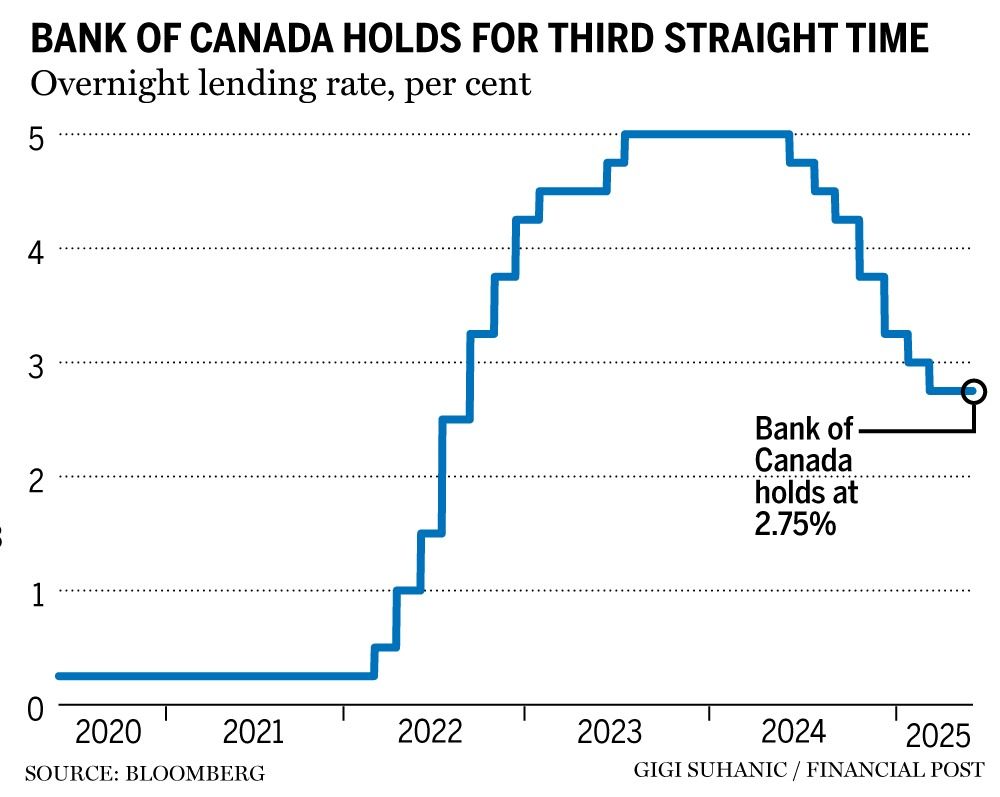

The

Financial institution of Canada

held its

rate of interest

at 2.75 per cent for the third straight time on Wednesday, however left the door open for additional price aid if inflation is contained.

“We’ll proceed to evaluate the timing and energy of each the downward pressures on inflation from a weaker financial system and the upward pressures on inflation from increased prices associated to tariffs and the reconfiguration of commerce,” Financial institution of Canada governor Tiff Macklem mentioned in Ottawa.

“If a weakening financial system places additional downward stress on inflation and the upward worth pressures from commerce disruptions are contained, there could also be a necessity for a discount within the coverage rate of interest.”

Macklem mentioned there have been three causes that led to the choice, together with the continued uncertainty from U.S. commerce coverage, a extra resilient Canadian financial system and proof of

underlying inflation pressures

.

The central financial institution additionally opted to not launch a forecast in its financial coverage report, as an alternative presenting three eventualities, with the primary encompassing the present tariffs in place as of July 27, the second representing a de-escalation in tariffs and a 3rd exhibiting an escalation in U.S. tariff charges.

“As in April, we’ve got determined to not current a traditional forecast for development and inflation,” mentioned Macklem. “I wish to underline that the dearth of typical forecast doesn’t impede our capacity to take financial coverage selections.”

Within the present tariff state of affairs, sectoral tariffs stay in place on autos, metal and aluminum and tariffs on items not compliant underneath the Canada-United-States-Mexico Settlement stay in place. (The Financial institution estimates that 100 per cent of vitality and 95 per cent of all different items are compliant with CUSMA, and thus not topic to tariffs.) The state of affairs takes into consideration the latest offers between the U.S. and the European Union and Japan and Canada’s retaliatory tariffs additionally stay in place on $60 billion price of U.S. items.

Beneath this state of affairs, the central financial institution expects development to contract within the second quarter, earlier than returning to 1 per cent within the third quarter, as exports stabilize and family spending strengthens. Development then picks up in 2026 and reaches 1.8 per cent in 2027.

Within the escalation state of affairs, Canada and Mexico lose their CUSMA exemptions and are topic to a ten per cent baseline tariff. The U.S. additionally imposes a 50 per cent tariff on copper and will increase its weighted common tariff price on international locations from 9 share factors to 23 share factors. Canada escalates its retaliatory tariffs on U.S. items and the China-U.S. commerce struggle worsens.

On this state of affairs, GDP contracts for the rest of 2025, with development choosing up slowly within the first half of 2026. Headline inflation rises to simply above 2.5 per cent by the third quarter of 2026.

Within the de-escalation state of affairs, sectoral tariffs are halved and the tariff price on Canadian items that aren’t CUSMA compliant falls from 25 per cent to 10 per cent. Canada additionally removes its retaliatory tariffs.

On this state of affairs, GDP grows round two per cent for the second half of 2025, and averages 1.7 per cent via the tip of 2027. Inflation stays under the 2 per cent goal till late 2026.

The central financial institution mentioned underlying inflation presently sits at 2.5 per cent, above the headline variety of 1.9 per cent, because of the influence of the removing of the carbon tax. The share of CPI elements rising by greater than three per cent on a year-over-year foundation has elevated and is above its historic common.

“Inflation in costs for items excluding vitality has elevated to 2.2 per cent from about zero within the second half of 2024, above its historic common,” mentioned the report. “This rise is primarily attributed to the pass-through of previous will increase in import prices throughout a broad vary of merchandise, from motor automobiles and furnishings to clothes and low.”

Components that led to this improve embrace the depreciation of the Canadian greenback in opposition to the buck in late 2024, previous development in transport prices and previous will increase in agricultural costs.

Beneath the present state of affairs, the central financial institution additionally expects residential funding to strengthen through the second half of this yr, after it declined by 11 per cent within the first quarter of 2025. It additionally expects sluggish inhabitants and weak enterprise funding will proceed to weigh on potential output development through the second half of this yr.

Learn the Financial institution of Canada’s official assertion

Canada’s counter tariffs might price Canadians $9 billion this yr

Canadian greenback’s rise to be tamed by price cuts, says prime forecaster

• E-mail: jgowling@postmedia.com

Bookmark our web site and help our journalism: Don’t miss the enterprise information you must know — add financialpost.com to your bookmarks and join our newsletters right here.

your blog is fantastic! I’m learning so much from the way you share your thoughts.