Ottawa’s “complete spending overview” will solely yield about half the financial savings wanted to place

federal funds

again on observe, in response to a

report from the Canadian think-tank C.D. Howe Institute.

John Lester in his examine, Federal Expenditure Evaluate: Welcome, However Flawed, estimates that the spending overview launched in July will cowl only a third of federal program spending.

Letters despatched to ministers

by Minister of Finance François-Philippe Champagne aimed to realize a 15 per cent discount in authorities working expenditures by 2028/29, with their solutions anticipated by the tip of this month. However Lester estimates that with exemptions and carveouts, potential financial savings will solely quantity to $22 billion, lower than half the $50 billion wanted to place

federal funds on a “prudent path.”

“The federal authorities’s ‘complete spending overview’ falls in need of its title and goal,” he stated.

Whereas the overview focuses on working expenditures, Lester stated there are “substantial” carve outs. Some are for presidency priorities comparable to applications that assist capital funding and the proposed will increase in defence spending. Lester stated it additionally seems that transfers approved via laws and refundable tax credit shall be exempt.

Most departments have a 15 per cent goal for cuts, however the goal is 2 per cent for the Division of Nationwide Defence, the Canadian Border Providers Company and the RCMP.

“With all these carve outs, spending in 2025/26 topic to the “complete” overview will quantity to $175 billion, which is about two-thirds of working expenditures however just one third of program spending,” he stated.

The quantity of financial savings he estimates the overview will generate are usually not sufficient to forestall an increase within the

debt-to-GDP

ratio over the forecast horizon.

Lester stated its scope must be broadened to incorporate not solely all program spending but additionally applications delivered via the tax system.

The federal government must also abandon its across-the-board method and goal the poorest performers.

“It takes time to establish underperforming applications and to construct political assist for substantial spending reductions,” stated the report.

What Lester recommends is increasing the overview, however imposing a multi-year cap on working prices to ship rapid restraint. Then the federal government can take extra time to establish underperforming applications and construct consensus to alter them.

Join right here to get Posthaste delivered straight to your inbox.

