Canada’s housing market

confirmed indicators of life in Might when gross sales rose for the primary time in about six months, main some to hope the long-awaited turnaround had lastly arrived.

However some economists are warning this “breather” will probably be short-lived and the housing downturn will proceed by means of the yr.

“Until a direct deal is reached to take away most

U.S.-Canada tariffs

, we count on the housing hunch will prolong by means of the tip of 2025,” wrote Tony Stillo, director of Canada economics for Oxford Economics and Michael Davenport, senior economist.

The housing market stays weak, they argue. Nationwide gross sales in Might, although up from the month earlier than, have been nonetheless about 16 per cent under the five-year common and the MLS benchmark worth slid decrease for the sixth month in a row, down 3.2 per cent yr over yr.

The

Financial institution of Canada

delivered some critical borrowing aid to Canadians over the previous yr, slicing its benchmark rate of interest from 5 to 2.75 per cent. However the anticipated rally within the housing market by no means materialized as a result of U.S. President

Donald Trump

began a tariff warfare.

Stillo and Davenport stated Trump’s commerce assault threatens to deepen Canada’s housing market downturn as consumers and sellers stay “paralyzed” by uncertainty.

“Poor affordability, weak confidence, and job losses from the recession now possible underway, on prime of headwinds from a shrinking inhabitants, will proceed to weigh on demand,” they stated.

They count on house costs to fall a cumulative 8 to 10 per cent by the tip of the yr as distressed house gross sales rise, pushing up provide.

Whether or not they’re proper or not stays to be seen, however June information from regional actual property boards, now beginning to come out, doesn’t look as upbeat as Might.

Yesterday Calgary, the primary of the boards to report, stated house gross sales dropped 16.5 per cent final month from the yr earlier than as new listings rose. The town’s stock reached 6,941 houses on the market, up 83.2 per cent from final yr.

Early information from digital realtor Wahi.com additionally factors to a “less-than-festive June” for the Better Toronto Space, stated

MortgageLogic.information strategist Robert McLister

.

Gross sales have been down over 12 per cent from final yr, and costs dropped 1.5 per cent from the month earlier than. Whole lively listings have been up virtually 35 per cent from final yr.

Probabilities of extra

mortgage charge aid

reviving the market are additionally dimming.

Oxford Economics expects the Financial institution of Canada to maintain its coverage charge regular at 2.75 per cent for “the foreseeable future,” whereas rising authorities bond yields push up fastened mortgage charges.

It expects the five-year mortgage charge to rise from 5.1 per cent within the second quarter to five.5 per cent by the tip of the yr.

Enroll right here to get Posthaste delivered straight to your inbox.

