It’s small marvel that People and Canadians are anxiously watching the turbulence U.S. President

Donald Trump’s

commerce insurance policies are inflicting on inventory markets.

They’ve quite a bit driving on them.

Based on a

latest report from Nationwide Financial institution of Canada

company equities, each straight and not directly held, now account for nearly 44 per cent of whole monetary property for U.S. households — a report excessive.

“Seemingly taking a cue from their American cousins, Canadian households now possess unprecedented fairness publicity too,” mentioned the Nationwide Financial institution economists.

The market worth of fairness and funding fund shares hit $5.16 trillion on the finish of 2024, representing 47 per cent of Canada’s whole family monetary property.

“Clearly then, a severe/sustained lack of traction in equities might handicap a Canadian family sector more and more apprehensive about job prospects and nonetheless contending with cost-of-living pressures,” they mentioned.

After

Trump introduced tariffs

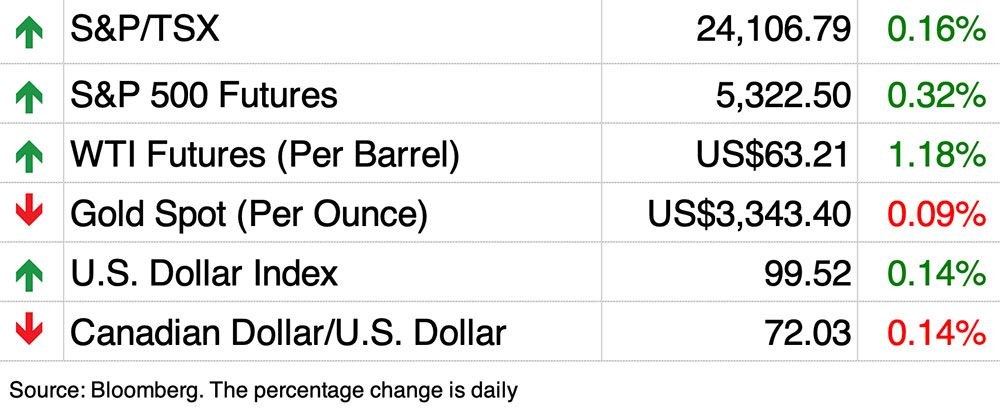

on nations around the globe April 2, the S&P 500 shed 15 per cent on the 12 months, however then started rallying days later when the president granted a 90-day delay on lots of the duties.

Nonetheless, the market continues to swing with each twitch on the commerce entrance, rivalling the turbulence within the depths of the pandemic. Yesterday the S&P 500 closed down 2.2 per cent, however futures are up this morning.

One saving grace to inventory losses may need been that Canadians are inclined to put extra of their wealth in

actual property

than People, however now due to the commerce struggle, that too has soured.

Considerations concerning the potential financial hit from U.S. tariffs have “clearly unsettled consumers” this 12 months, inflicting many to place their seek for a house on pause,

assistant chief economist at

Royal Financial institution of Canada

.

Residence gross sales

are down 12 per cent for the reason that starting of the 12 months, dropping 4.8 per cent between February and March. The nationwide composite MLS Residence Worth Index fell for a 3rd consecutive time in March, and is now down 2.1 per cent from a 12 months in the past.

The toughest hit provinces, Ontario and British Columbia, are additionally those the place non-financial property, principally actual property, account for the bigger share of family wealth.

“Weakening labour markets and tariffs threatening to strike southern Ontario’s financial system laborious has considerably soured market sentiment,” mentioned Hogue.

Residence gross sales have plummeted 21 per cent in Ontario prior to now two months and 17 per cent in British Columbia. The sharpest drop is in Toronto the place gross sales had been down 27 per cent.

Costs are additionally dropped in practically all markets within the two provinces, with declines accelerating in March.

“For extra housing-dependent provinces like Ontario and British Columbia, the latest cooling in housing exercise is disconcerting,” mentioned Nationwide Financial institution economists Warren Beautiful and Daren King.

If the job market softens in these areas, which Nationwide says is probably going, closely indebted households are in for a battle.

“For Canadian households, it appears there are presently few locations to cover,” mentioned Beautiful and King.

“Little marvel customers are anxious and governments really feel obliged to step up helps for susceptible regional economies.”

Enroll right here to get Posthaste delivered straight to your inbox.

