Canadians are at the hours of darkness about Ottawa’s funds as they anticipate the funds to be unveiled within the fall, however economists say they need to most likely brace for a

greater deficit

than has been projected.

How a lot greater? Fairly a bit, in response to BMO Capital Markets.

“Suffice it to say that each the Parliamentary Finances Officer’s March baseline ($46.8 billion deficit) and the Liberal platform ($62.3 billion) are seemingly underestimating the dimensions of the FY25/26 shortfall,” mentioned Robert Kavcic, senior economist with BMO Capital Markets

Lots has modified since Prime Minister

Mark Carney

gained the election, and BMO now estimates the federal deficit may climb in the direction of $80 billion or about 2.5 per cent of GDP.

First there are the knowns. Measures within the Liberal platform to supply aid to Canadians are already coming into play, such because the July 1 private revenue tax lower, cancellation of the

capital good points inclusion fee hike

and

GST aid

for some new dwelling patrons.

Then there are the unknowns. The sudden cancellation of Canada’s

digital companies tax

after U.S. President Donald Trump broke off commerce talks will value the federal government about $7 billion in misplaced income, BMO estimates.

Defence is one other “main shift.” The rise in defence spending to 2 per cent of GDP this fiscal yr and 5 per cent by 2035 means $8 billion extra in incremental spending within the 2025/26 fiscal yr, mentioned Kavcic.

The de-escalation of the commerce warfare with the U.S. and risk of a deal is nice information and means the federal authorities can seemingly trim the $3 billion it had earmarked for direct help to these affected by tariffs.

On the flip aspect, the $20 billion Ottawa put down as

retaliatory tariff income

may even seemingly fall quick.

“Given the pause in some measures, and a looming commerce deal more likely to cut back some others, that determine may are available in $10-to-$15 billion decrease,” mentioned Kavcic.

Through the election marketing campaign, Carney mentioned he would gradual development in authorities spending to about 2 per cent yearly, down from 9 per cent below Justin Trudeau. And there are already indicators the federal government is engaged on it.

Finance Minister Francois-Philippe Champagne reportedly despatched a letter to cupboard members this week urging them to search out methods to chop program spending by 7.5 per cent for the 2026-27 fiscal yr, which begins subsequent April.

Kavcic mentioned authorities program spending climbed steadily below Trudeau to about 16 per cent of GDP by 2024/25. Earlier than that, it was comparatively secure at about 13 per cent of GDP.

“Now, it’s unlikely we’re going to see spending retrench again to these ranges, as cuts will extra seemingly be back-filled with up to date coverage priorities,” he mentioned.

But when an $80-billion deficit makes your eyes water, the economist provides some context which may assist.

“Whereas a wave of purple ink is rolling over Canada’s funds, it nonetheless pales compared to the tsunami south of the border,” he mentioned.

Trump’s One Large Lovely invoice is about to lift the U.S. deficit above $2 trillion subsequent yr, greater than 6 per cent of GDP.

There’s additionally purpose to hope that the pro-growth insurance policies behind Canada’s deficit — tax aid and infrastructure spending — will increase the economic system and have longer-term payoffs, he mentioned.

Enroll right here to get Posthaste delivered straight to your inbox.