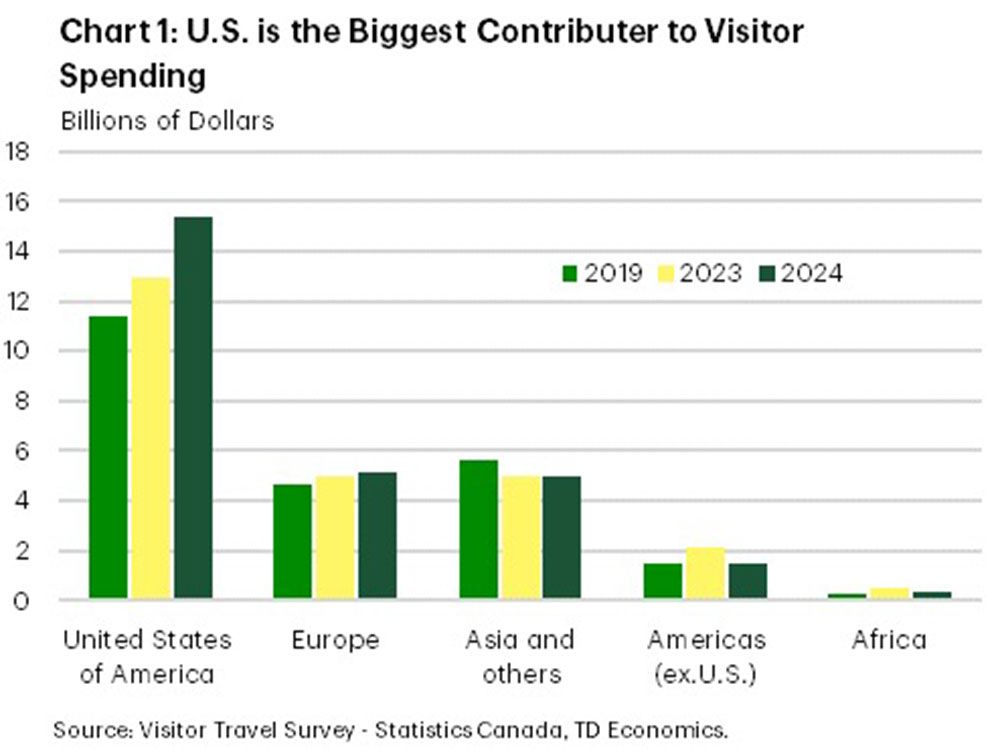

With regards to vacationers in Canada, Individuals prime the charts. U.S. guests accounted for 4 out of 5 non-resident journeys in 2024, spending a file $15 billion, greater than all different nations mixed, says

But their numbers are down this yr as commerce tensions, financial uncertainty and a weak U.S. greenback preserve extra Individuals away. U.S. resident automobile journeys to Canada have been down 8.4 per cent in Might, the fourth month in a row of declines.

TD Economics estimates that U.S. spending in Canada will drop 5 to 10 per cent this yr, a lack of about $1 billion.

Worldwide travellers from different nations are choosing up a few of the slack. Visits from the UK rose by 14 per cent and visits from Mexico have been up by 22 per cent in April. In Might travellers from China elevated 11 per cent from the yr earlier than.

Alberta Premier Danielle Smith flips the primary pancake forward of the beginning of the Calgary Stampede Right now’s Knowledge: Canada worldwide merchandise commerce, United States jobs, commerce steadiness, manufacturing unit and sturdy items orders

The digital companies tax was one other policy-driven tax debacle

Canada’s historic first cargo of LNG units sail for consumers in Asia

Amazon faucets into Canadian patriotism

Is actual property actually the perfect place to park your cash? Mortgage strategist Robert McLister takes a tough have a look at the numbers and reaches some stunning conclusions.

Learn on

Ship us your summer time job search tales

Lately, we printed a function on the

demise of the summer time job

as pupil unemployment reaches disaster ranges. We need to hear straight from Canadians aged 15-24 about their summer time job search.

Ship us your story, in 50-100 phrases, and we’ll publish the perfect submissions in an upcoming version of the Monetary Submit.

You may submit your story by electronic mail to

beneath the topic heading “Summer time job tales.” Please embody your title, your age, town and province the place you reside, and a cellphone quantity to achieve you.

Are you apprehensive about having sufficient for retirement? Do you should alter your portfolio? Are you beginning out or making a change and questioning the right way to construct wealth? Are you making an attempt to make ends meet? Drop us a line at wealth@postmedia.com together with your contact data and the gist of your drawback and we’ll discover some consultants that will help you out whereas writing a Household Finance story about it (we’ll preserve your title out of it, in fact).

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

can assist navigate the advanced sector, from the newest developments to financing alternatives you received’t need to miss. Plus test his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the power sector and extra.

Right now’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? E mail us at

.

Why extra economists assume the Financial institution of Canada is finished slicing rates of interest

Canada is in for a tough couple of quarters, say economists

Bookmark our web site and help our journalism: Don’t miss the enterprise information you should know — add financialpost.com to your bookmarks and join our newsletters right here

I love how you write—it’s like having a conversation with a good friend. Can’t wait to read more!This post pulled me in from the very first sentence. You have such a unique voice!Seriously, every time I think I’ll just skim through, I end up reading every word. Keep it up!Your posts always leave me thinking… and wanting more. This one was no exception!Such a smooth and engaging read—your writing flows effortlessly. Big fan here!Every time I read your work, I feel like I’m right there with you. Beautifully written!You have a real talent for storytelling. I couldn’t stop reading once I started.The way you express your thoughts is so natural and compelling. I’ll definitely be back for more!Wow—your writing is so vivid and alive. It’s hard not to get hooked!You really know how to connect with your readers. Your words resonate long after I finish reading.