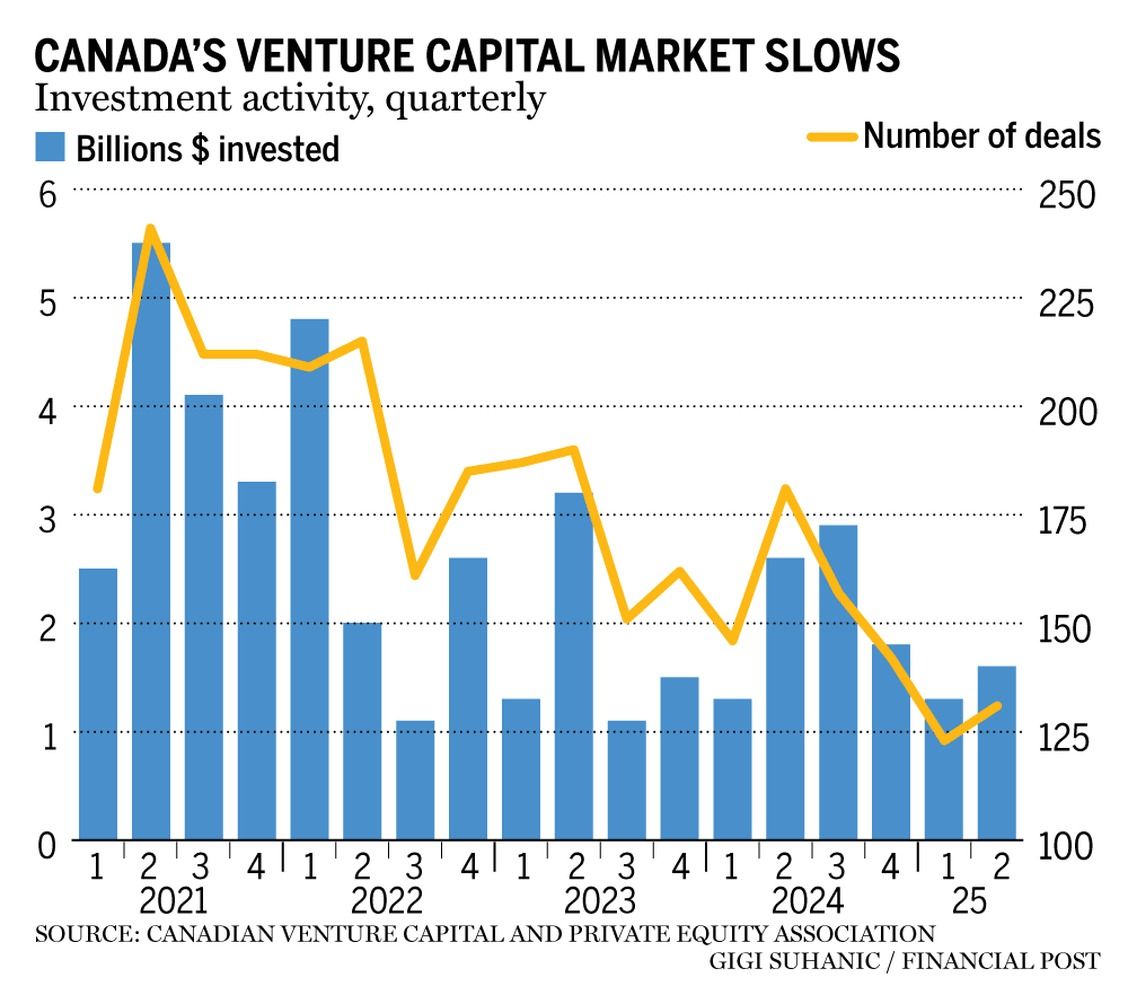

Enterprise capital offers in Canada have slowed to a tempo final seen on the peak of the pandemic, a brand new report by Canadian Enterprise Capital and Personal Fairness Affiliation (CVCA) reveals.

Buyers put $2.9 billion into 254 Canadian VC offers within the first six months of 2025, a 26 per cent drop within the variety of {dollars} invested and 22 per cent decline within the variety of offers.

It provides as much as the bottom first-half complete since 2020.

U.S. buyers are large gamers in Canada’s enterprise capital area, however to date this yr their participation is down 3 per cent from final yr and down 8 per cent from a document excessive reached in 2021.

CVCA director David Kornacki stated international commerce tensions and the same slowdown within the U.S. is behind the stoop.

Learn extra from Yvonne Lau

In the present day’s Knowledge: United States producer value index Earnings: Deere & Co.

Right here’s why it is advisable to negotiate your lease however could have to maneuver for a deal This 24-year-old tech employee sells cardigans and clocks via her aspect hustle, raking in an additional $1,000 every month Divorce worn out her financial savings. At 65, ought to Kate begin drawing CPP?

At 65, Kate is rebuilding her life and funds in a brand new province after a pricey divorce worn out her financial savings. She want to purchase a home, however wonders if that’s out of attain. Household Finance has some solutions on the right way to make that occur, together with drawing Canada Pension Plan now moderately than ready.

Discover out extra

Are you anxious about having sufficient for retirement? Do it is advisable to alter your portfolio? Are you beginning out or making a change and questioning the right way to construct wealth? Are you attempting to make ends meet? Drop us a line at wealth@postmedia.com along with your contact information and the gist of your drawback and we’ll discover some specialists that can assist you out whereas writing a Household Finance story about it (we’ll preserve your title out of it, after all).

McLister on mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

will help navigate the advanced sector, from the newest developments to financing alternatives you received’t wish to miss. Plus examine his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date every day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

for interviews with Canada’s main specialists in enterprise, economics, housing, the power sector and extra.

In the present day’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? E-mail us at

.

Casualties of the tariff conflict are exhibiting up on either side of the border, say economists

‘Merciless summer season’ for Canadian youth may linger for years to return

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it is advisable to know — add financialpost.com to your bookmarks and join our newsletters right here