The rising financial uncertainty is forcing Canadians to overlook their

bank card funds

at charges not seen because the monetary disaster.

The typical Canadian owes $21,859 in non-mortgage debt within the face of upper costs and a powerful auto mortgage market, in keeping with a brand new report by Equifax Inc.

Demand for non-mortgage debt has slowed down in current quarters, however balances have remained flat, which Rebecca Oakes, vice-president of superior analytics at Equifax Canada, believes is an indication that paying down present debt has been a problem.

“Our information reveals card cost ranges, particularly for youthful customers, are beginning to fall, indicating this spending slowdown is probably going pushed extra by customers attempting to be prudent moderately than switching from credit score to debit for financing,” she mentioned in a information launch.

Oakes known as the decreased bank card utilization within the first quarter a “optimistic shift,” however mentioned there may very well be extra challenges forward.

“Headwinds will seemingly persist, comparable to rising unemployment and rising meals costs, in already strained areas,” she mentioned.

The typical pay price dropped 32 foundation factors to 52.9 per cent within the quarter, with 1.4 million Canadians lacking a bank card cost.

“Though mortgage holders skilled some stabilization due to regular

rates of interest

, monetary pressure remained acute for non-mortgage customers,” the report mentioned. “Shopper-level delinquency charges amongst non-mortgage holders rose 8.9 per cent yr over yr, in comparison with 6.5 per cent for mortgage holders.”

One other

report by TransUnion of Canada Inc.

mentioned Canadians who’re thought of a excessive threat of defaulting on bank card funds are extra weak than ever. Canadians on this demographic who opened a bank card throughout the previous two years had been twice as more likely to grow to be delinquent within the first 12 months of opening the cardboard.

TransUnion mentioned Albertans are almost certainly to default on credit score repayments, with a non-mortgage delinquency price of two.35 per cent. It mentioned the volatility in Alberta’s oil and fuel sector performs a task within the excessive delinquency price.

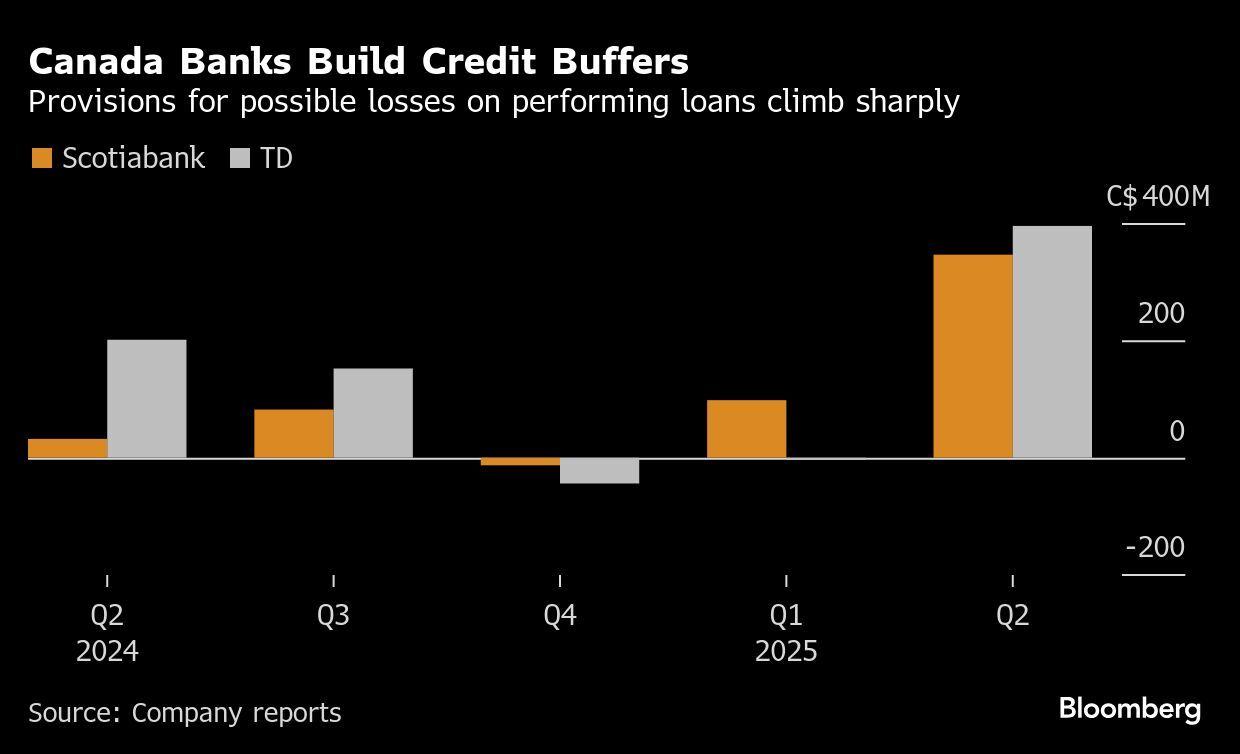

Canada’s huge banks are getting ready for an uptick of bankruptcies. On Tuesday,

Financial institution of Nova Scotia

mentioned it had elevated the cash it units apart for unhealthy loans — referred to as provisions for credit score losses (PCLs) — to $1.39 billion. Toronto-Dominion Financial institution final week mentioned it had elevated its PCLs to $1.3 billion.

Enroll right here to get Posthaste delivered straight to your inbox.

As Canada’s huge banks report quarterly earnings this week, early indicators present they don’t seem to be optimistic concerning the state of the financial system.

Each Scotiabank and Toronto-Dominion Financial institution have upped their provisions for credit score losses (PCLs), a typical signal that banks are bracing for delinquent funds or bankruptcies.

Scotiabank

elevated its PCLs to $1.39 billion, whereas TD hiked PCLs to $1.3 billion.

The Financial institution of Montreal is scheduled to launch its earnings on Wednesday.

Learn extra right here.

OPEC Joint Ministerial Monitoring Committee assembly U.S. Federal Reserve’s FOMC minutes from Might 7 rate of interest choice Earnings: NVIDIA Corp., Salesforce Inc., Financial institution Of Montreal, HP Inc., U-Haul Holding Co., Abercrombie & Fitch Co., Common Corp.

Scotiabank posts decrease revenue amid uncertainty associated to U.S. tariffs Pivotal pipeline choice looms to find out destiny of Canada’s subsequent huge LNG terminal The tax hit to Canadians from Trump’s ‘huge stunning’ invoice may very well be large OECD predicts Canadian financial system will keep away from recession, however will see flat development in 2025

For these seeking to present cash to younger ones for training with a totally topped up Registered Schooling Financial savings Plan (RESP), a contribution to a registered retirement financial savings plan (RRSP) may very well be an choice, although taxes should be paid on their withdrawal. Testamentary trusts are additionally an choice, although they require accounting and authorized charges.

Learn extra right here.

Are you nervous about having sufficient for retirement? Do it is advisable modify your portfolio? Are you beginning out or making a change and questioning the way to construct wealth? Are you attempting to make ends meet? Drop us a line at wealth@postmedia.com together with your contact data and the gist of your downside and we’ll discover some consultants that can assist you out whereas writing a Household Finance story about it (we’ll maintain your identify out of it, in fact).

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

may also help navigate the advanced sector, from the newest developments to financing alternatives you received’t wish to miss. Plus examine his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the power sector and extra.

At present’s Posthaste was written by Ben Cousins with further reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this article? Electronic mail us at

.

Burning your mortgage goes the way in which of rotary telephones and station wagons

Excessive down funds maintain Canadians out of homeownership

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it is advisable know — add financialpost.com to your bookmarks and join our newsletters right here