Bonds

flashing pink pressured

Donald Trump

to U-turn on reciprocal

tariffs

, however the sector shouldn’t be out of the woods but, analysts say.

“Most monetary market members are satisfied that turmoil in authorities bond markets — which suffered neck-snapping volatility from (April 2) via (Wednesday) morning — and recession warnings from company executives — like JP Morgan’s

Jamie Dimon

— have been crucial in convincing the administration to again off,” Karl Schamotta, chief market strategist at Corpay Forex Analysis, mentioned in a be aware.

Previous to Trump’s

stunning announcement

on Wednesday that he was pausing greater tariffs towards many nations,

rates of interest

on United States authorities bonds of all maturities have been on the rise, “

with the lengthy finish main the way in which greater and exhibiting unusually excessive volatility,” Royce Mendes, managing director and head of macro technique at Desjardins Group, mentioned in a be aware on Wednesday.

He mentioned the yield on the 10-year Treasury rose above 4.5 per cent, whereas the 30-year yield hit 5 per cent.

“Liquidity was skinny and there have been dangers that market functioning might start to deteriorate extra meaningfully, which might have confirmed catastrophic,” he mentioned.

The hazard to the monetary system was fairly actual.

Schamotta mentioned it appeared traders earlier within the week have been in search of to lift money by promoting bonds, probably to cowl their inventory market losses.

“That’s one thing fairly typical of a monetary disaster,” he mentioned, as “liquidity will get faraway from all world markets concurrently, then we have now a serious downturn and different issues begin to seize up.”

U.S. Treasuries are the worldwide lending market benchmark, so bother there can unfold round world bond markets.

“The danger right here was that if we had a speedy rise in yields, then that may set off misery for members throughout the worldwide financial system who’re reliant on that entry to U.S. funding,” Schamotta mentioned, including that the U.S.

Federal Reserve

was near stepping in so as to add liquidity to maintain the bond market functioning.

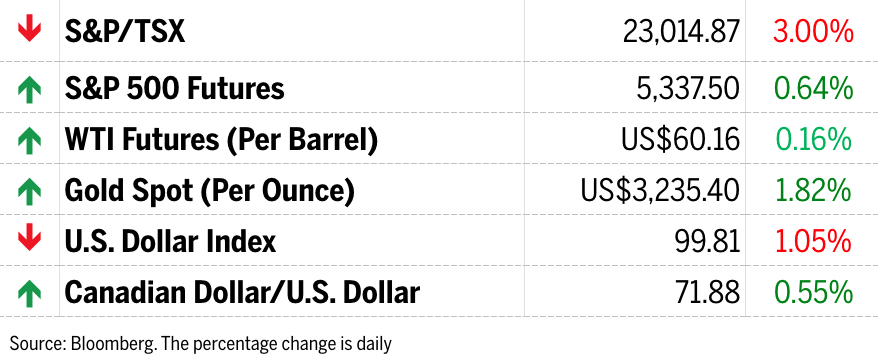

Inventory markets

soared Wednesday following Trump’s announcement, recouping trillions of {dollars} in losses, with the

S&P 500

closing up 9.5 per cent, whereas the

S&P/TSX composite index

rose 5.4 per cent.

However the euphoria didn’t final lengthy. Markets closed down once more on Thursday as traders got here to phrases with the ten per cent baseline world reciprocal tariffs and the potential affect on U.S. and world financial exercise.

On Thursday, long-term bond yields have been on the rise once more, although not as precipitously as earlier within the week, with the yield on 30-year Treasuries hitting 4.85 per cent after pulling again. Yields on shorter-term bonds got here down.

Economists at

Nationwide Financial institution of Canada

mentioned they’ve bond traders of their sights.

“As current occasions have emphasised, abroad bond investor attitudes bear shut scrutiny,” Taylor Schleich, Warren Beautiful and Ethan Currie mentioned in a be aware.

Schamotta agrees bonds aren’t out of the woods but.

“The dynamics that we’ve seen even right this moment are worrisome once more; firstly, that U.S. yields are rising and the

greenback

is falling on the similar time, indicative of a whole lot of stress within the monetary system,” he mentioned. “And it’s very clear … none of those monetary devices could be relied on to be secure within the coming months.”

Enroll right here to get Posthaste delivered straight to your inbox.