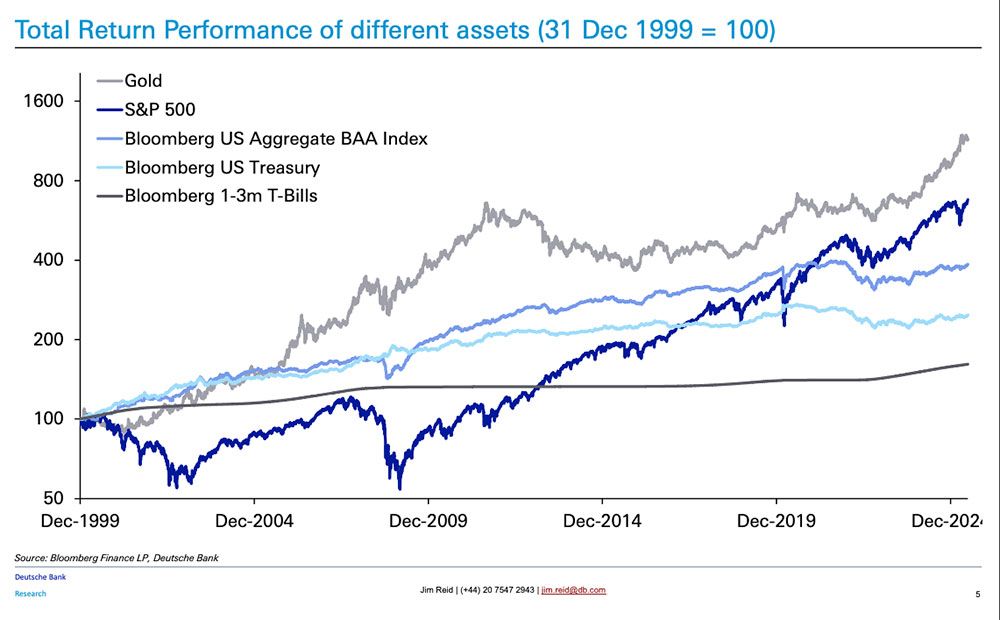

Gold wins the “standout performer”

of the twenty first century, returning greater than 11 instances its worth from the tip of 1999, says Deutsche Financial institution Analysis. That’s in comparison with 6.8 instances for the S&P 500. The yellow steel additionally had its strongest first half of the yr since 1980.

The Canada Mortgage and Housing Company will present an replace on rental market situations in Vancouver, Edmonton, Calgary, Toronto, Ottawa, Montreal, and Halifax At this time’s Information: United States client credit score, NFIB small enterprise optimism

Carney authorities’s nation-building initiatives record anticipated to attract from these 5 areas, says supply How the commerce warfare is popping right into a tourism win for Canada

Amazon and Walmart go head-to-head in on-line low cost battle

It’s a troublesome time to be a 60/40 investor. The mannequin, as soon as a dependable framework for conservative traders, has struggled to offer the draw back safety it traditionally supplied, writes investing professional Martin Pelletier. Bonds have did not hedge fairness threat and volatility has grow to be extra frequent and extra emotionally charged. That’s why goal-based investing works in unsure instances, says Pelletier.

Discover out extra

Ship us your summer time job search tales

Lately, we printed a characteristic on the

loss of life of the summer time job

as scholar unemployment reaches disaster ranges. We wish to hear instantly from Canadians aged 15-24 about their summer time job search.

Ship us your story, in 50-100 phrases, and we’ll publish the perfect submissions in an upcoming version of the Monetary Submit.

You possibly can submit your story by e-mail to

below the topic heading “Summer season job tales.” Please embody your identify, your age, town and province the place you reside, and a telephone quantity to succeed in you.

Are you frightened about having sufficient for retirement? Do it’s essential modify your portfolio? Are you beginning out or making a change and questioning easy methods to construct wealth? Are you making an attempt to make ends meet? Drop us a line at wealth@postmedia.com together with your contact information and the gist of your downside and we’ll discover some specialists that can assist you out whereas writing a Household Finance story about it (we’ll hold your identify out of it, after all).

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

might help navigate the advanced sector, from the newest developments to financing alternatives you gained’t wish to miss. Plus test his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

for interviews with Canada’s main specialists in enterprise, economics, housing, the power sector and extra.

At this time’s Posthaste was written by Pamela Heaven with further reporting from Monetary Submit employees, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? Electronic mail us at

.

Listed here are 5 Canadian cities the place you may make much less and nonetheless purchase a house

Prepared for summer time journey? Your guidelines might have some holes

Bookmark our web site and help our journalism: Don’t miss the enterprise information it’s essential know — add financialpost.com to your bookmarks and join our newsletters right here