The Financial institution of Canada paused rate of interest cuts in April to get a greater of concept of the place Donald Trump’s tariffs and the economic system had been headed.

A month and a bit on and it’s questionable whether or not that outlook is any clearer.

Final week the U.S. Courtroom of Worldwide Commerce dominated in opposition to the tariffs Trump invoked beneath Worldwide Financial Emergency Powers Act, although that call has been placed on maintain by an appeals courtroom.

Then on Friday Trump mentioned he would double tariffs on metal and aluminum, of which Canada is a serious provider, to 50 per cent to assist shield American employees.

Lots is unclear then on the commerce entrance, however alerts from the economic system have been virtually as murky.

One of many key arguments for a pause when the Financial institution of Canada decides on charges this Wednesday is that core inflation information final month got here in hotter than anticipated.

Nonetheless, that acceleration was extra benign than it appeared, mentioned Jimmy Jean, chief economist for Desjardins Group, coming from a small set of elements, similar to rents and airfare, which might be usually risky.

Items affected by retaliatory tariffs from Canada additionally helped hike costs, however there may be cause for “cautious optimism” on this entrance, he mentioned. To this point Ottawa has put tariffs on about $60 billion price of U.S. items, although a portion of those have been placed on pause.

“Whereas future commerce coverage choices affecting Canada stay laborious to foretell, the tone between Ottawa and Washington has grown extra conciliatory in latest weeks,” mentioned Jean. “The authorized obstacles that Trump’s commerce coverage encountered this week may maybe additionally assist pave the best way for a deal.”

It’s subsequently trying much less seemingly that Canada will go forward with tariffs on the complete $185 billion checklist of products, he mentioned. Furthermore, a stronger Canadian greenback, decrease oil costs and the scrapping of the carbon tax will assist ease worth pressures.

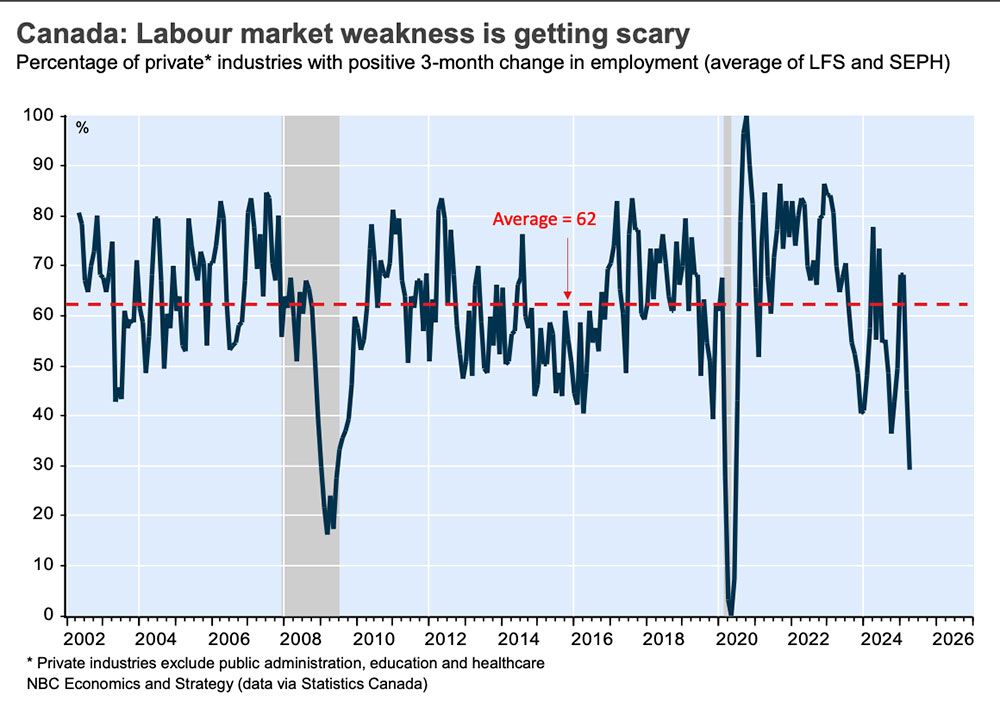

The labour market might be a greater information to the place the economic system goes and right here issues aren’t trying so good, mentioned Stephen Brown, deputy chief North America economist for Capital Economics.