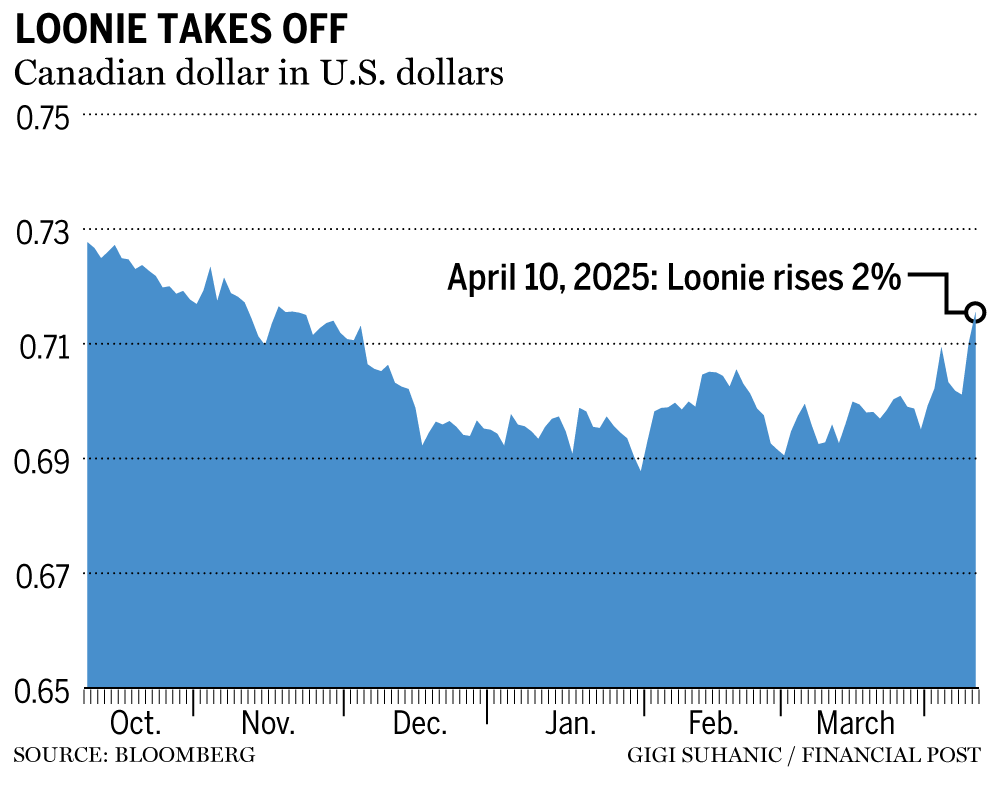

The

Canadian greenback

on Wednesday rose above 71 cents U.S. for the primary time since early December, whereas its

American counterpart

is being severely weakened by the uncertainty and chaos that Donald Trump’s

commerce warfare has unleashed

.

The loonie was up

1.4 per cent in early buying and selling Thursday as a part of a surge that began Wednesday after Trump introduced a 90-day pause on greater reciprocal tariffs, lowering the levy on most nations to a baseline of 10 per cent, however mountaineering duties on China to 125 per cent.

Learn the complete story right here.

Financial institution of Montreal holds its annual common assembly As we speak’s Information: College of Michigan Shopper Sentiment Index Earnings: JPMorgan Chase & Co., Wells Fargo & Co., Morgan Stanley, Blackrock Inc., MTY Meals Group Inc., Corus Leisure Inc.

The following Canadian authorities must cope with an immigration system that has ‘misplaced its model’ Canada might change into LNG world chief, however authorities wants new roadmap, says TC Power CEO Cash-laundering questions proceed to chase TD months after U.S. sanctions Many Canadians are delaying submitting their taxes over confusion with current modifications Some taxpayers could discover CRA’s on-line portal is lacking tax slips

Are you apprehensive about having sufficient for retirement? Do you want to modify your portfolio? Are you beginning out or making a change and questioning construct wealth? Are you attempting to make ends meet? Drop us a line at wealth@postmedia.com” data-qa=”opens-in-new-tab”> together with your contact information and the gist of your drawback and we’ll discover some specialists that can assist you out whereas writing a Household Finance story about it (we’ll preserve your identify out of it, after all).

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

will help navigate the complicated sector, from the most recent tendencies to financing alternatives you received’t wish to miss. Plus examine his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

for interviews with Canada’s main specialists in enterprise, economics, housing, the power sector and extra.

As we speak’s Posthaste was written by SUHANIC GIGH with extra reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

CIBC warns Canada will find yourself extra tied to U.S. as soon as the tariff mud settles

Trump tariff chaos units the stage for ‘vicious bear market rallies’

Bookmark our web site and assist our journalism: Don’t miss the enterprise information you want to know — add financialpost.com to your bookmarks and join our newsletters right here