All of Canada is predicted to battle this yr amid the

uncertainty of the tariff battle

, however for some provinces that battle might be worse than for others.

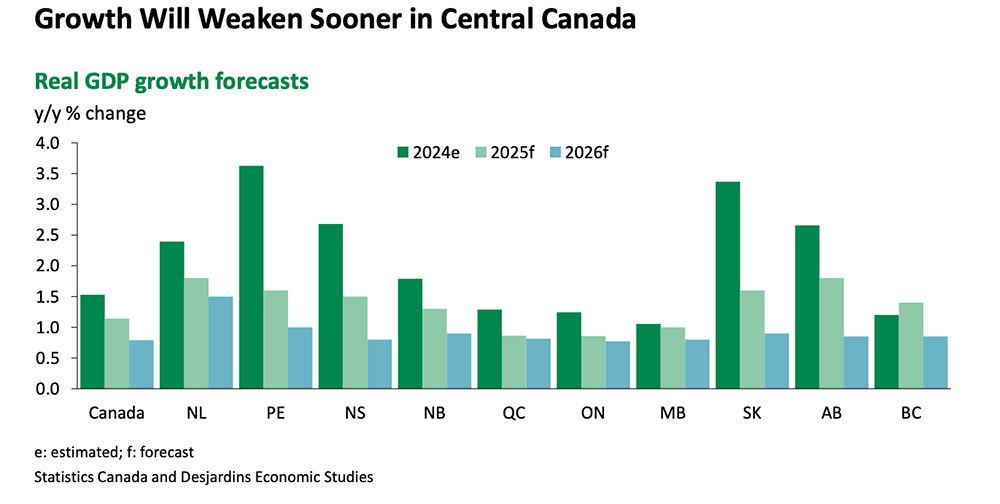

Latest research by economists establish a rising regional disparity within the nation, the place the west and east stride above the nationwide common and the centre stumbles.

“The approaching quarters will seemingly reveal extra pronounced regional disparities, with central provinces going through steeper headwinds in comparison with their western and Atlantic counterparts and doubtlessly

dipping into recessions

,” stated Laura Gu, senior economist for Desjardins Group.

Alberta and Saskatchewan

are anticipated to steer progress this yr as decrease tariffs on vitality merchandise show manageable and the Trans Mountain pipeline growth opens new markets. The economies of British Columbia on one aspect of the nation and the jap provinces on the opposite are comparatively insulated from

Donald Trump’s tariffs

.

It’s the centre of Canada — Ontario, Quebec and Manitoba — that can bear the brunt of the commerce battle, stated the economists.

The

outlook for Ontario

, with its heavy manufacturing base, has deteriorated sharply stated Gu, hit by each its publicity to U.S. commerce and the

housing market downturn

.

The auto sector that employs greater than 135,000 individuals is struggling to deal with the “double whammy” of U.S. tariffs and a stalling transition to electrical autos. Already there was plant shutdowns, shift reductions and delays in EV investments.

“With exports set to say no, consumption weakening and enterprise funding underneath stress, Ontario is more likely to enter a technical recession as early as Q2 2025,” stated Gu.

Desjardins additionally expects Quebec to slide right into a technical recession — two consecutive quarters of unfavorable progress — quickly as exports fall and uncertainty weighs on enterprise funding.

The province’s massive manufacturing sector, particularly in

aluminum which now faces a 50 per cent tariff

from the US, makes it among the many most uncovered to the commerce battle.

Manitoba too is predicted

to underperform the nationwide common as Desjardins estimates that it faces the third highest efficient tariff fee behind Ontario and Quebec.

The province’s agricultural sector can also be underneath stress from stiff duties on its key exports, canola, pork and peas. Seventy per cent of Manitoba’s agricultural exports go to both the U.S. or China.

Desjardins forecasts that Ontario and Quebec’s actual gross home product will advance simply 0.9 per cent this yr, and Manitoba’s 1 per cent, all lagging country-wide progress of 1.1 per cent.

A

latest forecast by BMO Capital Markets

pegs progress even decrease at 0.4 per cent for Quebec and 0.6 per cent for Ontario and Manitoba, in contrast with a progress fee of 1 per cent for Canada.

Enroll right here to get Posthaste delivered straight to your inbox.

