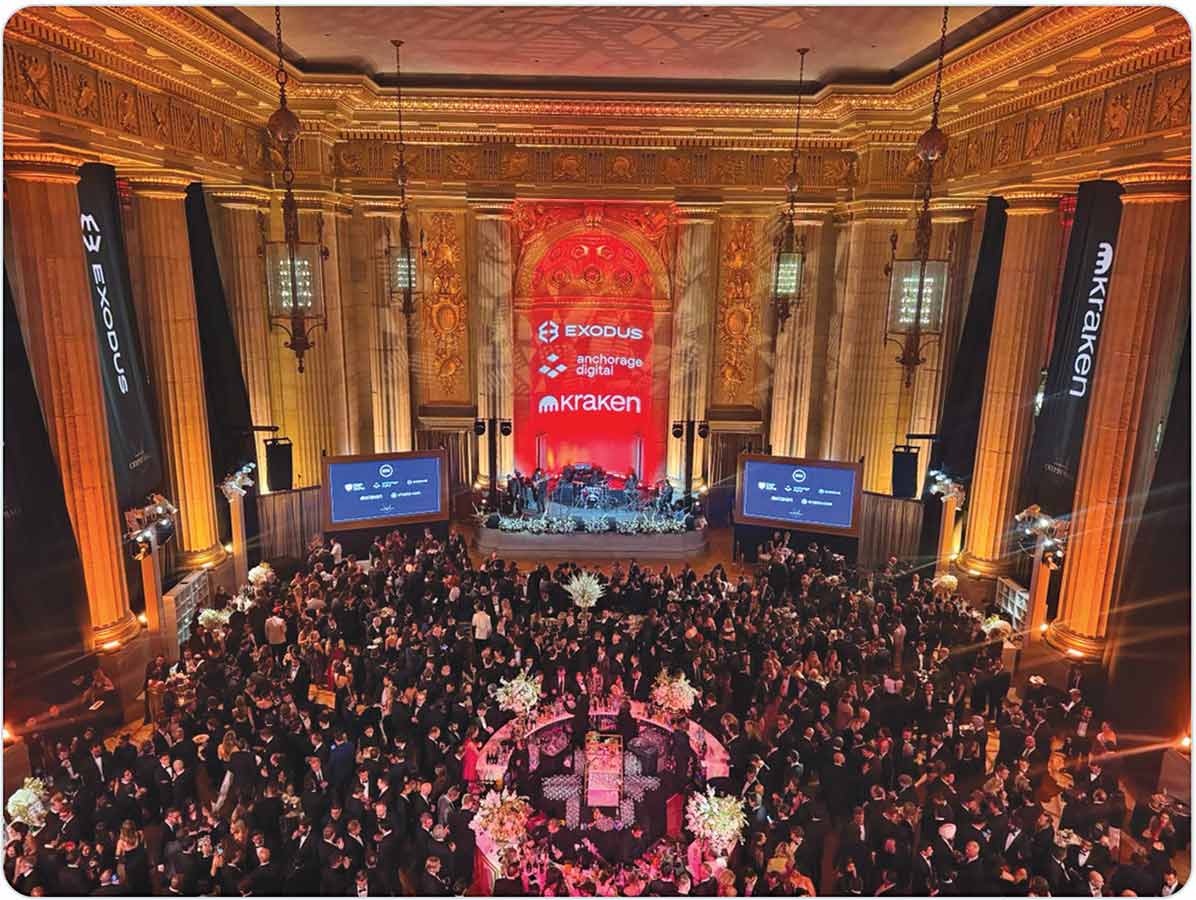

The cash-go-round: The Crypto Ball, a scorching ticket throughout Trump’s inuaguration weekend.(Nicolas Cary)

The cash-go-round: The Crypto Ball, a scorching ticket throughout Trump’s inuaguration weekend.(Nicolas Cary)

Others discovered that, in distinction to its shambolic would-be opposition in Congress, the crypto trade was well-organized and armed with a battery of speaking factors authorized by its political allies on the appropriate. “You get a very one-sided type of engagement from the trade,” mentioned Consultant Ben Waxman, a member of the Pennsylvania Legislature, who launched a invoice final 12 months requiring cryptocurrency lenders to higher collateralize and segregate funds—two points that contributed to the bursting of the crypto bubble in 2022. “The general public we had testify in my listening to, they have been against my invoice,” he mentioned. (At Waxman’s request, I testified in favor of his invoice—which resembled comparable insurance policies in place in different monetary markets—earlier than a state legislative subcommittee.) The invoice was by no means introduced up for a ground vote.

Now Democrats try to parse proposed stablecoin laws that might make it simpler for big companies, like Amazon and Walmart, to difficulty their very own digital cash. It’s one other determined entrance in America’s slide towards plutocracy, and Democrats—the few who’re prepared to combat head-on—are shedding that warfare.

“The identical people which are selling crypto as a software for monetary liberation—and making an attempt to get Democrats to vote for one thing as a result of it could be good for his or her customers—are actively a part of the hassle to dismantle the Client Monetary Safety Bureau to defang banking regulators,” mentioned Mark Hays, the affiliate director for cryptocurrency and monetary know-how at Individuals for Monetary Reform.

“I don’t suppose Democrats, each rank and file and management, actually perceive that,” Hays mentioned. It wasn’t nearly defending customers from monetary predation, he defined: “It’s about defending democracy and democratic establishments.”

Casten mentioned that he tried however was unable to get what he referred to as primary protections added to the most recent invoice into account, which he mentioned will create “stablecoins that aren’t secure.” The Senate’s GENIUS Act was no higher. “In case your objective is to launder cash, these payments are arrange rather well to do it,” Casten mentioned, lamenting “how stupidly partisan this has turn out to be.”

Casten added that his colleagues have been extra anxious about preserving their seats than in regards to the well being of the economic system or their oversight accountability. “You understand that there’s going to be an enormous monetary disaster pushed by crypto,” he informed them whereas making an attempt to whip votes towards the decision to overturn the IRS dealer reporting requirement for crypto corporations. “And all people’s going to look again and say, ‘Who allowed this to occur?’”

Casten’s pleas went unheeded, as 76 Democrats voted with their Republican colleagues. Simply because it did within the Senate, the measure handed with bipartisan help—and our shitcoiner in chief signed it into regulation in April. Crypto could not produce something, but it surely will get outcomes.

Jacob Silverman

Jacob Silverman is the creator of Phrases of Service: Social Media and the Value of Fixed Connection and the coauthor of Simple Cash: Cryptocurrency, On line casino Capitalism, and the Golden Age of Fraud. He’s engaged on a e book about Silicon Valley and the political proper.