Breadcrumb Path Hyperlinks

NewsEconomy

Tariff uncertainty to proceed to weigh on financial system and hiring

Printed Apr 04, 2025 • Final up to date 2 days in the past • 4 minute learn

It can save you this text by registering without cost right here. Or sign-in when you have an account.

Canada’s unemployment fee rose to six.7 per cent from 6.6 per cent the month earlier than. Picture by Laura Pedersen/Nationwide Put up

Article content material

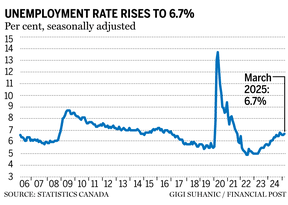

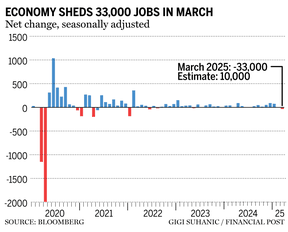

Canada’s financial system misplaced jobs in March for the primary time since January 2022, with the unemployment fee rising to six.7 per cent from 6.6 per cent the month earlier than, Statistics Canada stated Friday.

Article content material

Article content material

The financial system gave up 33,000 positions final month, lacking analysts’ estimates for a achieve of 10,000 jobs. Nonetheless, their unemployment fee prediction was appropriate.

The jobless fee nonetheless sits under its current excessive of 6.9 per cent in November 2024, however Statistics Canada stated the speed has been trending increased since March 2023, when it stood at 5 per cent.

Commercial 2

This commercial has not loaded but, however your article continues under.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to learn the newest information in your metropolis and throughout Canada.

Unique articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, and others.Each day content material from Monetary Instances, the world’s main world enterprise publication.Limitless on-line entry to learn articles from Monetary Put up, Nationwide Put up and 15 information websites throughout Canada with one account.Nationwide Put up ePaper, an digital duplicate of the print version to view on any gadget, share and touch upon.Each day puzzles, together with the New York Instances Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to learn the newest information in your metropolis and throughout Canada.

Unique articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman and others.Each day content material from Monetary Instances, the world’s main world enterprise publication.Limitless on-line entry to learn articles from Monetary Put up, Nationwide Put up and 15 information websites throughout Canada with one account.Nationwide Put up ePaper, an digital duplicate of the print version to view on any gadget, share and touch upon.Each day puzzles, together with the New York Instances Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or register to proceed together with your studying expertise.

Entry articles from throughout Canada with one account.Share your ideas and be a part of the dialog within the feedback.Take pleasure in extra articles per thirty days.Get e mail updates out of your favorite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or register to proceed together with your studying expertise.

Entry articles from throughout Canada with one accountShare your ideas and be a part of the dialog within the commentsEnjoy extra articles per monthGet e mail updates out of your favorite authors

Signal In or Create an Account

or

Article content material

“Since March 2024, the unemployment fee has remained above its pre-COVID-19 pandemic common of six per cent (from 2017 to 2019),” the company stated within the launch, including it’s taking longer for unemployed folks to seek out work.

Right here’s what economists suppose the newest employment information means for the financial system, the Financial institution of Canada and rates of interest.

Full-time jobs hit arduous: Financial institution of Montreal

The March information signalled that “the widespread decline in enterprise (and client) sentiment previously two months performed out in actual selections final month,” Douglas Porter, chief economist at BMO Capital Markets, stated in a be aware on Friday.

Full-time and private-sector positions took the brunt of the hit, with the previous falling by what he known as a “heavy 62,000.”

Porter stated the unemployment fee would have chugged even increased had the participation fee not fallen.

He pointed to the rise in hours labored as one potential vibrant spot, however he interpreted it to imply that employers requested folks to work longer hours slightly than including to their payrolls.

Porter thinks it’s too early to immediately attribute the losses to U.S. tariffs, particularly because the survey was taken previous to metal and aluminum duties coming into impact on March 12.