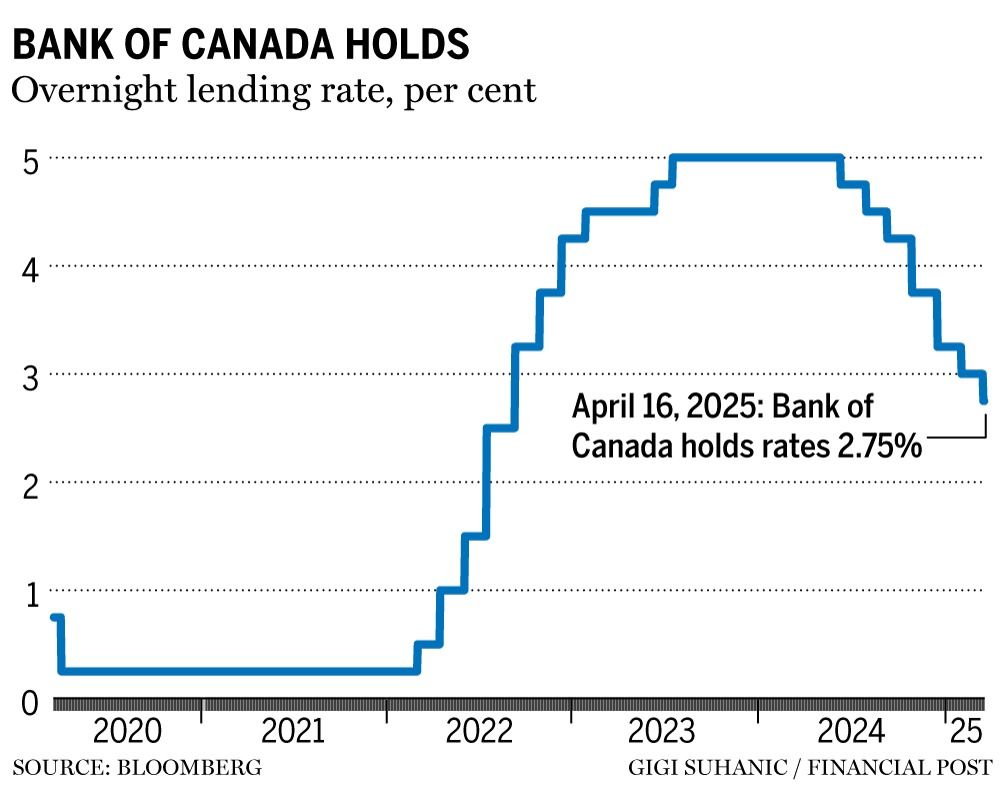

The

Financial institution of Canada

broke its streak of seven consecutive cuts on Wednesday when it held its rate of interest at 2.75 per cent.

The central financial institution mentioned it determined to proceed cautiously as occasions in Donald Trump’s commerce struggle proceed to unfold.

Governor Tiff Macklem mentioned throughout a press convention after the choice that governing council thought of slicing by 1 / 4 proportion level, but it surely in the end reached a transparent consensus for a maintain.

“The trail of U.S. commerce coverage stays extremely unpredictable,” mentioned Macklem. “There may be additionally appreciable uncertainty concerning the impacts of a commerce struggle on our financial system.”

In the present day’s Information: Canada worldwide securities transactions, United States housing begins and constructing permits Earnings: Netflix Inc., American Categorical Co., Blackstone Inc., Charles Schwab Corp., Marsh & McLennan Cos Inc.

Extra Canadians are ‘underwater’ on their autos and should do not know they’re

Trump tariff struggle might set off flood of purple ink in Canada regardless of who wins the federal election

Right here’s what occurred when a taxpayer claimed a swimming pool as a medical expense

One of many extra well-liked tax credit for Canadians is the medical expense credit score, which gives tax reduction for above-average medical or disability-related bills.

Not all bills, nevertheless, qualify, even when beneficial by a medical practitioner.

Tax knowledgeable Jamie Golombek exhibits how

with a latest case of an Ontario taxpayer who tried to assert the price of a swimming pool as a medical expense.

Are you apprehensive about having sufficient for retirement? Do it’s worthwhile to regulate your portfolio? Are you beginning out or making a change and questioning methods to construct wealth? Are you attempting to make ends meet? Drop us a line at wealth@postmedia.com together with your contact data and the gist of your drawback and we’ll discover some consultants that can assist you out whereas writing a Household Finance story about it (we’ll preserve your title out of it, after all).

McLister on mortgages

Need to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

can assist navigate the complicated sector, from the most recent tendencies to financing alternatives you gained’t wish to miss. Plus test his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the vitality sector and extra.

In the present day’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? Electronic mail us at

.

Need to Purchase Canadian? Here is what it can price you

People are scrambling to fill up earlier than tariffs jack up costs

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it’s worthwhile to know — add financialpost.com to your bookmarks and join our newsletters right here