Canadian meals producers and distributors are frantically renegotiating longstanding contracts and making an attempt to broaden their footprint internationally to fight steep United States tariffs, in accordance with

a current report by Richter LLP

.

Canadian exporters face a blanket 25 per cent tariff from the U.S., although many exports are exempt in the event that they adjust to the Canada-U.S.-Mexico Settlement.

To make issues worse, U.S. President Donald Trump has threatened to hike the tariffs to 35 per cent on Aug. 1.

“Tariff disruption is now not a short lived hurdle; it’s a defining function of the North American commerce atmosphere,” the report mentioned. “Firms that fail to evolve will stay uncovered.”

Canada’s meals business already closely depends on U.S. commerce, with greater than 60 per cent of its agri-food exports heading south,

in accordance with the Canadian Federation of Agriculture (CFA)

.

“With protectionist sentiments on the rise, our cross-border provide chains face critical dangers,” the CFA mentioned on its web site. “Now, greater than ever, dialogue, advocacy and collaboration are important to make sure our agricultural sectors stay sturdy and mutually useful.”

To guard themselves, meals producers have renegotiated offers with longtime suppliers, added clauses into their contracts and have checked out exporting their merchandise to Asia, Mexico or Europe.

“There’s now a shift from transactional buying to extra strategic, risk-aware procurement,” the Richter report mentioned. “Some firms have efficiently negotiated volume-based reductions or revised cost phrases with suppliers, counting on scale or long-term partnership potential to scale back publicity to tariff-driven value fluctuations.”

The measures have had various ranges of success, nonetheless, as a result of many meals suppliers have important pricing energy, the report mentioned, leaving some producers with no alternative however to just accept the prices.

Regardless of the measures meant to mitigate tariffs, a variety of the associated fee will increase are nonetheless handed right down to the patron.

“To handle rising enter prices, many meals operators have applied selective value will increase, the report mentioned. “Nonetheless, buyer resistance, notably in value-driven segments, continues to restrict how a lot of these will increase might be handed by way of.”

As meals prices climb, producers are contemplating totally different value fashions to maintain prices down, together with bundling gadgets collectively as demand for higher-end merchandise slows.

Richter recommends meals producers diversify their provides, get inventive to bypass tariffs, use analytics to forecast tariff situations and cut back their reliance on the U.S. market by wanting elsewhere.

Join right here to get Posthaste delivered straight to your inbox.

