The times of

burning your mortgage

as a ceremony of passage into your golden years look like slipping into the previous together with rotary telephones and station wagons.

A brand new

survey by actual property firm Royal LePage

means that

millennials and gen Z

will not be the one generations combating

housing affordability

in Canada — seniors are carrying the burden effectively into retirement.

Virtually a 3rd of Canadians who’re planning to retire within the subsequent two years will proceed to make mortgage funds on their major residence into retirement, the survey stated.

That’s twice as many seniors carrying mortgage debt as a decade in the past, and in 1999 the share was simply eight per cent.

House costs in Canada soared to $827,100 in 2023 from $120,200 in 1990, in accordance with the

Canadian Actual Property Affiliation

, and these features have been a “double-edged sword” for older Canadians, Royal LePage chief govt Phil Soper stated.

“On one hand, it has delivered unprecedented monetary features. On the opposite, this era is much extra more likely to have carried mortgage balances that will have been unimaginable to their dad and mom or grandparents,” he stated.

It’s a development that can probably proceed as first-time homebuyers more and more enter the housing market later in life.

A Royal LePage research in 2023 stated 43 per cent of first-time homebuyers had been aged 35 and older, up from 33 per cent simply two years earlier.

Within the dear Ontario actual property market, the median age of a first-time homebuyer hit 40 in 2024, up from 36 a decade earlier, which

is “a testomony to the probably results of the affordability challenges within the Ontario housing market.”

But Royal LePage additionally stated {that a} stunning variety of older Canadians will not be prepared to downsize in retirement — almost half, 47 per cent.

Seniors in Manitoba and Saskatchewan, in accordance with Royal LePage brokers, are extra inclined to downsize, whereas extra retirees in Quebec and Ontario choose to remain in their very own properties.

“The advantages of coming into retirement as a house owner with a paid-off mortgage are clear: extra disposable revenue, insulation from rate of interest modifications, and even the emotional safety that comes from understanding you’ll all the time have a spot to stay,” Soper stated.

“Within the period of rotary telephones and station wagons, burning your mortgage was the financial end line. Right now’s retiree actuality is far more nuanced.”

Join right here to get Posthaste delivered straight to your inbox.

Possibly manufacturing isn’t the American dream. President Donald Trump has made it clear he needs to convey manufacturing facility jobs again to the US, however this

suggests the American folks could be a bit extra ambivalent.

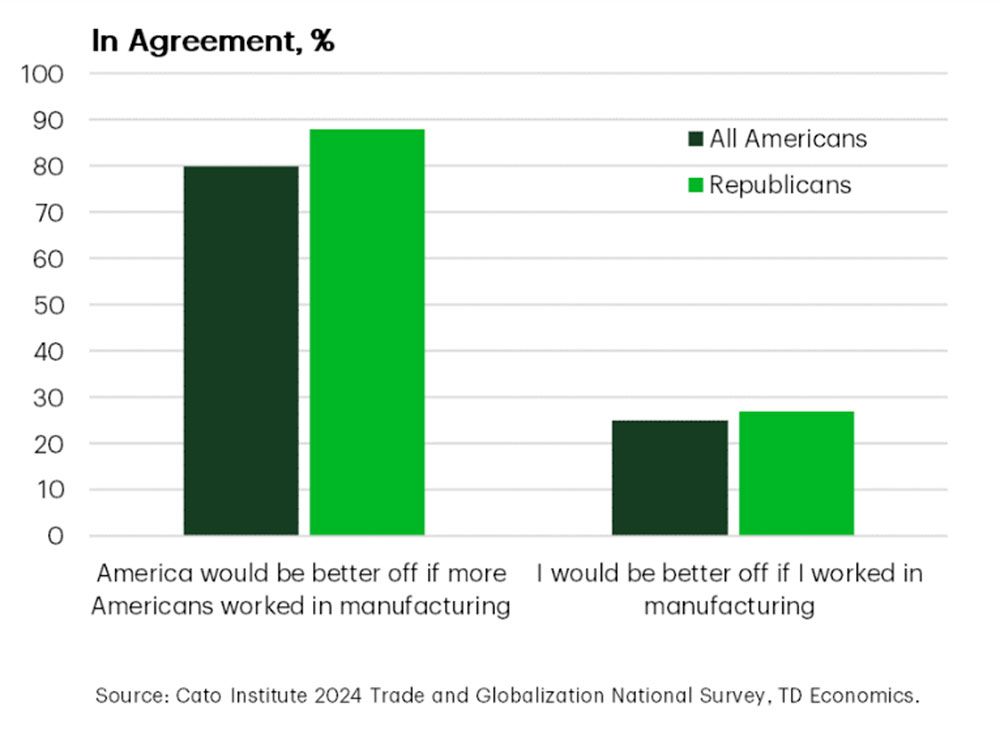

Most agree that there must be extra folks working in home manufacturing, however far fewer suppose it must be them.

Trump may need a tougher time than he thought convincing Individuals that they should pay greater costs to win again manufacturing facility jobs.

Right now’s Information: United States sturdy items orders, Convention Board shopper confidence, S&P CoreLogic Case-Shiller house worth index Earnings: Financial institution of Nova Scotia, Autozone Inc.

How Trump’s ‘massive lovely invoice’ may grow to be an enormous headache for company Canada and buyers

Many buyers stay unaware of the dimensions of the unfolding bond disaster What it is advisable to learn about Canadian Tire, the retail large that purchased Hudson’s Bay manufacturers

Canadian family wealth surged to a brand new collective excessive of $17.49 trillion on the finish of 2024, and on common Canadians noticed their internet price climb 5.77 per cent to succeed in $1,026,205, fuelled by sturdy monetary asset features. The Monetary Publish’s Serah Louis

breaks down the state of family wealth

in Canada — and appears on the uncertainty that lies forward.

Are you anxious about having sufficient for retirement? Do it is advisable to regulate your portfolio? Are you beginning out or making a change and questioning how you can construct wealth? Are you attempting to make ends meet? Drop us a line at wealth@postmedia.com together with your contact data and the gist of your downside and we’ll discover some specialists that will help you out whereas writing a Household Finance story about it (we’ll preserve your title out of it, after all).

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Publish column

may help navigate the complicated sector, from the most recent tendencies to financing alternatives you gained’t need to miss. Plus examine his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

for interviews with Canada’s main specialists in enterprise, economics, housing, the power sector and extra.

Right now’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Publish workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? E mail us at

.

‘The worry is actual,’ says TD, predicting 100,000 jobs will probably be misplaced in looming recession

Canada house costs are heading into correction territory

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable to know — add financialpost.com to your bookmarks and join our newsletters right here

I love how you write—it’s like having a conversation with a good friend. Can’t wait to read more!This post pulled me in from the very first sentence. You have such a unique voice!Seriously, every time I think I’ll just skim through, I end up reading every word. Keep it up!Your posts always leave me thinking… and wanting more. This one was no exception!Such a smooth and engaging read—your writing flows effortlessly. Big fan here!Every time I read your work, I feel like I’m right there with you. Beautifully written!You have a real talent for storytelling. I couldn’t stop reading once I started.The way you express your thoughts is so natural and compelling. I’ll definitely be back for more!Wow—your writing is so vivid and alive. It’s hard not to get hooked!You really know how to connect with your readers. Your words resonate long after I finish reading.