Foreign money analysts at Scotiabank say it’s potential the

Canadian greenback

might rise to as excessive as 78 cents U.S. towards the buck by the tip of this yr as an alternative of 2026 on a deteriorating outlook for the loonie’s

American counterpart

“We stay a bit extra bullish on the CAD (Canadian greenback) outlook, bearish on the U.S. greenback

than the Road consensus,” Shaun Osborne, chief FX strategist at Scotiabank World FX Technique, mentioned throughout a webinar.

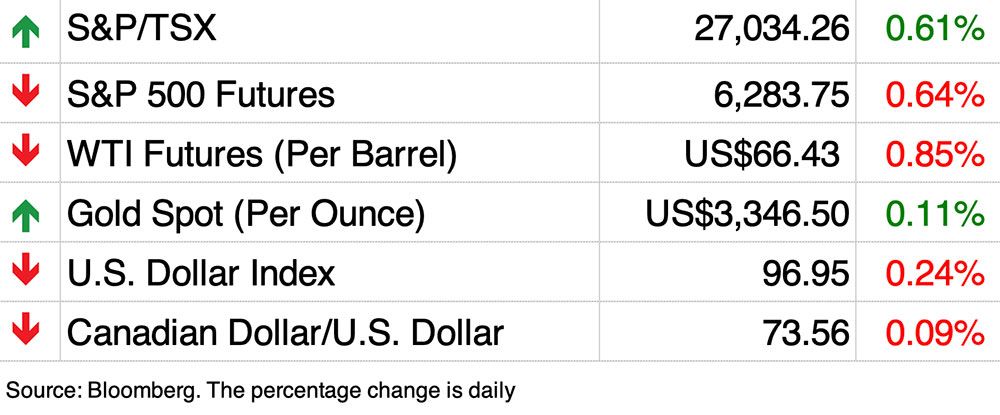

The Canadian greenback has clocked a powerful run over the past six months and is up 6.2 per cent towards the U.S. greenback. Thursday alone, the loonie rose 0.5 per cent to an intraday excessive of 73.76 cents U.S.

Conversely, the U.S. greenback index, which measures the buck’s efficiency towards a basket of different main currencies together with the Canadian greenback, has fallen practically 11 per cent in its worst efficiency over six straight months for the reason that Seventies, and its worst first-half displaying since 2017.

“A six-month run (down) is fairly uncommon,” Osborne mentioned. “It does appear fairly possible that though we’ve seen this important depreciation … prior to now few months. That development could be very more likely to proceed.”

Osborne forecast

to the insurance policies and actions of United States President

Donald Trump,

together with his large tax-cut invoice, which is projected to extend U.S. debt by US$3.3 trillion. The invoice handed its closing legislative take a look at on Thursday and was

due

to be signed into regulation by Trump by his July 4 deadline.

“It appears fairly possible that we are going to see persistent deficits within the U.S. Over time we’ve seen a fairly sturdy relationship between the state of affairs on the deficit facet and the evolution

of the U.S. greenback,” he mentioned.

Osborne additionally mentioned the “potential erosion of Fed (U.S.

Federal Reserve

) independence is one other fear for traders at a time the place inflationary pressures nonetheless appear to be simmering,” which is one other headwind for the U.S. greenback’s efficiency.

On Wednesday, Trump mentioned in a Reality Social publish that Federal Reserve chair

Jerome Powell

was “too late” and “ought to resign instantly.”

The U.S. greenback might decline additional if Trump decides to call a “shadow” chair who’s amenable to the president’s requires decrease rates of interest.

“Given the distinctive returns from the U.S. economic system and property over the past 10 to fifteen years, we predict we’re ready the place world traders have turn out to be over-indexed to U.S. greenback property and they’re questioning if that state of affairs is sensible and whether or not it ought to proceed,” Osborne mentioned.

There have been indicators in April that traders have been pondering precisely

that when the most important web outflow from U.S. Treasuries by Canadian traders ($57.8 billion) was recorded

—

additionally unhealthy information for the buck, however a particular enhance to the loonie.

On the plus facet for the Canadian greenback, a TD Securities report from final week mentioned if Canadian pension funds determine to repatriate U.S. investments to hedge towards buck losses, that circulate of cash again into Canada might present a big carry.

TD Securities is at present calling for the Canadian greenback to rise 76 cents U.S. by December.

Added Karl Schamotta, chief market strategist at Corpay Foreign money Analysis: “So long as the slow-motion flight from the greenback continues, the loonie stands to profit.”

Enroll right here to get Posthaste delivered straight to your inbox.