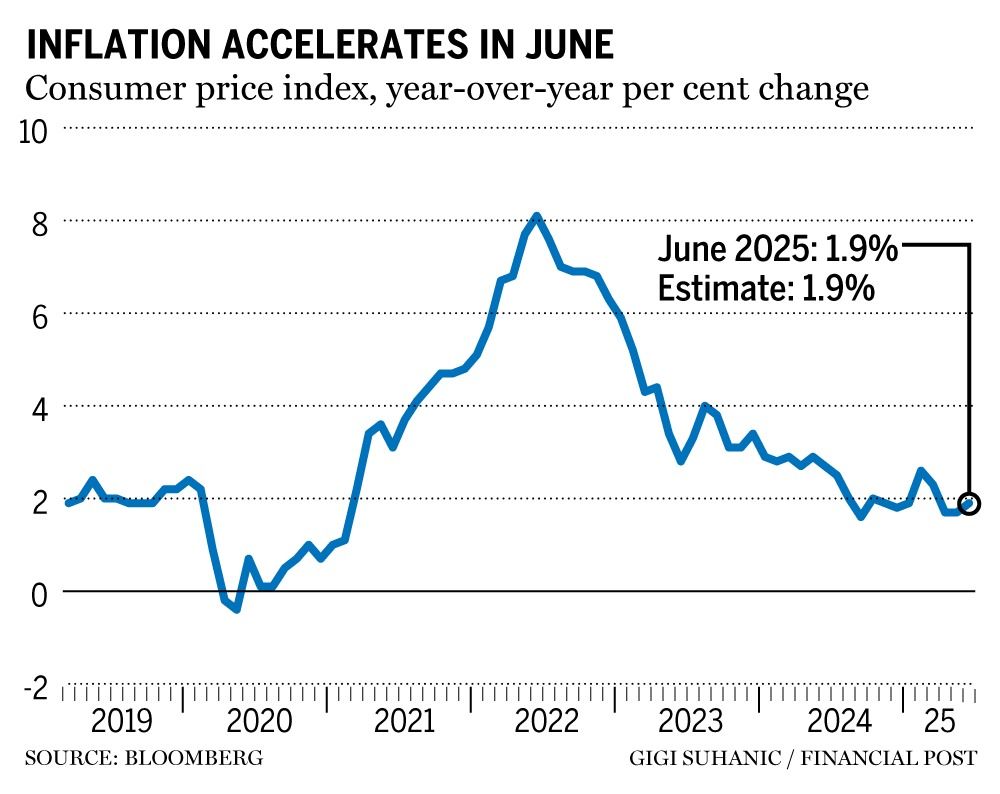

Canada’s inflation price climbed to 1.9 per cent in June, up from 1.7 per cent in Might.

Costs climbed in seven of the most important classes inside the index, whereas fuel costs fell at a slower price in comparison with Might, which helped prop the inflation figures increased.

With out power, inflation rose to 2.7 per cent.

Economist say the inflation numbers all however finish hypothesis of one other rate of interest minimize later this month.

Learn extra right here.

Prime Minister Mark Carney will make an announcement on the metal business whereas touring a Hamilton, Ont., metal plant this morning. G20 finance ministers and central financial institution governors assembly in South Africa continues Immediately’s Information: U.S. producer value index for June Earnings: Johnson & Johnson, Financial institution of America Corp., Morgan Stanley, Goldman Sachs Group Inc., Kinder Morgan Inc., United Airways Holdings Inc.

Canada’s inflation price heats up in June Newest inflation numbers slam door ‘shut’ on Financial institution of Canada July price minimize, say economists CRA retains messing up regardless of an elevated headcount and greater funds ‘I don’t suppose we’re bouncing again’: Struggling Toronto housing market may stay fragile by way of 2025, realtors say

Landlords can typically declare tax deductions on a rental unit within the occasion of losses from the property, amounting to as much as 54 per cent relying on the province, however the property have to be rented with the aim of creating wealth. Not too long ago, one landlord was denied tax deductions after rental to their mom at a severely discounted price, with the decide noting that the property couldn’t have been a enterprise at that price and was as an alternative a private enterprise.

Learn extra right here.

Ship us your summer time job search tales

Not too long ago, we revealed a function on the

demise of the summer time job

as pupil unemployment reaches disaster ranges. We wish to hear immediately from Canadians aged 15-24 about their summer time job search.

Ship us your story, in 50-100 phrases, and we’ll publish the perfect submissions in an upcoming version of the Monetary Publish.

You’ll be able to submit your story by electronic mail to

underneath the topic heading “Summer time job tales.” Please embrace your title, your age, town and province the place you reside, and a cellphone quantity to succeed in you.

Are you apprehensive about having sufficient for retirement? Do you might want to regulate your portfolio? Are you beginning out or making a change and questioning learn how to construct wealth? Are you making an attempt to make ends meet? Drop us a line at wealth@postmedia.com along with your contact information and the gist of your drawback and we’ll discover some specialists that can assist you out whereas writing a Household Finance story about it (we’ll preserve your title out of it, after all).

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Publish column

may also help navigate the complicated sector, from the most recent developments to financing alternatives you received’t wish to miss. Plus verify his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

for interviews with Canada’s main specialists in enterprise, economics, housing, the power sector and extra.

Immediately’s Posthaste was written by Ben Cousins with further reporting from Monetary Publish workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this article? E-mail us at

.

Canadians are nonetheless saving, however habits are shifting amid market turmoil

Listed below are 5 Canadian cities the place you may make much less and nonetheless purchase a house

Bookmark our web site and help our journalism: Don’t miss the enterprise information you might want to know — add financialpost.com to your bookmarks and join our newsletters right here