Canadians are

creating wealth

at a report tempo, however there’s trigger for concern amid the statistics, say economists.

Monetary belongings rose 0.9 per cent within the first quarter, hitting a report excessive for the sixth quarter in row, stated Moody’s Analytics.

Actual property values

additionally climbed, although at a slower tempo.

General these contributed to boosting

family wealth

by 0.8 per cent to $17.6 trillion.

However different data are being set amid this development that aren’t so optimistic.

Decrease-income teams, the entrance line within the commerce struggle with the USA, are falling behind.

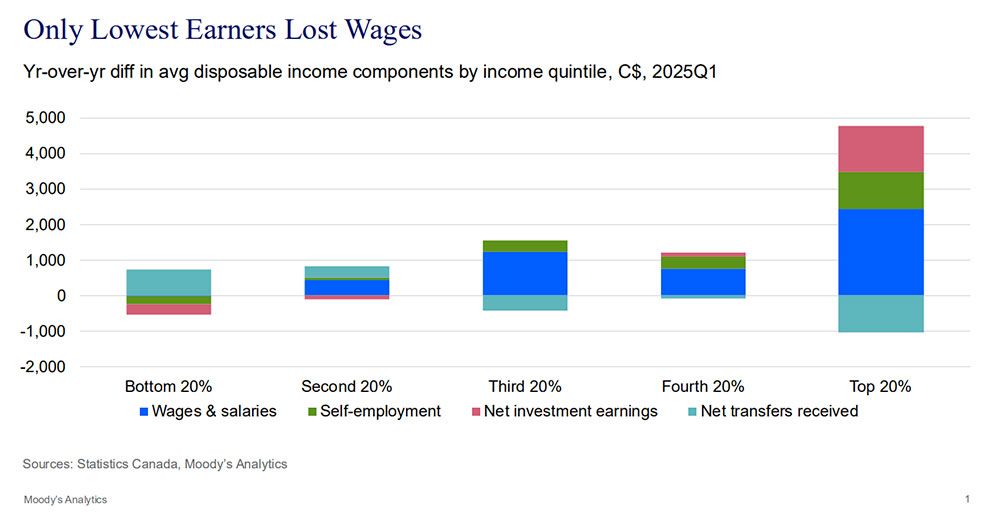

Disposable earnings for the underside 20 per cent of earnings distribution on this nation grew simply 3.2 per cent, about half the common development and the weakest of any group.

Furthermore, the acquire was principally pushed by a 30 per cent rise in internet transfers from authorities assist and decreased taxes, stated Moody’s. Common wages slipped 0.7 per cent and funding earnings declined.

“On the similar time, all different quintiles skilled wage development, and the highest two noticed a bump in internet funding earnings,” stated Moody’s economist Kyra Kendrick.

Decrease-wage jobs in manufacturing and wholesale and retail commerce have been hit hardest by weak financial development and the uncertainty of

Donald Trump’s tariffs

. Latest layoffs have been concentrated in these industries, slicing hours labored and wages.

Canada’s

family financial savings

charge fell for the second quarter in a row and spending overtook good points in disposable earnings. Borrowing slowed however complete debt rose quicker than earnings, pushing the debt-to-income ratio to 173.9 per cent.

“Regardless of the top-line record-breaking good points in family wealth creation, wealth stays concentrated,” stated Moody’s economist Sebastian Mintah.

In line with the newest knowledge from Statistics Canada, the wealthiest 20 per cent of households now maintain 68 per cent of monetary belongings and 51 per cent of actual property.

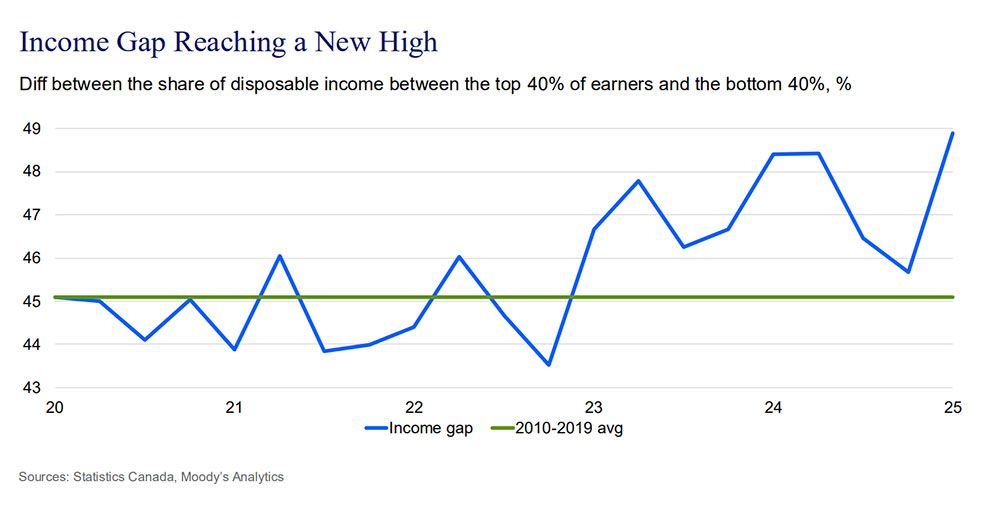

This pushed the earnings hole on this nation to its highest on report within the first quarter. The measure, which is the distinction within the share of disposable earnings between households within the prime 40 per cent and backside 40 per cent of earnings distribution, rose to 49 per cent.

