The information landed final evening with a thud that despatched shockwaves around the globe.

The U.S. Courtroom of Worldwide Commerce declared late Wednesday that President

Donald Trump

overstepped his authority when he invoked the Worldwide Financial Emergency Powers Act to

impose tariffs

on dozens of nations together with Canada.

“Is there a dignified authorized method, ideally in Latin, to say ‘holy s**t’?, wrote Nobel prize profitable economist Paul Krugman in a late-night tackle the ruling.

The federal courtroom resolution blocks each the “Liberation Day” tariffs and the sooner duties towards Canada and Mexico associated to fentanyl.

Tariffs on metal, aluminum

and autos made exterior the US have been imposed underneath completely different powers and nonetheless apply.

The courtroom has given the federal government 10 days to take away the tariffs and if its ruling holds it will eradicate new 30 per cent U.S. duties on imports from China, 25 per cent tariffs on items from Canada and Mexico and 10 per cent duties on most different items getting into the U.S.,

Bloomberg studies.

“Simply when merchants thought they’d seen each twist within the tariff saga, the gavel dropped like a lightning bolt over the Pacific,” Stephen Innes of SPI Asset Administration stated in a word.

Nobody, nevertheless, believes that is the tip of the story. The White Home instantly appealed the choice, beginning a battle that would go all the best way to the Supreme Courtroom. It’s also unclear if the president will abide by the ruling within the meantime.

“It’s not for unelected judges to determine learn how to correctly handle a nationwide emergency,” White Home spokesman Kush Desai in an emailed assertion.

“President Trump pledged to place America First, and the Administration is dedicated to utilizing each lever of govt energy to handle this disaster and restore American Greatness.”

There may be additionally likelihood Trump’s administration will discover different methods to implement its insurance policies.

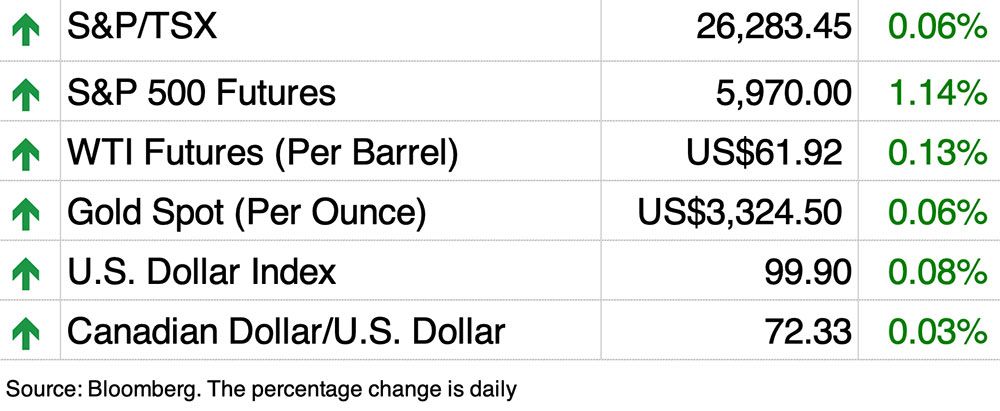

All the identical, market screens have been a sea of inexperienced this morning as hopes for aid from the tariff warfare echoed around the globe. Futures on the S&P 500 have been up 1.6 per cent in a single day, with Asian markets and European futures making massive good points.

“If the courtroom ruling holds and tariffs are blocked, brace for a world danger rally throughout main indices, the U.S. greenback, and commodities on improved international progress expectations,” stated Ipek Ozkardeskaya, senior analyst at Swissquote Financial institution.

Canada and Mexico have been first hit with economy-wide 25 per cent tariffs in March after Trump declared an emergency associated to the circulation of fentanyl over U.S. borders. Imports that adjust to the

Canada-U.S.-Mexico Settlement

have been later exempted.

If these common tariffs are eliminated, Canada as one of many nations depending on commerce with the US, would profit essentially the most, stated Capital Economics.

Nevertheless, as a giant exporter of autos, metal and aluminum to the U.S., Canada nonetheless loses out until it could actually negotiate concessions just like the U.Ok. Canada can also be weak to lumber tariffs, that are nonetheless underneath investigation.

What occurs in tariff talks is the following massive query. Will Trump’s buying and selling companions proceed to hunt offers?

“I don’t know why any nation would need to have interaction in negotiations to get out of tariffs which have now been declared unlawful,” Jennifer Hillman, a Georgetown Regulation College professor and former WTO decide and common counsel for the U.S. Commerce Consultant, advised Bloomberg.

“It’s a really definitive resolution that the reciprocal worldwide tariffs are merely unlawful.”

With information from Bloomberg and The Related Press

Enroll right here to get Posthaste delivered straight to your inbox.