April narrowly prevented one other decline in employment, solely due to jobs associated to the federal election. The personal sector misplaced 78,000 positions in three months and is predicted to lose extra.

David Rosenberg, president of Rosenberg Analysis & Associates Inc, mentioned in a latest column that with the unemployed swelling 14 per cent over the previous yr weak, labour information present the necessity for extra price aid in Canada.

“There can actually be little doubt that the Canadian economic system has entered a recession, and the Financial institution of Canada can be properly suggested to maneuver out of the dugout and onto the baseball area,” he mentioned.

But the markets are solely placing a 20 per cent likelihood on one other reduce this Wednesday.

Economists with Royal Financial institution of Canada, who predict a maintain, mentioned the information hasn’t been all unhealthy for the reason that central financial institution’s final determination.

RBC’s personal cardholder monitoring exhibits client spending held up higher than anticipated in March and April and job postings on Certainly.com sign that hiring demand could also be stabilizing.

The Financial institution of Canada has reduce greater than different central financial institution in a developed nation and if the economic system weakens it nonetheless has room to scale back the speed additional, mentioned RBC economists Nathan Janzen and Abbey Xu. But it surely additionally should take into account the influence of presidency help, which is a simpler device to supply focused help for sectors hit by the tariff struggle.

Join right here to get Posthaste delivered straight to your inbox.

Job loss within the personal sector is now at ranges that previously have solely been seen in recessions, says

Nationwide Financial institution of Canada.

Knowledge from the Survey of Employment, Payrolls and Hours confirmed that employment fell for the third month in a row in March, racking up a cumulative web lack of 78,000 jobs.

Each that indicator and Statistic Canada’s Labour Pressure Survey present that 71 per cent of personal sectors have contracted over the previous three months, mentioned Nationwide economists.

Native actual property boards will launch the most recent information on dwelling gross sales and costs of their areas for Could this week, beginning with Calgary at present, Vancouver on Tuesday and Toronto on Wednesday. Right now’s Knowledge: United States ISM manufacturing, building spending Earnings: The Campbell’s Firm

Overlook the commerce struggle, the fish are biting in Canada Ought to Moira handle her $400,000 RRSP investments on her personal? Assume the problem of office vaccine mandates is long-settled? Not fairly, say courts

Moira, now 55, plans to retire at 60. She has $500,000 in RRSPs, two-thirds of it in a completely managed account with a serious brokerage. For a mean of six per cent returns up to now seven years, she is paying 1.94 per cent, which is greater than $600 a month.

She manages $100,000 of that on her personal and wonders if she ought to get a self-managed account and put all of it in a balanced fund with low charges, or exchange-traded funds (ETFs).

Discover out what FP Solutions recommends.

Are you apprehensive about having sufficient for retirement? Do it’s essential modify your portfolio? Are you beginning out or making a change and questioning methods to construct wealth? Are you making an attempt to make ends meet? Drop us a line at wealth@postmedia.com along with your contact data and the gist of your downside and we’ll discover some specialists that will help you out whereas writing a Household Finance story about it (we’ll hold your title out of it, in fact).

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

will help navigate the advanced sector, from the most recent tendencies to financing alternatives you received’t wish to miss. Plus examine his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

Right now’s Posthaste was written by Pamela Heaven with further reporting from Monetary Submit employees, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this article? E-mail us at

.

What the tariff ruling that shook the world means to Canada

‘The concern is actual,’ says TD, predicting 100,000 jobs might be misplaced in looming recession

Bookmark our web site and help our journalism: Don’t miss the enterprise information it’s essential know — add financialpost.com to your bookmarks and join our newsletters right here

I love how you write—it’s like having a conversation with a good friend. Can’t wait to read more!This post pulled me in from the very first sentence. You have such a unique voice!Seriously, every time I think I’ll just skim through, I end up reading every word. Keep it up!Your posts always leave me thinking… and wanting more. This one was no exception!Such a smooth and engaging read—your writing flows effortlessly. Big fan here!Every time I read your work, I feel like I’m right there with you. Beautifully written!You have a real talent for storytelling. I couldn’t stop reading once I started.The way you express your thoughts is so natural and compelling. I’ll definitely be back for more!Wow—your writing is so vivid and alive. It’s hard not to get hooked!You really know how to connect with your readers. Your words resonate long after I finish reading.