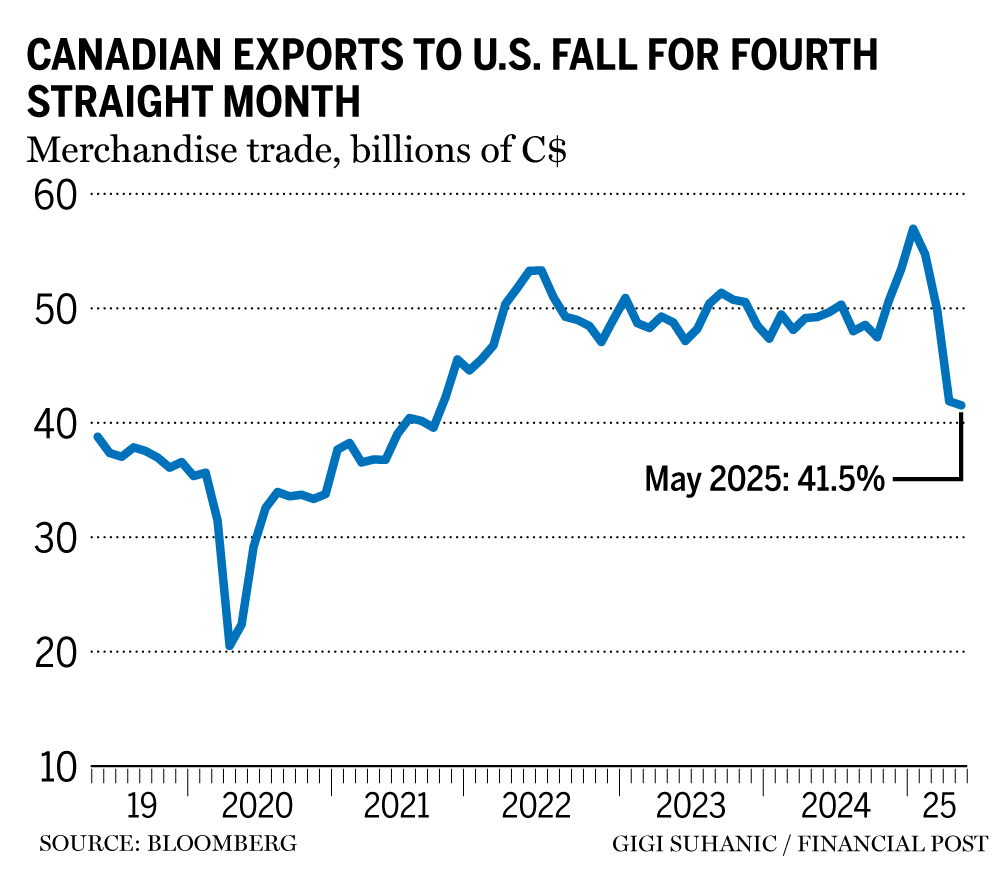

Canada’s share of exports destined for the US shrank to the smallest proportion since at the least 1997, excluding the COVID pandemic. Shipments to different nations reached a brand new excessive, led by gold exports.

Tariffs crushing exports and imports between Canada and its greatest buying and selling companion, exports to different nations helped slim the nation’s commerce deficit to $5.9 billion in Might, from a report $7.6 billion in April, in line with Statistics Canada information on Thursday. — Bloomberg

Learn the total story right here.

U.S. markets are closed for the July 4 vacation. Right this moment’s Knowledge: S&P World Canada companies and composite buying managers indexes

Corporations caught in digital companies tax crossfire as CRA received’t situation refunds How does Canada’s burgeoning LNG business measure as much as its ambitions? What’s the destiny of Canada’s oil and gasoline as new period of nation-building dawns

Markets simply preserve chugging alongside regardless of a bunch of obvious headwinds. Many traders fear about new highs, pondering the tip is nigh however FP columnist Peter Hodson sees market data extra as a affirmation of power slightly than a cause to promote. He explains why

right here

.

Ship us your summer time job search tales

Monetary Submit printed a function on the

loss of life of the summer time job

as pupil unemployment reaches disaster ranges. We wish to hear immediately from Canadians aged 15-24 about their summer time job search.

Ship us your story, in 50-100 phrases, and we’ll publish one of the best submissions in an upcoming version of FP.

You’ll be able to submit your story by e-mail to

below the topic heading “Summer season job tales.” Please embody your identify, your age, the town and province the place you reside, and a telephone quantity to succeed in you.

Are you nervous about having sufficient for retirement? Do you want to modify your portfolio? Are you beginning out or making a change and questioning learn how to construct wealth? Are you attempting to make ends meet? Drop us a line at

along with your contact information and the gist of your drawback and we’ll discover some consultants that will help you out whereas writing a Household Finance story about it (we’ll preserve your identify out of it, after all).

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

might help navigate the complicated sector, from the most recent tendencies to financing alternatives you received’t wish to miss. Plus verify his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

Right this moment’s Posthaste was written by SUHANIC GIGH with further reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E mail us at

.

Posthaste: Canada residence costs seen falling additional as tariff battle deepens downturn

Posthaste: Canada is in for a tough couple of quarters, say economists

Bookmark our web site and help our journalism: Don’t miss the enterprise information you want to know — add financialpost.com to your bookmarks and join our newsletters right here