The hole has been widening because the pandemic and is now about 4 per cent increased than the common within the 2010s, stated Moody’s.

“With tariff worries removed from over, extra job losses will hit this weak earnings phase,” stated Kendrick.

“All informed, a serious turnaround within the earnings hole is unlikely quickly.”

Join right here to get Posthaste delivered straight to your inbox.

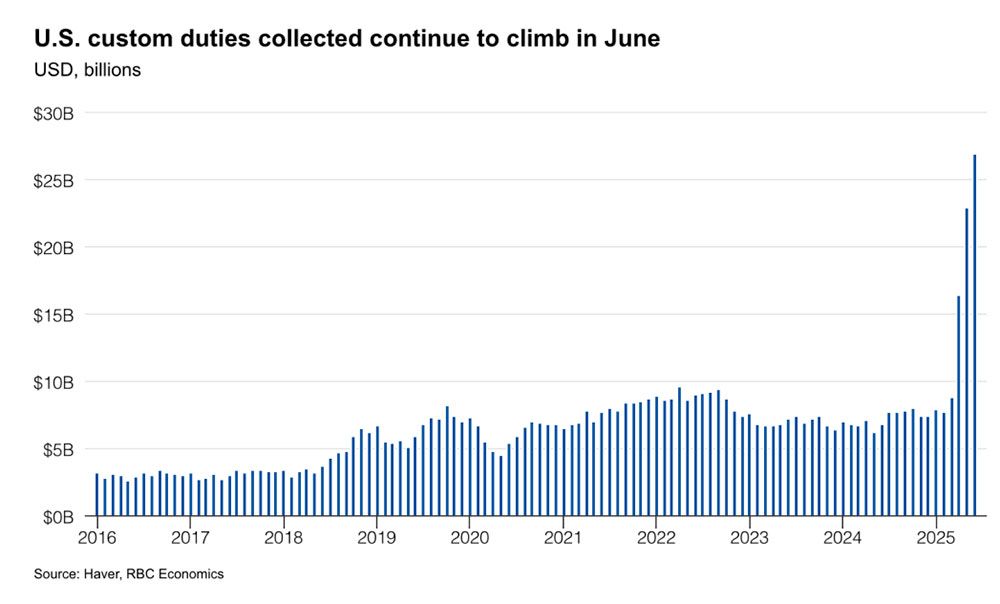

Billions are flowing into United States coffers from Donald Trump’s tariffs.

Income from duties totalled US$90 billion between January and June, although in accordance with

Royal Financial institution of Canada economists

that’s lower than half of the US$188 billion implied by Trump’s tariff bulletins.

U.S. Treasury Secretary Scott Bessent has stated the tariffs are on monitor to tug in US$300 billion, however commerce observers have their doubts.

“Both tariffs are a income, or they’re a method to guard American trade — past the brief time period they will’t be each,” stated Robert Wolfe, a professor emeritus at Queens College. “If imports decline in response (to) the tax, so will revenues.”

Learn extra on Trump’s tariff haul right here

Canada’s premiers meet in Muskoka district, Ont. The Financial institution of Canada releases its second-quarter difficulty of its enterprise outlook survey and Canadian survey of shopper expectations. The experiences come forward of the central financial institution’s rate of interest determination on July 30. In the present day’s Knowledge: Canada industrial merchandise and uncooked supplies value indices Earnings: Rogers Communications Inc., Domino’s Pizza Inc., Verizon Communications Inc.

Donald Trump’s tariffs are pulling in billions, however is it actually a win?

Is it time to lock in that variable mortgage charge?

Howard Levitt: Even essentially the most desultory worker can discover favour with the courts

Regardless of most economists claiming there are cracks forming in our financial system, markets nonetheless assume inflation has enamel. If merchants are proper and economists are incorrect, additional Financial institution of Canada rate of interest cuts might keep shelved for months — possibly skipped completely this cycle.

This prompts a key dilemma for sure variable-rate holders: do you have to lock in now or hold driving the speed waves?

Mortgage strategist Robert McLister presents six causes you would possibly wish to stick to variable and 6 causes you would possibly wish to seize a set charge.

See which possibility most closely fits your scenario.

Ship us your summer time job search tales

Not too long ago, we revealed a function on the

loss of life of the summer time job

as scholar unemployment reaches disaster ranges. We wish to hear straight from Canadians aged 15-24 about their summer time job search.

Ship us your story, in 50-100 phrases, and we’ll publish one of the best submissions in an upcoming version of the Monetary Submit.

You may submit your story by electronic mail to

beneath the topic heading “Summer time job tales.” Please embody your identify, your age, town and province the place you reside, and a telephone quantity to achieve you.

Are you anxious about having sufficient for retirement? Do it is advisable to regulate your portfolio? Are you beginning out or making a change and questioning the right way to construct wealth? Are you attempting to make ends meet? Drop us a line at wealth@postmedia.com together with your contact information and the gist of your drawback and we’ll discover some consultants that can assist you out whereas writing a Household Finance story about it (we’ll hold your identify out of it, after all).

McLister on mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

might help navigate the advanced sector, from the newest developments to financing alternatives you gained’t wish to miss. Plus verify his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the power sector and extra.

In the present day’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Submit employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

Did the Financial institution of Canada minimize charges an excessive amount of and too quick?

Canada’s industrial heartland is bleeding jobs

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it is advisable to know — add financialpost.com to your bookmarks and join our newsletters right here