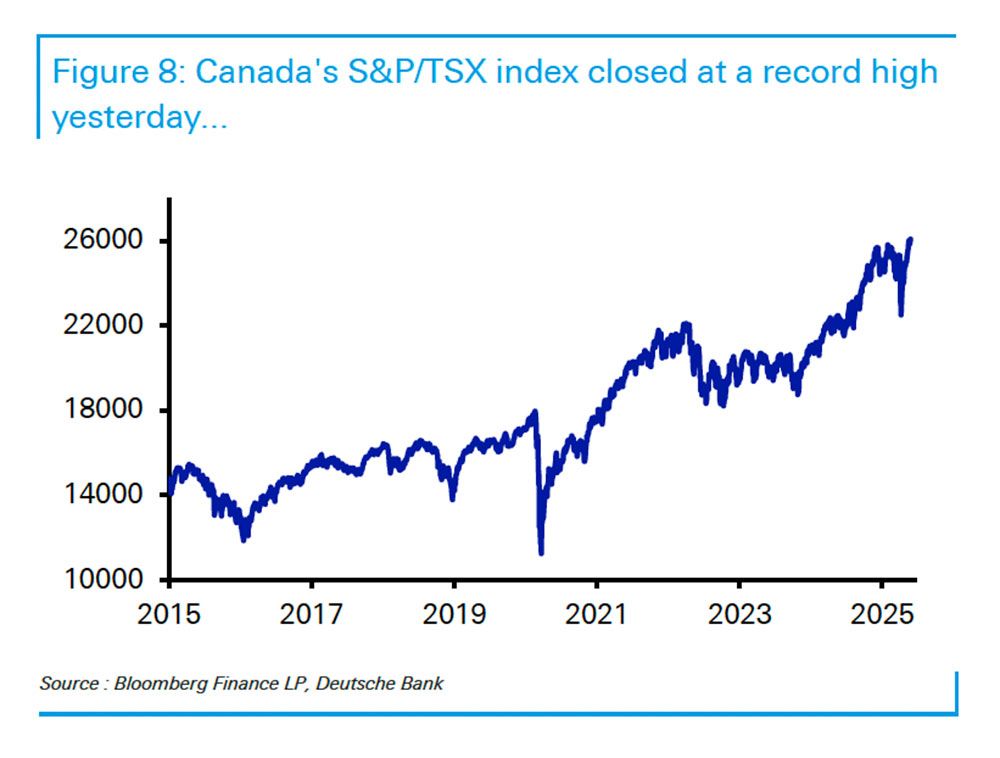

In a rustic closely uncovered to Trump’s tariffs, Canada’s inventory market has held up remarkably effectively, say strategists. So outstanding that it made it onto Deutsche Financial institution’s checklist of the most important market dislocations this 12 months.

Hitting an all-time excessive this week, the S&P TSX composite index is up 5.4 per cent for the reason that begin of a 12 months which has been by anybody’s requirements tumultuous. And Bloomberg’s mixture index of Canadian bonds (authorities and company) is up 0.3 per cent 12 months thus far.

“It appears that evidently Canadian property haven’t been hit to the extent one might need anticipated in the event you knew there’d be intensive tariffs with its greatest buying and selling accomplice,” wrote Deutsche macro strategist Henry Allen.

At present’s Information: Canada present account steadiness, United States gross home product, private consumption and pending house gross sales Earnings: Canadian Imperial Financial institution of Commerce, Royal Financial institution of Canada, BRP Inc, Finest Purchase Automotive Inc., Costco Wholesale Corp, Dell Applied sciences Inc., Hormel Meals Corp.

These eight information factors present how Trump’s commerce warfare is already affecting the Canadian financial system Canadian banks as ‘recession prepared as they are often,’ says New Haven’s Rebecca Teltscher U.S. buyers personal Canada’s future and that should change

As Donald Trump’s ‘one, massive lovely invoice’ makes its option to the Senate, tax advisers north of the border are warning that its impact on Canadians could possibly be extreme if Canada falls inside Washington’s definition of a “discriminatory international nation.”

Monetary Put up tax columnist Kim Moody says if enacted, the invoice would impose considerably greater U.S. tax charges — starting from 5 per cent to 30 per cent — on passive revenue, actual property good points and enterprise earnings for affected international buyers.

Discover out extra

Are you nervous about having sufficient for retirement? Do you have to modify your portfolio? Are you beginning out or making a change and questioning learn how to construct wealth? Are you attempting to make ends meet? Drop us a line at wealth@postmedia.com together with your contact data and the gist of your drawback and we’ll discover some consultants that can assist you out whereas writing a Household Finance story about it (we’ll preserve your title out of it, in fact).

McLister on mortgages

Need to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

may help navigate the complicated sector, from the newest tendencies to financing alternatives you received’t need to miss. Plus verify his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

for interviews with Canada’s main consultants in enterprise, economics, housing, the power sector and extra.

At present’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this article? E-mail us at

.

Canadians are lacking credit score funds at charges not seen for the reason that monetary disaster

‘The worry is actual,’ says TD, predicting 100,000 jobs might be misplaced in looming recession

Bookmark our web site and help our journalism: Don’t miss the enterprise information you have to know — add financialpost.com to your bookmarks and join our newsletters right here