Canadians are nonetheless including to their financial savings accounts regardless of market and financial volatility, however they’re additionally making changes to their saving habits on the identical time.

Divesting United States equities, rising contributions and discussing financial savings methods with knowledgeable are among the many changes Canadians have made this yr to maintain their financial savings accounts rising, based on

Solar Life Monetary Inc. clients.

Canadians pulled cash out of the U.S. inventory market in the course of the first quarter at a price not seen for the reason that COVID-19 pandemic. However, total, common contributions to financial savings amounted to $9,500 a yr, which is up six per cent from 2022.

“The ‘Purchase Canadian’ sentiment that gained reputation earlier this yr can also be having an affect on how individuals are investing their cash,” Dave Jones, senior vice-president of Group Retirement Companies at Solar Life, stated in a launch.

“Whereas some are adjusting their funds, it’s encouraging to see that they aren’t reactively pulling their cash out of the market. Some purchasers are shifting their property from U.S. equities into extra conservative choices. They’re engaged and taking their monetary future critically whereas navigating via turbulence.”

Canadian buyers are additionally taking an even bigger take a look at goal date funds (TDFs), that are particularly designed for retirement and alter asset allocation as retirement approaches. These plans sometimes deal with the extra unstable inventory market originally and slowly shift to a extra conservative bond technique over time.

The report stated 42 per cent of Solar Life plan member balances are tied to TDFs, up from 29 per cent in 2018. TDFs have additionally outperformed non-target date funds in eight of the previous 10 years.

Most Canadians worry they may run out of cash in retirement, based on the C.D. Howe Institute, which stated that is partly because of having a number of financial savings accounts throughout monetary establishments, leaving them not sure of precisely how a lot cash they’ve saved away and the way far more they should retire.

C.D. Howe senior fellow Kathryn Bush stated Canada must implement a government-owned pension dashboard that lays out all financial savings throughout suppliers, much like these in Sweden, Denmark and the Netherlands.

“How can Canadians make optimum choices in the event that they don’t have a simple strategy to see how financial savings and entitlements translate into month-to-month revenue?”

“We want a contemporary and accessible device that provides them an correct image of their anticipated retirement revenue — with no need to be an knowledgeable.”

Solar Life can be urging Canadians to benefit from office financial savings plans since members sometimes retire two years sooner than non-members.

It additionally suggested Canadians to create a personalised monetary plan to fulfill their wants and to talk with a monetary skilled for recommendation.

Enroll right here to get Posthaste delivered straight to your inbox.

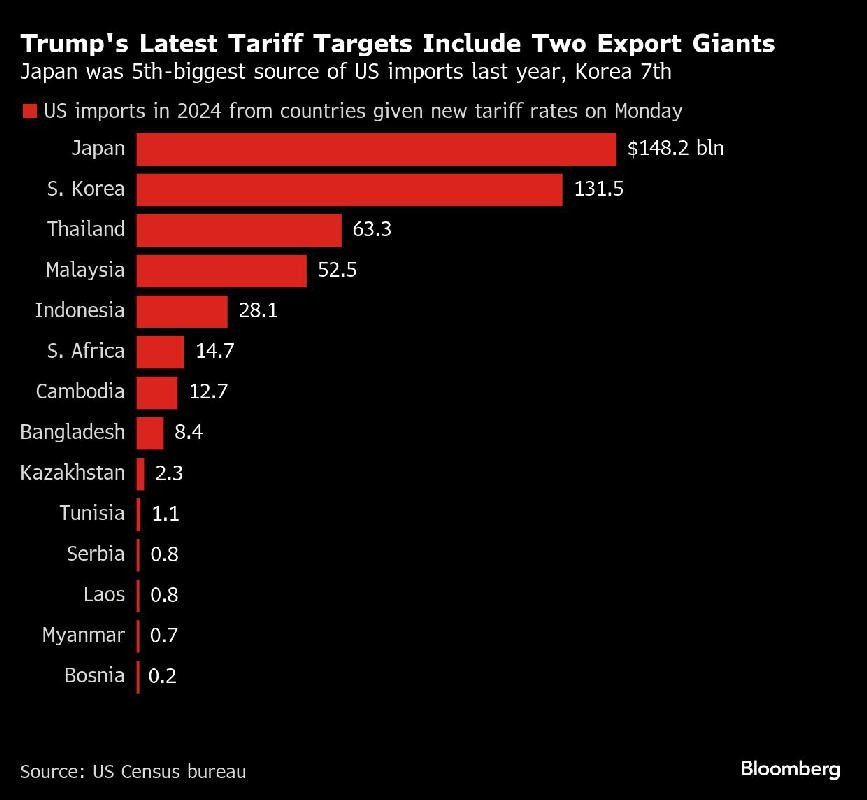

United States President Donald Trump says he won’t concern one other extension on reciprocal tariffs past Aug. 1.

In a submit on his social media platform Trump wrote that “all cash will probably be due and payable beginning AUGUST 1, 2025 – No extensions will probably be granted.”

Trump had beforehand deliberate a deadline for offers this week, however is giving nations one other three weeks to return to the negotiating desk.

Trump beforehand instructed reporters the Aug. 1 deadline was “not 100 per cent agency.”

Learn extra right here.

Minutes from the Federal Open Market Committee’s June rate of interest choice. It was a maintain As we speak’s Knowledge: U.S. wholesale commerce for Might

The place do issues stand on Trump’s international tariffs and the way does Canada slot in? The quantity of wealth leaving Canada could be eye-opening for a lot of Canadians Rents are falling in Calgary, Toronto, Vancouver and Halifax as provide swells, says CMHC Indicators that shares are overheating a warning for budding small-cap rally

Should you’re apprehensive that market turmoil and geopolitics might affect your monetary planning, it might be time to hunt recommendation from a licensed skilled, writes Allan Norman of Aligned Capital Companions Inc. Whether or not you’re in stage of reviewing life objectives or trying to put a worth on property, knowledgeable might help set you on the fitting path.

Learn extra right here.

Are you apprehensive about having sufficient for retirement? Do you might want to alter your portfolio? Are you beginning out or making a change and questioning the right way to construct wealth? Are you attempting to make ends meet? Drop us a line at

along with your contact data and the gist of your downside and we’ll discover some specialists that can assist you out whereas writing a Household Finance story about it (we’ll hold your title out of it, after all).

McLister on mortgages

Need to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

might help navigate the advanced sector, from the most recent traits to financing alternatives you gained’t need to miss. Plus test his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

As we speak’s Posthaste was written by Ben Cousins with extra reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E mail us at

.

5 Canadian cities the place you can also make much less and nonetheless purchase a house

Prepared for summer season journey? Your guidelines might have some holes

Bookmark our web site and help our journalism: Don’t miss the enterprise information you might want to know — add financialpost.com to your bookmarks and join our newsletters right here

I love how you write—it’s like having a conversation with a good friend. Can’t wait to read more!This post pulled me in from the very first sentence. You have such a unique voice!Seriously, every time I think I’ll just skim through, I end up reading every word. Keep it up!Your posts always leave me thinking… and wanting more. This one was no exception!Such a smooth and engaging read—your writing flows effortlessly. Big fan here!Every time I read your work, I feel like I’m right there with you. Beautifully written!You have a real talent for storytelling. I couldn’t stop reading once I started.The way you express your thoughts is so natural and compelling. I’ll definitely be back for more!Wow—your writing is so vivid and alive. It’s hard not to get hooked!You really know how to connect with your readers. Your words resonate long after I finish reading.