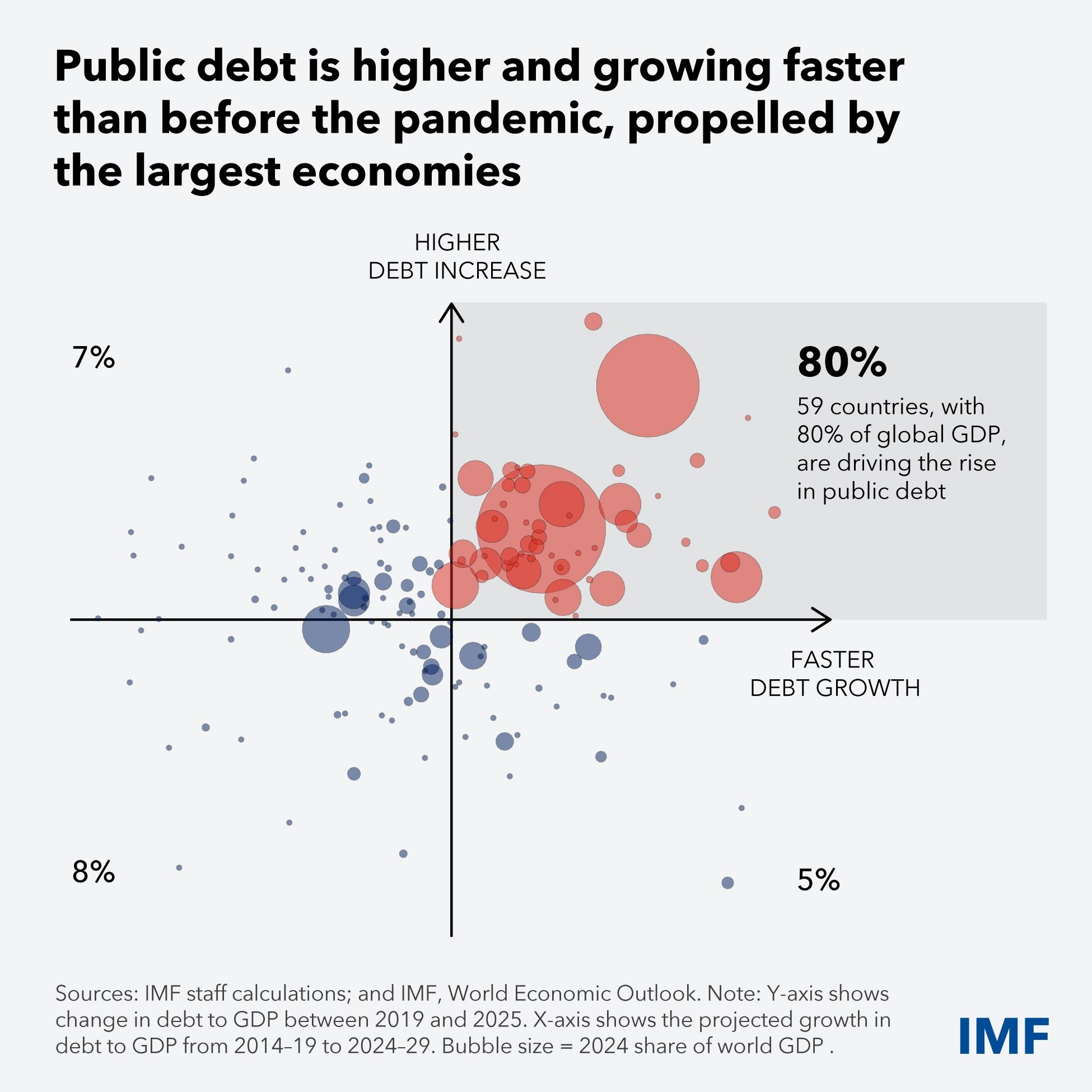

U.S. President Donald Trump’s “large lovely invoice” has thrown public debt into the highlight and never in a great way.

An evaluation by the Congressional Funds Workplace out yesterday stated the invoice will add US$2.4 trillion to America’s debt by 2034, driving up price range deficits over the approaching decade, regardless of White Home’s insistence that it could slash them.

U.S. debt is probably probably the most excessive profile, however it isn’t alone in its fast growth.

As as we speak’s chart from the Worldwide Financial Fund exhibits, public debt is greater than earlier than the pandemic and rising at a sooner tempo in a 3rd of the world’s nations that account for 80 per cent of world output, stated the Worldwide Financial Fund.

Greater than two-thirds of the 175 economies within the IMF research now have heavier public debt burdens than earlier than the COVID pandemic in 2020.

If this pattern continues that debt may rise to 100 per cent of the worldwide gross home product by the tip of the last decade, stated the IMF.

Financial institution of Canada Deputy Governor Sharon Kozicki speaks on how real-world insights form financial coverage in Toronto At this time’s Information: Canada Worldwide Merchandise Commerce, United States commerce steadiness, nonfarm productiveness, Earnings: Lululemon Athletica Ltd., Saputo Inc., Broadcom Inc.

Financial institution of Canada holds rate of interest at 2.75% once more as ‘uncertainty stays excessive’ ‘There’s no obstacles for mom nature’: Wildfires proceed to burn uncontrolled close to oilsands crops Canadian AI start-up Cohere seeks US$500 million in effort to catch as much as OpenAI and Anthropic

Bianca is 65, enjoys her job and is aware of her employer would love her to remain so long as attainable. Nevertheless, she turns 66 on the finish of this yr and thinks this is perhaps the appropriate time to retire – if her funding portfolio can generate $6,000 a yr in after-tax {dollars}.

Is that this a pipe dream? Would she be higher off working an extra yr or two, particularly given the excessive value of dwelling and the very fact she has a mortgage? Household Finance crunches the numbers.

Discover out extra

Are you fearful about having sufficient for retirement? Do you should alter your portfolio? Are you beginning out or making a change and questioning the way to construct wealth? Are you making an attempt to make ends meet? Drop us a line at wealth@postmedia.com along with your contact data and the gist of your downside and we’ll discover some consultants that will help you out whereas writing a Household Finance story about it (we’ll preserve your title out of it, after all).

McLister on mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

may help navigate the complicated sector, from the newest tendencies to financing alternatives you received’t need to miss. Plus examine his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

At this time’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? E mail us at

.

Owners up for renewal are in for a wake-up name

Canadians are lacking credit score funds at charges not seen because the monetary disaster

Bookmark our web site and help our journalism: Don’t miss the enterprise information you should know — add financialpost.com to your bookmarks and join our newsletters right here