Prime Tales

Thanks for signing up!

Article content material

Commercial 3

This commercial has not loaded but, however your article continues under.

Article content material

Nonetheless, he does suppose the regional information tells the story of the approaching affect of tariffs, pointing to job losses in Ontario, Quebec and Manitoba. Alberta additionally misplaced positions.

“Finally, we consider that Ontario is most in danger from U.S. protectionism, and its jobless fee rose two ticks to 7.5 per cent,” he stated.

He stated he thinks the Financial institution of Canada will need to see extra information earlier than it implements one other fee minimize.

Policymakers “made it clear” following the rate of interest minimize in March that the one cause they did so was in response to United States President Donald Trump’s tariff threats.

“Falling vitality costs and the top of the carbon tax will assist dampen inflation pressures,” taking some strain off the Financial institution of Canada, Porter stated. Nonetheless, poor employment numbers and slumping inventory markets will “hold prospects of an April fee minimize very a lot alive.”

For now, BMO is asking for the Financial institution of Canada to carry off on additional fee cuts, “however the scenario is, let’s say, fluid.”

Larger jobless fee on the way in which: Capital Economics

“The broad-based weak spot in final month’s Labour Drive Survey doesn’t bode properly for the outlook,” Bradley Saunders, North America economist at Capital Economics Ltd., stated in a be aware, including that idea is supported by surveys exhibiting firm hiring intentions have “sharply” fallen.

Commercial 4

This commercial has not loaded but, however your article continues under.

Article content material

He stated U.S. tariffs performed a job in a few of March’s job losses, attributing the 7,000 drop in manufacturing positions to Trump’s upending of commerce routes and norms, however that’s simply the tip of the iceberg.

“Whereas Canadian exporters could have escaped ‘Liberation Day’ comparatively unscathed, we nonetheless anticipate U.S. tariffs to weigh on GDP progress — and, in flip, hiring — this 12 months,” he stated.

Saunders pointed to carmaker Stellantis NV’s determination to shut its auto plant in Windsor, Ont., for not less than two weeks beginning Monday, which can have an effect on 4,000 positions, as “proof of the uncertainty that U.S. tariffs will pose for Canadian producers going ahead.”

Capital Economics thinks the unemployment fee will rise to seven per cent and that financial weak spot will drive the Financial institution of Canada to chop rates of interest on the upcoming announcement on April 16.

‘Huge fluctuations’: RSM Canada

“Commerce uncertainty is inflicting huge fluctuations in job numbers,” Tu Nguyen, an economist at tax consultancy RSM Canada LLP, stated in a be aware.

Employment in Canada “fluctuated” earlier within the 12 months as employers added positions to get forward of the approaching tariff storm.

Commercial 5

This commercial has not loaded but, however your article continues under.

Article content material

“Nonetheless, now that many tariffs are in place, the pattern within the upcoming months is extra layoffs and unemployment as tariffs trigger widespread financial ache,” she stated.

Nguyen expects this to particularly be the case in trade-dependent sectors akin to wholesale and retail, manufacturing, particularly auto manufacturing, and metal and aluminum, with 25 per cent tariffs now in drive within the automotive and the metal and aluminum sectors.

“Weariness in regards to the macroeconomy and recession fears, together with that of a world recession, will trigger layoffs and delays in hiring throughout sectors,” she stated.

On condition that the extent of the job losses in March was a shock, she stated the Financial institution of Canada may really feel compelled to chop charges by one other 25 foundation factors to 2.5 per cent in April, though Canada missed the reciprocal tariff bullet.

Really helpful from Editorial

Canada’s financial system loses 33,000 jobs

Tariffs may result in 160,000 job losses in second quarter

• Electronic mail: gmvsuhanic@postmedia.com

Bookmark our web site and help our journalism: Don’t miss the enterprise information you could know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material

Share this text in your social community